Key Takeaways

- Approximately $17 billion in Bitcoin and Ether options are set to expire on Deribit this Friday, potentially influencing crypto prices.

- While smaller than September’s $22 billion expiry, this event is still significant for market dynamics.

- Bitcoin options suggest a cautiously bullish market sentiment, with less emphasis on downside protection.

- Ethereum options indicate a more cautious approach, reflected in a higher put-to-call ratio and a maximum pain point at $4.1K.

- Bitcoin’s recent market sentiment has shifted towards fear, contributing to its price volatility.

October Options Expiry Approaches

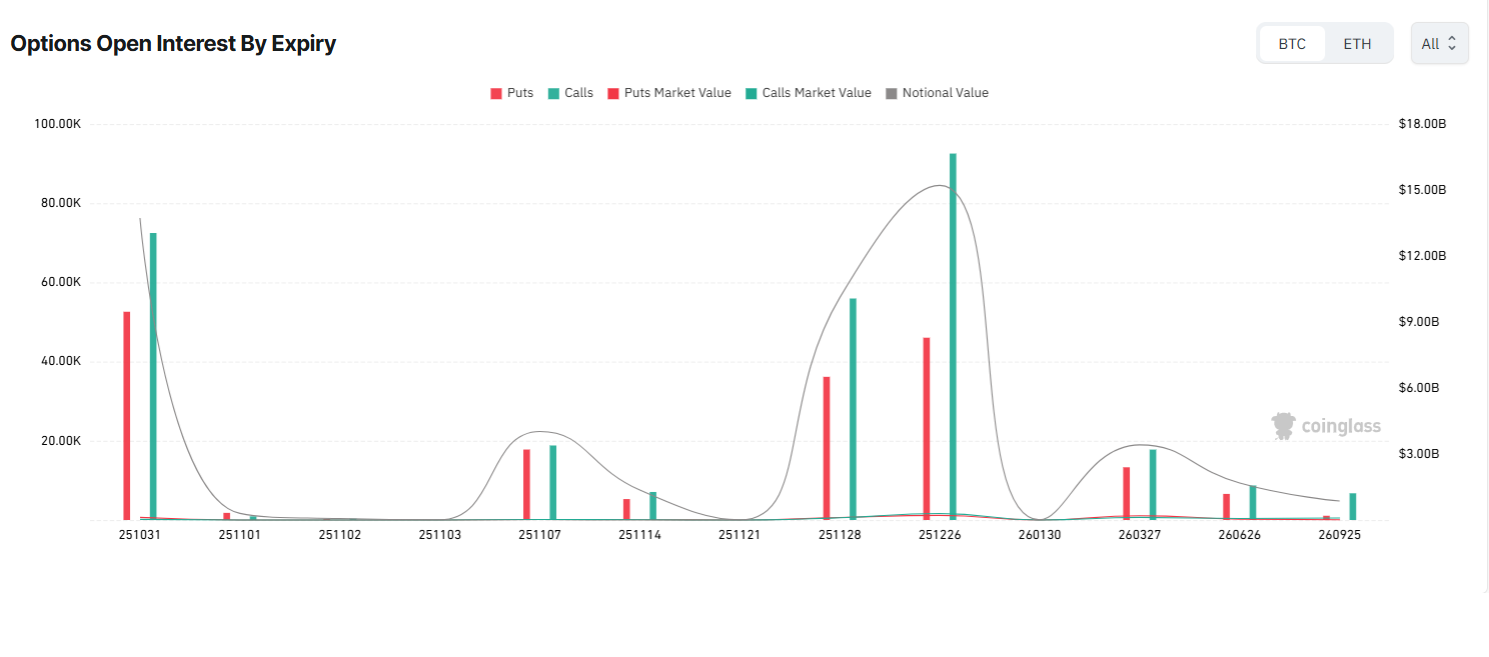

This Friday, an estimated $17 billion in monthly options contracts is set to expire on the Deribit exchange, potentially introducing increased price volatility for Bitcoin (BTC) and Ethereum (ETH). While this figure is lower than the $22 billion expiry recorded in September, it remains a significant market event.

Deribit’s open interest for longer-term options continues to be strong, nearing a one-year high at over $45 billion, indicating sustained investor participation in leveraged positions.

The monthly options are scheduled for expiration on Friday at 08:00 UTC. Prior to this event, BTC was trading near $109,881, and ETH was priced at $3,982.21.

BTC Options Signal Cautiously Bullish Sentiment

Analysis of Bitcoin options on Deribit suggests that traders are maintaining a cautiously bullish stance. The current call-to-put option ratio indicates a diminished focus on hedging against substantial price declines.

Currently, BTC is trading below its theoretical maximum pain expiration level of $114,000. This suggests that some traders might incur losses if the price stays below this threshold at expiration. The easing of US-China trade tensions has also contributed to a decreased perception of risk and a reduced need for downside hedging.

ETH Options Reflect Increased Caution

In contrast to Bitcoin, Ethereum’s monthly options expiry shows a put-to-call ratio of 1.25, signaling a more cautious outlook among its traders. The established maximum pain point for this specific expiry is $4.1K.

This higher proportion of put options suggests traders are positioning for potential price drops, making ETH appear more volatile leading up to the expiry. Despite considerable interest from ETF buyers and data companies, ETH’s price remains prone to greater fluctuations, necessitating more robust hedging strategies.

Bitcoin Sentiment Shifts Towards Fear

In the period leading up to the options expiry, Bitcoin’s market sentiment has notably shifted towards fear. The sentiment score has fallen from 51 points to 24 points, reflecting a less optimistic outlook among market participants.

While BTC briefly experienced a neutral sentiment, this recovery was short-lived. Current liquidation heatmaps indicate potential for short-term upward price movements, possibly driven by a short squeeze. Significant short liquidity has accumulated up to $117,000, which could be triggered by upward price action.

⚡ Bitcoin’s present volatility is at a six-month peak of 1.93%, highlighting the dynamic nature of its price action as it navigates the options expiry event and broader market pressures.

Final Thoughts

The approaching $17 billion options expiry on Deribit introduces a degree of uncertainty for both Bitcoin and Ethereum. While BTC traders appear cautiously optimistic, ETH traders are exhibiting more caution, leading to differing sentiment and hedging strategies.

Both assets face potential volatility as the expiry event unfolds, with market sentiment and technical indicators like liquidation heatmaps playing crucial roles in price discovery.