Key Takeaways

- A significant options trade, valued at $20.9 million, was placed betting on the S&P 500 reaching 9,000 by the end of 2026.

- This substantial trade coincided with market anticipation of Federal Reserve interest rate decisions and a wave of Big Tech earnings reports.

- The strategy offers potential profit from a substantial upward move in the S&P 500 or increased market volatility.

- High volumes in U.S. options markets, driven by retail investors and structured products, have made options potentially more affordable.

Substantial Options Trade Precedes Key Market Events

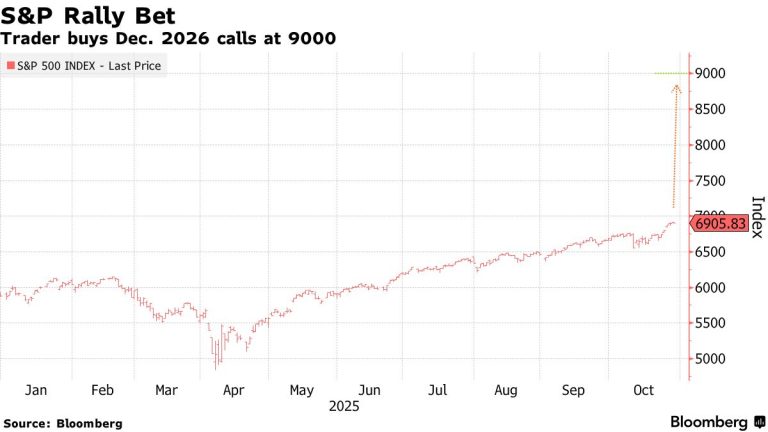

Shortly before the Federal Reserve announced its decision to lower interest rates by 25 basis points, a notable market transaction occurred. One single trade, valued at nearly $21 million, was executed with the expectation that the S&P 500 would surge to 9,000 by the close of the following year.

The investor behind this position paid a premium of $20.9 million, aiming for a market rally exceeding 30%. This is particularly noteworthy as the S&P 500 was trading around the 6,900 level at the time.

Christopher Jacobson, co-head of derivatives strategy at Susquehanna International Group, highlighted this substantial trade in a client note, emphasizing its sheer size even by the standards of the S&P 500 options market.

Options, utilized by both individual and institutional investors daily, often serve as tools for risk management or for making directional bets on market movements.

Trader Bets on Upside and Increased Volatility

Jacobson indicated that the trader appears to be seeking limited-risk exposure to a significant move higher over the course of the next year and/or an increase in that upside volatility. This strategy provides an opportunity to profit even if the S&P 500 falls short of the 9,000 target, as long as the index trends upward or volatility increases.

💡 The focus on volatility is particularly relevant given the unusually calm market conditions experienced throughout the year. Despite frequent record highs, significant market disruptions have been minimal, with only brief dips, such as the one in April, causing short-lived uncertainty.

This period of low volatility has led to relatively inexpensive pricing for U.S. stock options. The timing of this large trade, preceding major tech earnings and a key Federal Reserve meeting, suggests a potentially strategic, rather than random, approach.

📊 The U.S. options market has shown robust activity, with September’s daily volumes reaching 67 million contracts, marking a 40% increase from the previous year. This surge is attributed to participation from both retail traders and structured product transactions, according to data from the Options Clearing Corp.

Market Reacts to Tech Earnings and Fed Signals

The significant $21 million options trade occurred just hours before major technology companies including Alphabet, Meta, and Microsoft released their quarterly earnings.

Alphabet’s stock saw a notable 6% jump in after-hours trading following strong financial results. In contrast, Meta experienced an 8% decline, and Microsoft’s shares fell by 4%, contributing to a downward pressure on futures markets.

S&P 500 futures experienced a dip of 0.2%, while the Dow Jones Industrial Average saw futures fall by 95 points, and Nasdaq 100 futures slipped by 0.3%.

The preceding day saw the Dow Jones Industrial Average decrease by 74 points, or 0.2%, after briefly touching a record high. The S&P 500 closed nearly unchanged, while the Nasdaq registered a gain of nearly 0.6%.

⚡ This market reversal followed comments from Federal Reserve Chair Jerome Powell indicating that a further reduction in the policy rate at the December meeting is not a foregone conclusion.

Expert Summary

A massive options trade expecting a significant S&P 500 rally by late 2026 has captured market attention. This move coincides with a period of high options market volume and precedes key economic events, including Federal Reserve rate decisions and major tech company earnings reports.