The Rise of AI and Applied Materials

- Applied Materials (AMAT) is experiencing a surge in demand for its semiconductor manufacturing systems, driven by the global expansion of AI infrastructure in data centers and cloud computing.

- The company has introduced three new systems – Kinex Bonding System, Centura Xtera Epi System, and PROVision 10 eBeam Metrology System – to support the production of advanced AI chips.

- Competitors Lam Research (LRCX) and ASML Holding (ASML) are also witnessing strong demand for their sophisticated systems.

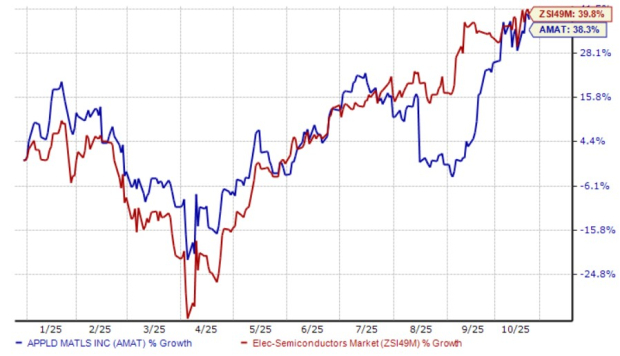

- AMAT’s stock has seen a year-to-date increase of 38.3%, trading at a lower forward price-to-sales ratio compared to its industry peers.

- Fiscal 2025 earnings estimates for AMAT project an 8.21% year-over-year increase, although recent downward revisions have led to a Zacks Rank #3 (Hold).

Applied Materials is Driving AI Innovations

Applied Materials (AMAT) is strategically positioned to capitalize on the significant growth in demand for AI infrastructure. As artificial intelligence becomes increasingly integral to data centers and cloud computing worldwide, the need for advanced fabrication, processing, and packaging systems is rapidly accelerating. This trend presents substantial growth opportunities for AMAT.

Innovations Driving Next-Generation AI Chips

In response to this escalating demand, Applied Materials has launched three innovative semiconductor manufacturing systems specifically designed to support the development of next-generation AI chips. These advanced systems include the Kinex Bonding System, the Centura Xtera Epi System, and the PROVision 10 eBeam Metrology System.

Kinex Bonding System

This system is recognized as the industry’s first integrated die-to-wafer hybrid bonder. It is engineered to optimize the hybrid bonding process for multi-die packages by enhancing accuracy, consistency, and throughput, while simultaneously reducing power consumption and overall costs.

Centura Xtera Epi System

The Centura Xtera Epi System is a new epitaxy tool developed specifically for the production of void-free Gate-All-Around (GAA) transistors. It aims to reduce gas usage by approximately 50% and improve transistor performance and reliability through enhanced uniformity.

PROVision 10 eBeam Metrology System

This metrology system offers significant advancements in imaging capabilities, delivering 50% higher image resolution and a tenfold increase in imaging speed.

These technological leaps underscore Applied Materials’ vital role in scaling semiconductor production for the AI era. The company is addressing key device inflection points across logic, memory, and packaging, particularly for 2nm nodes. AMAT’s existing systems, such as the Sym3 Magnum etch system and its Cold Field Emission eBeam technology, have already garnered positive reception from chip developers.

Navigating the Competitive Semiconductor Landscape

The semiconductor manufacturing equipment sector is marked by intense competition. Leading players like Lam Research and ASML Holding are also experiencing robust demand and achieving significant technological advancements.

Lam Research’s Strategic Successes

Lam Research (LRCX) has recently secured important technology wins with a major DRAM manufacturer for its new Akara etch system, designed for advanced 3D DRAM architectures. This success is complemented by ongoing customer investments in next-generation memory technologies such as DDR5, LPDDR5, and high-bandwidth memory. Furthermore, Lam Research’s Aether dry-resist technology has been selected as the production tool of record by a leading DRAM manufacturer, reinforcing its position in this high-growth market segment.

ASML Holding’s EUV Technology Advancements

ASML Holding (ASML) is observing strong demand from both DRAM and logic customers as they ramp up production on leading-edge nodes utilizing ASML’s NXE:3800E EUV systems. The company has also noted that multiple DRAM customers are adopting EUV lithography, a development that helps shorten production cycle times and reduce manufacturing costs.

Applied Materials: Financial Performance and Investment Outlook

Applied Materials’ stock performance reflects its standing within the dynamic semiconductor industry. As of recent reports, the company’s shares have gained 38.3% year to date. This performance closely mirrors the broader Electronics – Semiconductors industry, which has seen a growth of 39.8% over the same period.

Valuation Metrics for AMAT

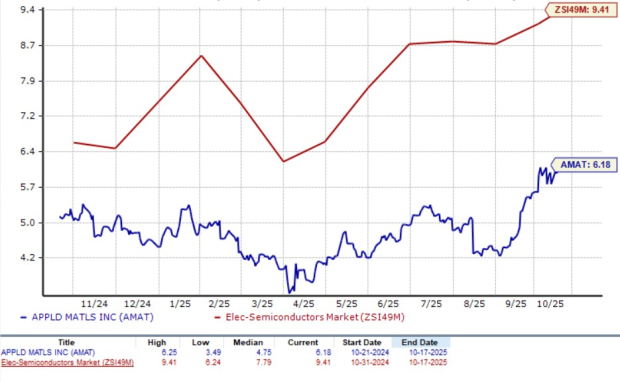

From a valuation perspective, Applied Materials is currently trading at a forward price-to-sales ratio of 6.18X. This valuation is notably lower than the industry average of 9.41X, suggesting potential value for investors when compared to its peers.

Earnings Estimates and Zacks Rank for AMAT

The Zacks Consensus Estimate for Applied Materials’ fiscal year 2025 earnings anticipates a year-over-year growth of 8.21%. However, the estimate for fiscal year 2025 has experienced downward revisions in the past week. Consequently, Applied Materials currently holds a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Evolving Landscape of Semiconductor Investment

The continuously increasing demand for data is creating a new wave of opportunities within the technology sector. As data centers expand and upgrade, companies supplying essential hardware for these facilities are poised for significant growth, potentially mirroring the success of industry leaders.

💡 An under-the-radar chipmaker is strategically positioned to benefit from the next phase of market expansion. This company specializes in semiconductor products that major players do not produce and is beginning to gain industry recognition, presenting a potentially advantageous entry point for investors.

See This Stock Now for Free >>

ASML Holding N.V. (ASML) : Free Stock Analysis Report

Lam Research Corporation (LRCX) : Free Stock Analysis Report

Applied Materials, Inc. (AMAT) : Free Stock Analysis Report

Final Thoughts on Applied Materials

Applied Materials is making significant advancements in developing cutting-edge manufacturing systems to meet the growing demands of AI infrastructure. Despite strong competition from industry leaders like Lam Research and ASML, AMAT’s recent product innovations position it well for future growth. Its current valuation and stock performance suggest a potentially attractive investment opportunity, though recent earnings estimate revisions warrant careful consideration.