At a Glance

- STBL founder Avtar Sehra announced that STBL buybacks will commence by the end of October.

- The new stablecoin, USST, will function as Stablecoin 2.0 and is designed to be the TCP/IP of money.

- A Multi-Factor Staking (MFS) model is introduced, allowing investors to potentially increase earnings by staking USST.

- STBL aims to provide a decentralized, market-driven, and private digital currency infrastructure.

STBL Initiates Buyback Program and Unveils ‘Stablecoin 2.0’

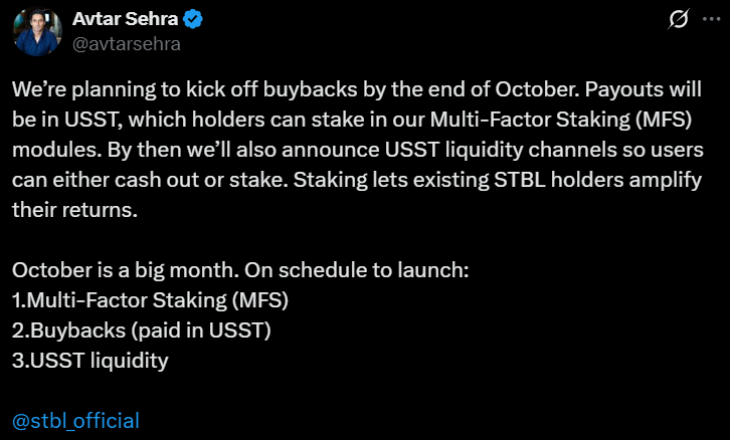

Avtar Sehra, the founder and CEO of STBL, revealed on October 13th that the company plans to begin buybacks for its STBL tokens by the end of October. This announcement signals a significant development for the STBL ecosystem.

STBL Buyback and USST Stablecoin Details

In a series of posts on X, Sehra detailed that the STBL buyback program will utilize USST, a new stablecoin developed by STBL. The buyback initiative is designed to reduce the total supply of STBL tokens, potentially supporting or increasing their market value.

Payments for these buybacks will be made in USST, offering holders flexibility in how they utilize or retain their tokens. This move positions USST as a key component of the STBL network.

💡 Alongside the buyback announcement, Sehra introduced the Multi-Factor Staking (MFS) model. This system allows users to stake their USST tokens to earn rewards through a process guided by smart calculations, aiming to enhance investor returns.

⚡ Sehra also highlighted the development of USST Liquidity Channels, intended to facilitate easier cashing out and trading of USST, thereby increasing its overall flexibility and utility within the market.

The Vision for ‘Stablecoin 2.0’

We’re not “another stablecoin.” We’re building the TCP/IP of money: infrastructure that is open, decentralised, and durable, Sehra stated on X. He elaborated that the goal is to create a stablecoin whose peg is maintained by market forces, with transparent collateral, enforceable rights, and privacy as a core feature.

He further added that STBL aims to become the foundational layer upon which other stablecoins will be built, underscoring its ambition to be a fundamental piece of digital finance infrastructure.

Sehra’s Roadmap for Advanced Stablecoin Technology

In a separate communication, Sehra positioned STBL as Stablecoin 2.0, referencing his 2017 research paper, On Cryptocurrencies, Digital Assets and Private Money. This designation reflects his early vision for a decentralized, market-influenced, and privacy-focused digital currency.

Seven years on: from theory to Stablecoin 2.0

Nearly eight years ago I published a paper on cryptocurrencies, digital assets and private money. Rereading it now, you can see exactly why we designed STBL the way we did. The core thesis still holds; our execution has matured.… pic.twitter.com/rYIcB6jhnv

— Avtar Sehra (@avtarsehra) October 13, 2025

Sehra described STBL as the TCP/IP of money, comparing its potential role in digital finance to the foundational internet protocol. This analogy highlights its intended function as a core building block for future financial applications.

He identified key shortcomings in existing stablecoins, such as reliance on centralized control, price volatility, and a lack of transaction privacy, which STBL aims to address.

✅ Built entirely on public blockchains, STBL uses transparent smart contracts for all operations, ensuring openness and interoperability with other financial tools.

💰 Sehra emphasized the necessity of robust real-world asset backing for stablecoin value, stating, Price stability needs credible reserves. Fixed/inelastic supplies and speculative flows alone cannot support Store of Value, Medium of Exchange, and Unit of Account functions(SoV/MoE/UoA) without volatility controls; credible collateral is non-negotiable. He explicitly rejected purely algorithmic or synthetic models lacking substantial backing.

📉 To maintain its value, expected to be pegged to the USD, STBL will employ an automated system. Smart contracts will dynamically adjust the supply based on market demand, bypassing manual intervention.

📊 STBL also features a three-token model designed for enhanced compliance and clarity, with separate tokens for spending, earning yield, and community governance.

🔗 The platform is described as having a composable design, enabling seamless operation across multiple blockchain networks with an integrated privacy layer.

Final Thoughts

Avtar Sehra’s recent announcements detail STBL’s upcoming buyback program and the strategic rollout of its Stablecoin 2.0 initiative, centered around the new USST stablecoin. The introduction of Multi-Factor Staking and its foundational TCP/IP of money vision suggest a move towards a more robust and decentralized digital currency infrastructure.