Recent market activity has seen Bitcoin (BTC) reach a new all-time high, surpassing previous records. This surge, occurring in what has been dubbed Uptober, reflects strong bullish sentiment and increased trading activity. This analysis delves into the current Bitcoin price action, its underlying market drivers, and a prospective exit strategy.

Quick Summary

- Bitcoin has achieved a new all-time high, exceeding previous milestones.

- The rally is supported by ETF inflows, institutional demand, and favorable macro-economic signals.

- Key technical levels to watch include support around $117,000-$118,000 and resistance clusters near the former ATH.

- Potential Q4 price targets range from a realistic $135,000-$140,000 to a more ambitious cycle stretch of $200,000-$250,000.

- An informed strategy involves scaling out of positions and adapting to market dynamics.

💡 Understanding these market movements is crucial for any investor in the digital asset space.

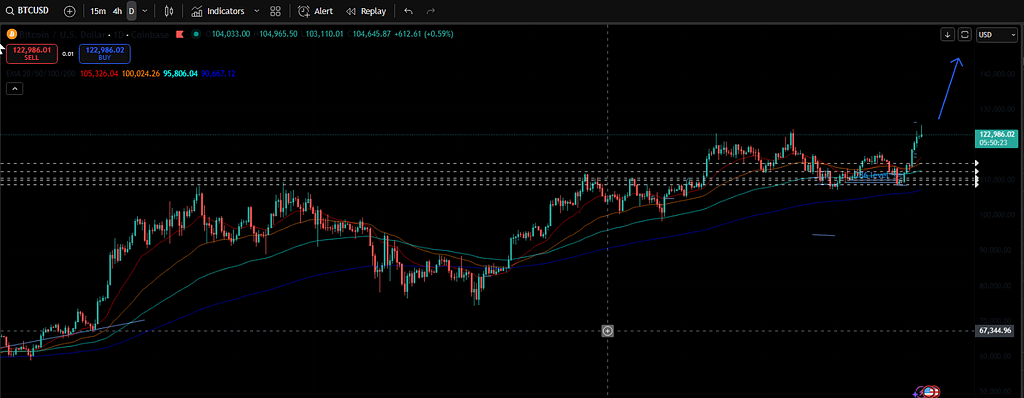

Price Action and Momentum

Following the breach of resistance levels near $124,480, Bitcoin (BTC) experienced a significant upward movement, accompanied by strong trading volumes. This surge has been bolstered by substantial inflows into Bitcoin Exchange Traded Funds (ETFs) and a growing appetite from institutional investors, providing the impetus for BTC to climb beyond its previous peaks. While some consolidation has occurred, with prices testing support zones between approximately $117,000 and $118,000, this area is now a critical zone for potential retests and new long entries. 📍 As bullish momentum persists, previously established resistance areas may transform into support, paving the way for further price appreciation.

✅ This price action indicates a strong underlying demand and technical confirmation of the uptrend.

Macroeconomic and Structural Tailwinds

Bitcoin’s recent breakout is not an isolated event but is significantly influenced by several key macroeconomic and structural factors. These include:

- Policy Shifts and Regulatory Clarity

Market sentiment has been positively impacted by more crypto-friendly signals, potentially associated with shifts in U.S. policy, leading to improved regulatory clarity and a more open stance toward digital assets. Notably, Trump Media’s commitment of $2 billion to Bitcoin as a treasury asset, alongside indications of potential economic stimulus measures in Q4, further adds to this positive outlook. - Growing Corporate and Treasury Demand, Particularly in Asia

There is a notable emergence of treasury strategies involving Bitcoin in Asia. Companies like AsiaStrategy have incorporated BTC into their treasuries, and other corporate players in the region are increasing their allocations, reinforcing BTC’s legitimacy as a balance-sheet asset. The launch of a $500 million digital treasury fund by HashKey in Hong Kong is another indicator of burgeoning institutional interest in Asia. - Expanding Utility, Maturation, and Institutional Adoption

Bitcoin is increasingly recognized as a hedge against currency debasement, attracting capital during periods of dollar weakness, inflation concerns, and fiscal instability. Concurrently, the advancement of ETFs and on-ramp infrastructure is streamlining capital deployment into the asset class. - Prudent Accumulation and Liquidity Constraints

Despite high aggregate holdings by Bitcoin treasuries, the average transaction sizes have decreased. This suggests that institutions are employing a more cautious approach to new exposure, meaning that each upward price movement may require stronger conviction or novel catalysts to sustain.

📊 It is important to monitor these macro trends as they provide the broader context for Bitcoin’s price movements.

Technical Landscape and Levels to Watch

Analyzing the price structure and key levels provides valuable insights for traders. Here’s a breakdown:

| Zone | Role | Notes |

|---|---|---|

| Support Zone: $117,000 – $118,000 | Retest / Entry Zone for Longs | This range is a primary target for potential re-entry on pullbacks. |

| Lower Fallback Zone | ~$110,000 – $114,000 | Deeper support to be considered if significant market weakness or macro events occur. |

| Resistance Cluster | ~$124,480 – $125,800 | Former All-Time High (ATH) band, now acting as a supply zone. |

| Next Major Hurdles | $135,000 – $150,000 | Potential targets if upward momentum is sustained. |

| Cycle Stretch Zone | $200,000 – $250,000 | Aspirational long-term target in a parabolic bull market scenario. |

📌 Key technical observations include: the successful retest of the previous ATH signifies that former resistance has become potential support. While higher timeframe momentum is robust, short-term overextensions could lead to minor pullbacks or shakeouts. Fibonacci extensions suggest $135k–$150k as a plausible near-term target if momentum continues. Given the potential for parabolic runs, especially in low-volatility environments with strong inflows, a broader cycle peak between $200k–$250k remains a possibility.

Consider exploring decentralized exchange (DEX) airdrops while navigating these market dynamics.

Q4 Targets and Scenario Framing

Based on current analysis, potential trading scenarios for Q4 include:

- Dream / Cycle Stretch Case: A price range of $200,000 – $250,000, contingent on a full bull market ramp-up, significant capital inflows, a regime shift, and dominant market narratives.

- Base / Realistic Case: A target of $135,000 – $140,000, assuming continued momentum without an excessive parabolic blow-off.

- Conservative / Correction Case: If market conditions deteriorate, a retracement to the $117k–$118k zone, or potentially lower to $110k–$114k, could occur before the upward trend resumes.

⚡ A mid-range target of $135k–$140k for Q4 appears reasonable. However, sustained volume, easing macro conditions, and substantial institutional movements could drive prices significantly higher.

Understanding how to utilize funding rates can provide valuable trading signals; explore relevant guides for insights.

Personal Trading Plan and Strategy

The current market presents opportunities for strategic position management:

- A portion of Bitcoin holdings has already been de-risked.

- Future focus is on executing smart exits and dynamic trading adjustments.

- The plan involves placing spot sell orders progressively between $130,000 and $150,000, scaling out as the price advances.

- Monitoring the $117,000–$118,000 zone for potential long entries on pullbacks remains a key strategy.

- Adaptability is paramount; strategies will be adjusted based on evolving price action, market flows, stop-loss tightening, hedging, or re-entering positions based on favorable risk-reward ratios.

- Looking ahead to the next year, a reassessment of market structure will inform decisions regarding neutral strategies, yield/airdrop farming with stablecoins, or maintaining side exposure until new catalysts emerge.

💡 Realizing profits and adapting to market conditions are essential for long-term success in trading.

Personal Reflection and Significance

Acquiring Bitcoin at $44 in 2013 represents a long-term commitment involving extensive research and conviction. This cycle may mark the first instance of a full liquidation of this early position, a significant milestone signifying the realization of substantial gains. The decision to sell half the stack and utilize those profits for significant life events, such as purchasing a home and supporting family, underscores the tangible impact of strategic investment. Moving forward, the focus shifts to astute trading, strategic exits, and allowing market dynamics to guide future decisions. Exploring avenues like farming, airdrops, and neutral strategies will be key components of the plan for the upcoming year, emphasizing disciplined trading and risk management in the current phase.

Final Thoughts and Outlook

The Uptober trend has delivered significant price action, with Bitcoin establishing new all-time highs. This upward momentum is underpinned by favorable macroeconomic factors, including treasury demand and evolving policy landscapes. However, traders must remain vigilant regarding swift momentum shifts, potential volatility, liquidity fluctuations, and unforeseen macro events. The projected realistic Q4 target remains around $135k–$140k, with a more optimistic bull meltup scenario potentially reaching $200k–$250k. The strategy involves a phased exit between $130k and $150k, emphasizing flexibility and responsiveness to market signals. Maintaining nimbleness, robust risk management, and avoiding emotional decision-making are crucial for navigating the current market environment.

✅ Staying informed and adaptable is key to capital preservation and growth in volatile markets.

For further insights, consider exploring comparisons between Gold and Bitcoin. As trading continues, remember to manage risk and make informed decisions.

Fundfa Insight

The current Bitcoin rally, driven by institutional adoption and favorable macroeconomic conditions, presents a significant opportunity. However, the inherent volatility of digital assets necessitates a disciplined approach to profit-taking and risk management. Strategic scaling out of positions and remaining adaptable to market shifts are crucial for capitalizing on bullish trends while mitigating potential downside risks.