Key Takeaways

- On-chain data from CryptoQuant indicates an increase in Bitcoin supply available for sale, coupled with shrinking buyer demand, a potential bearish signal.

- Long-term holders (LTHs) have increased their selling activity, a common behavior during bull markets as they take profits.

- Crucially, current market conditions show a lack of strong demand to absorb this LTH selling, unlike in previous rallies.

- Institutional demand sources like ETFs and MicroStrategy’s buying strategy are showing signs of weakness, further contributing to the demand deficit.

- Bitcoin’s price has seen a recent decline, and a sustained recovery will likely depend on renewed demand from institutional investors and ETFs.

Bitcoin Supply Rises Amidst Declining Demand

New on-chain data from CryptoQuant highlights a concerning trend for Bitcoin: the supply of coins available on the market is growing, while buyer demand is simultaneously shrinking. This imbalance presents a potentially bearish signal for the world’s largest cryptocurrency.

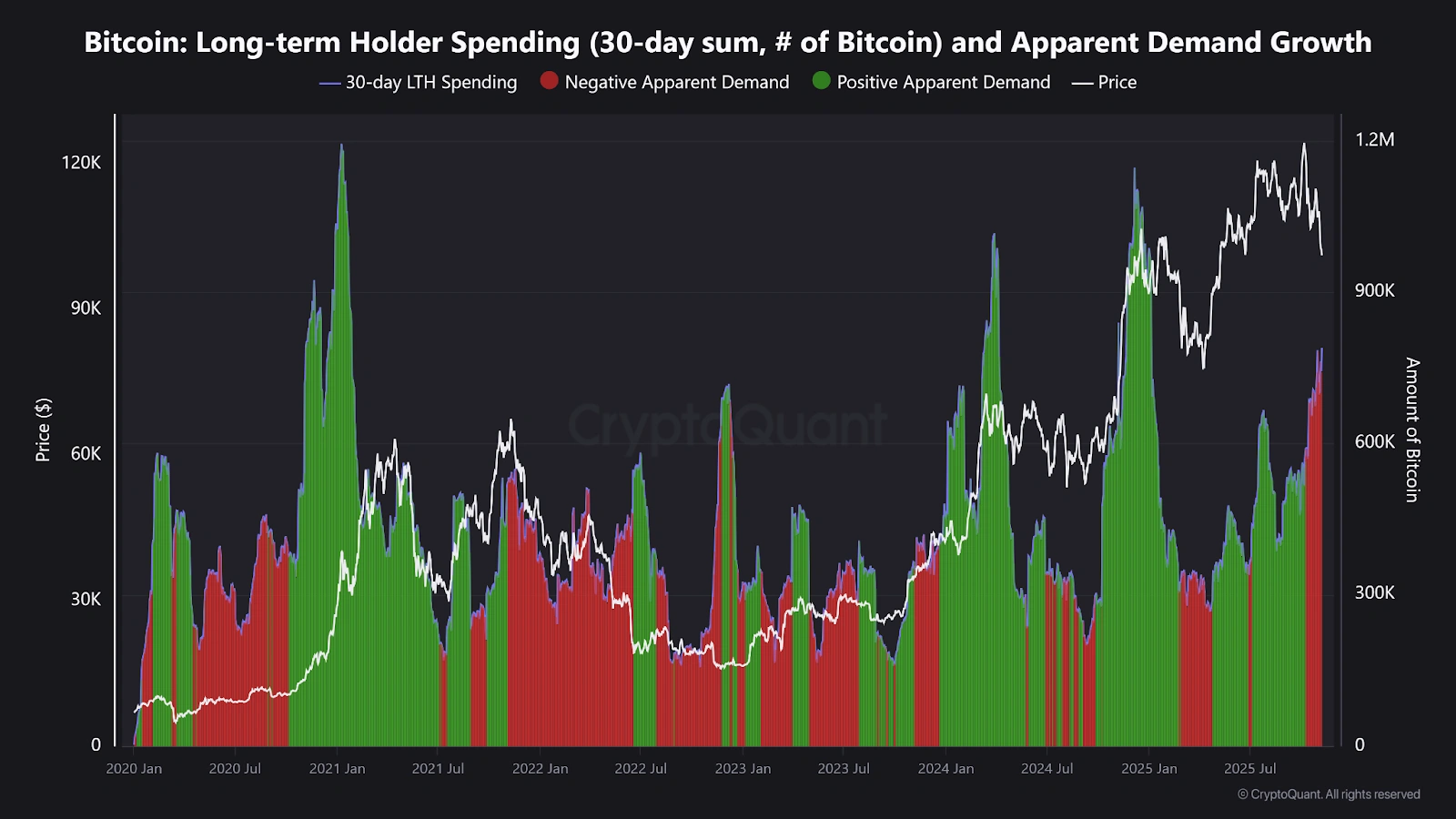

Julio Moreno, head of research at CryptoQuant, noted that long-term holders (LTHs) – those who have held Bitcoin for over 155 days – have significantly ramped up their selling activities in recent weeks. This behavior is often observed during bull markets as these investors aim to capitalize on price increases by taking profits.

However, what is particularly noteworthy in the current market, according to Moreno, is the apparent lack of substantial demand to offset this increased selling pressure. He emphasized the importance of analyzing whether growing Bitcoin demand exists to absorb the supply being offloaded by LTHs at higher price levels.

Demand Dries Up as LTH Selling Accelerates

A chart shared by Moreno illustrates that Bitcoin’s short-term demand, as measured by apparent demand metrics, has been in negative territory for approximately 30 days. This suggests that fewer new buyers are entering the market, even as long-term investors are actively selling to secure profits.

While the 1-year demand metric currently remains positive, there are visible signs of a decline. Moreno indicated that if this downward trend persists, the 1-year demand growth could soon fall below zero. Currently, both positive and negative apparent demand figures hover around zero. Concurrently, long-term holder spending is substantial, standing at approximately 790,000 BTC at the time of writing.

This delicate balance suggests that supply and demand are in a standoff. Large volumes of Bitcoin are being sold by experienced investors, but there isn’t enough fresh capital entering the market to absorb this selling pressure effectively.

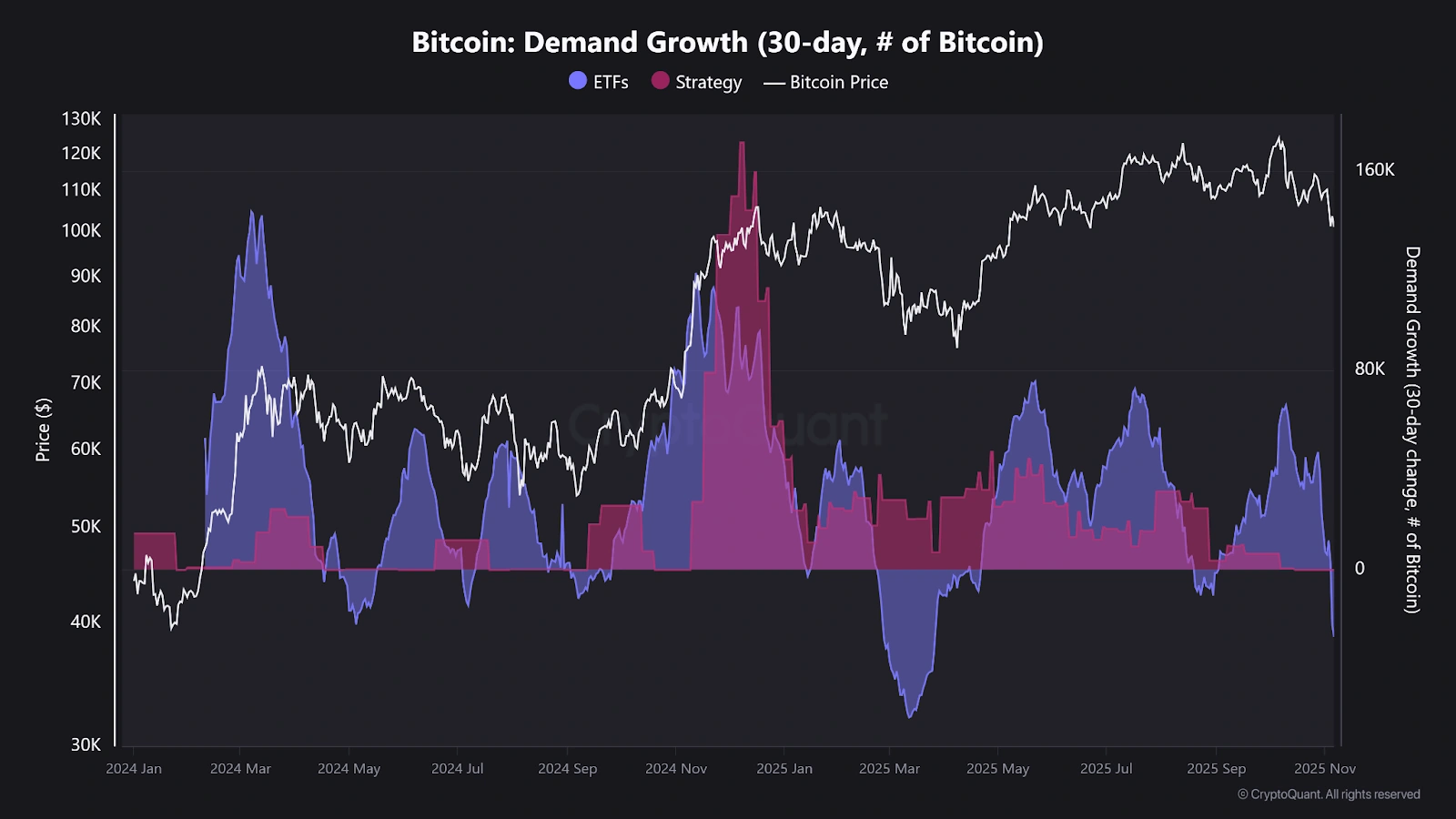

Further analysis of the data reveals weakness in two major sources of institutional demand: Exchange-Traded Funds (ETFs) and Michael Saylor’s firm, Strategy. ETF demand growth has sharply declined into negative territory, while Strategy’s demand remains flat at zero.

A Different Market Landscape

Historically, periods of increased selling by long-term holders, such as between January and February 2025, and again from November to December 2024, were accompanied by rising demand. These phases were characterized by green areas on demand charts and ultimately led to Bitcoin reaching new all-time highs.

However, the current market conditions appear less favorable. Following a significant market event around October 10, which caused considerable volatility, selling has increased, but demand has failed to keep pace.

Outlook for Bitcoin

While selling by long-term holders can sometimes be a healthy part of a cycle that prepares the market for further upward movement, current activity suggests otherwise.

Bitcoin prices have experienced a drop of over 5% in the past week, moving from approximately $110,000 to just above $103,000. For a price recovery, renewed demand, particularly from institutional investors and ETFs, will be crucial.

On a yearly basis, Bitcoin’s apparent demand growth remains positive, indicating that the fundamental demand for Bitcoin as an asset class persists. However, a continued contraction in demand that dips below zero could signal a market entering a cooling phase, similar to mid-cycle consolidations observed in previous bull markets.

Expert Summary

On-chain data from CryptoQuant suggests that increased selling by long-term Bitcoin holders is not being met with sufficient buyer demand, potentially signaling a bearish outlook. Weakness in institutional demand from ETFs and other strategies further compounds this issue, contrasting with previous bull market phases where rising demand absorbed LTH selling. While yearly demand remains positive, a continued contraction could indicate accumulation for a future market cooling phase.