Quick Summary

- Bitcoin’s recent price drop is linked to the reversal of factors that previously drove its rally, according to NYDIG.

- Earlier inflows into Bitcoin ETFs and demand from digital asset treasuries have turned into outflows.

- Actual capital exits are suggested by crypto treasury reversals and fund outflows, beyond mere negative sentiment.

- Despite spot Bitcoin ETF outflows, Bitcoin’s market dominance is rising as investors seek stability.

- The long-term outlook for Bitcoin remains strong, supported by institutional adoption, despite short-term volatility.

Bitcoin Price Drop Explanation: Key Drivers Reversed

The very forces that propelled Bitcoin to its peak are now contributing to its decline to multi-month lows. Crypto treasury reversals and significant fund outflows indicate that substantial capital is exiting the market, suggesting a more complex situation than simple negative sentiment, according to insights from NYDIG.

Greg Cipolaro, NYDIG’s head of research, highlighted that inflows into cryptocurrency exchange-traded funds (ETFs) and robust demand for digital asset treasuries (DATs) were pivotal in driving Bitcoin’s (BTC) previous market cycle success.

However, a major liquidation event earlier this month triggered a reversal of ETF inflows. Treasury premiums also collapsed, and the stablecoin supply decreased, signaling a significant withdrawal of liquidity from the broader crypto ecosystem. These are classic indicators that the positive feedback loop powering the market was losing considerable momentum.

📊 Understanding these reflexive market loops is crucial for investors. When liquidity tightens and excessive leverage unwinds, previously supportive narratives often fail to translate into genuine buying pressure, a pattern consistently observed across major market cycles.

Cipolaro explained that while specific market narratives may evolve, the underlying mechanics of these cyclical patterns remain remarkably consistent. The upward momentum generated by this reflexive loop eventually reverses, setting the stage for the subsequent phase of the market cycle.

Bitcoin Market Dynamics: ETF Outflows and Dominance

Spot Bitcoin ETFs, initially lauded as a significant success, have shifted from being a reliable source of inflows to a meaningful headwind for the cryptocurrency. Beyond ETF flows, broader influences such as global liquidity shifts, macroeconomic news, inherent market structure stresses, and investor psychology continue to significantly impact Bitcoin’s price trajectory.

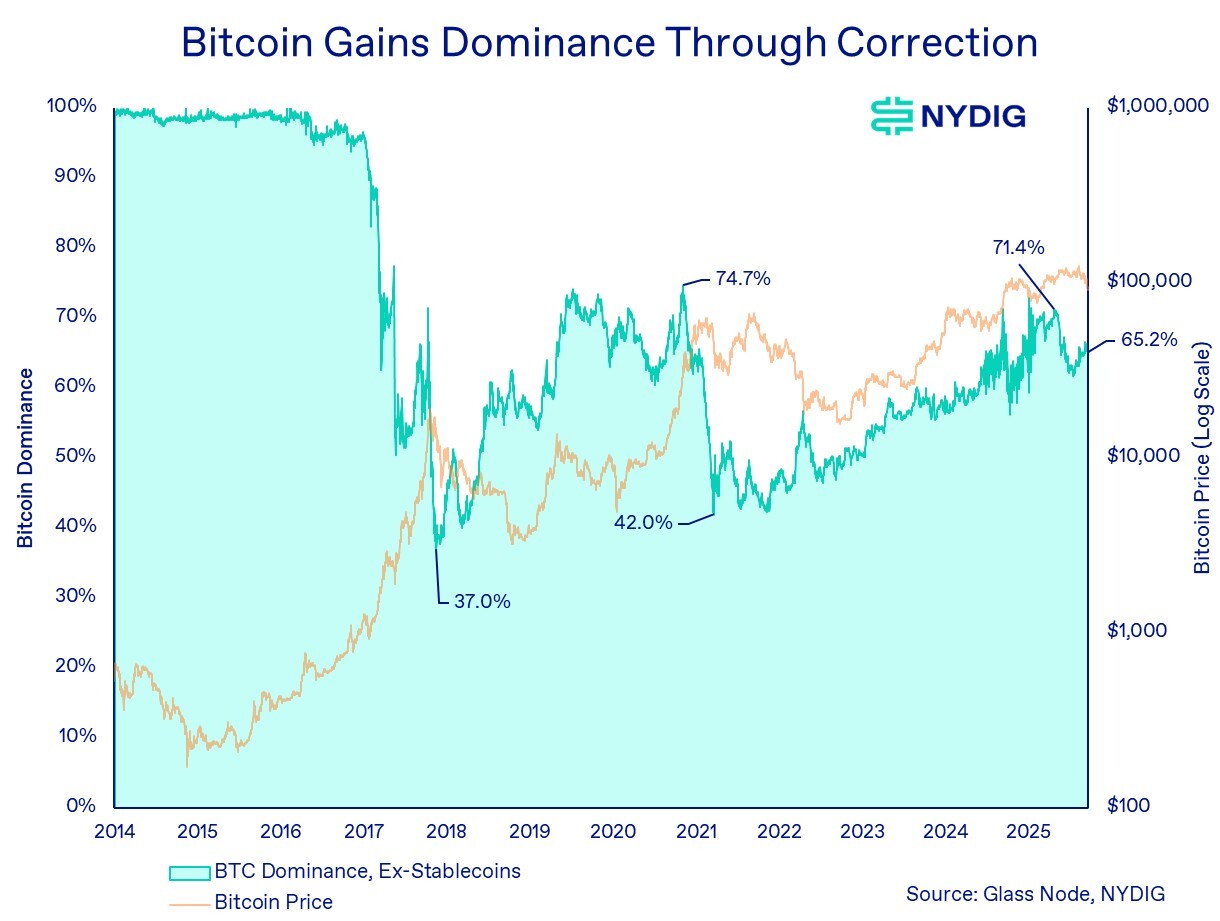

⚡️ Bitcoin dominance typically increases during broader market downturns. As more speculative assets experience steeper sell-offs, capital often consolidates into Bitcoin, which is widely recognized as the most established and liquid asset within the crypto space. This dynamic is clearly playing out once more in the current market environment.

Bitcoin dominance surpassed 60% in early November and has since stabilized around 58%, according to data from CoinMarketCap. This notable uptick in dominance suggests that even as overall market capitalization may be shrinking, a larger proportion of available capital is being strategically allocated to Bitcoin compared to other cryptocurrencies.

Digital Asset Treasuries and Stablecoin Reductions

Digital asset treasuries (DATs) and stablecoins previously provided substantial structural demand for Bitcoin within the ecosystem. However, Cipolaro emphasized that DAT premiums have compressed significantly across the entire board. Additionally, stablecoin supply has experienced a decline for the first time in several months, indicating that investors are actively withdrawing liquidity from the broader crypto universe.

💡 Even if the current market downturn intensifies further, the Digital Asset Treasury (DAT) sector appears to exhibit considerable resilience. Significant room remains before genuine financial stress becomes a widespread concern within these well-structured financial frameworks.

He further elaborated that leverage in these treasuries remains moderate, interest obligations are currently manageable, and many DATs offer inherent flexibility. This allows issuers to suspend dividend or coupon payments if market conditions truly necessitate it, thereby providing a crucial buffer against periods of severe market stress.

Bitcoin’s Long-Term Outlook Remains Positive

Despite the recent Bitcoin price pullback and associated volatility, Cipolaro maintains that Bitcoin’s long-term trajectory, often referred to as its secular story, remains entirely intact. Persistent factors such as increasing institutional adoption, growing sovereign interest from nations, and its well-established role as a neutral, programmable monetary asset continue to strongly support this optimistic view.

📌 The recent market fluctuations do not fundamentally alter Bitcoin’s long-term potential or its foundational value proposition. However, the current cyclical dynamics, primarily driven by immediate flow patterns, prevailing leverage levels, and reflexive market behavior, are exerting a far more dominant and immediate influence on short-to-medium term price action.

Investors should ideally hope for the best possible outcomes but remain prudently prepared for the worst-case scenarios. If past market cycles serve as any reliable guide, the path forward is likely to be inherently uneven, emotionally taxing for participants, and frequently punctuated by sudden and unexpected dislocations.

Frequently Asked Questions about Bitcoin Price Volatility

What caused Bitcoin’s recent price drop?

Bitcoin’s recent price decline is primarily attributed to the reversal of key drivers that previously fueled its ascent. These include significant outflows from crypto funds and reversals in digital asset treasuries, indicating actual capital flight according to analyses from NYDIG.

How have Bitcoin ETFs impacted the recent price action?

While spot Bitcoin ETFs were initially a strong source of capital inflow, they have now become a meaningful headwind, with these ETF inflows reversing into outflows. This shift is a crucial component of broader market cycle reversals currently affecting Bitcoin’s price dynamics.

Why is Bitcoin dominance increasing during a price drop?

Bitcoin dominance tends to increase during market drawdowns because investors frequently move capital from more speculative altcoins into Bitcoin. They seek the relative stability, established liquidity, and recognized status of the most prominent digital asset during periods of uncertainty.

Are Digital Asset Treasuries (DATs) and stablecoins facing significant stress?

While Digital Asset Treasury (DAT) premiums have compressed and stablecoin supply has seen a dip, NYDIG reports that no DAT has yet shown signs of financial distress. Leverage and interest obligations within these structures remain manageable, suggesting a degree of resilience in the sector despite market pressures.

What is the long-term outlook for Bitcoin despite current volatility?

The long-term outlook for Bitcoin remains positive, underpinned by ongoing institutional adoption, growing sovereign interest, and its fundamental role as a neutral, programmable monetary asset. While short-term price action may exhibit volatility, the underlying secular trend and its foundational value are considered intact.

Bitcoin Price Dynamics: Navigating the Cycle

The current market environment vividly underscores the inherently cyclical nature of cryptocurrency markets. While external macroeconomic factors, such as global liquidity and broader economic trends, undeniably play a role, internal market mechanics—involving capital flows, prevailing leverage, and evolving investor sentiment—are currently driving Bitcoin price action with far greater force and immediacy.

Investors are well-advised to maintain a balanced and informed perspective, diligently preparing for potential further volatility and sudden market movements. This prudence is essential even as the fundamental long-term investment case for Bitcoin continues to strengthen significantly, supported by increasing institutional interest and its unique properties as a resilient digital asset.