Key Highlights:

- Circle asserts it has consistently collaborated with government bodies to create a secure financial environment.

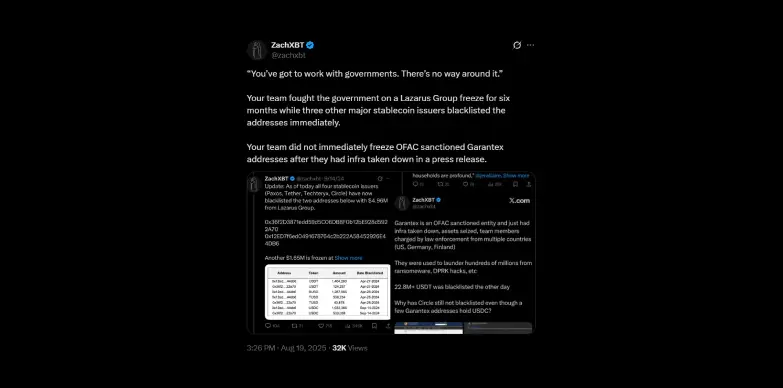

- ZachXBT has accused Circle of postponing the freezing of addresses linked to Lazarus Group and Garantex.

- This disagreement underscores the tension between corporate compliance and the speed of on-chain enforcement.

This week, a public disagreement unfolded on social media as blockchain investigator ZachXBT challenged Circle’s claims of close government cooperation. This dispute sheds light on a broader challenge: how stablecoin issuers can maintain regulatory compliance while preserving the open and transparent nature of crypto.

Circle’s Defining Statement

On Monday, August 18, 2025, USD Coin (USDC) issuer Circle took to X to reflect on its 12-year journey within the industry. The company highlighted its approach of working directly with governments and regulators to realize what it terms the “internet of money.”

“You have to collaborate with governments. There’s no alternative,” quoted Circle CEO Jeremy Allaire, linking to a profile outlining Circle’s efforts to build trust, influence policy, and establish a safer financial system. This message framed Circle as a responsible entity committed to transparency and regulatory oversight amid increasing scrutiny of stablecoin issuers.

ZachXBT’s Response

However, not everyone accepted this narrative. Shortly after Circle’s post went live, ZachXBT, a respected blockchain investigator, responded critically. He accused Circle of overstating its responsiveness to government directives.

From his comments on X (formerly Twitter), the criticism revolves around two key incidents:

- Lazarus Group incident: The North Korean hacking collective, sanctioned by the U.S. Treasury, has been connected to some of the largest DeFi breaches (including Bybit, Ronin Network, Horizon Bridge, and Atomic wallet exploits). While other stablecoin issuers like Tether acted quickly to freeze sanctioned Lazarus-linked addresses, ZachXBT alleges Circle delayed this action for several months before following suit.

- Garantex situation: The Russian crypto exchange Garantex was sanctioned by OFAC in 2022 for money laundering facilitation. ZachXBT pointed out that Circle did not promptly freeze addresses associated with Garantex despite U.S. authorities’ public announcements of the sanctions.

Significance of the Dispute

Examining both cases reveals that the issue extends beyond the speed of compliance. It highlights a deeper contradiction faced by stablecoin issuers: balancing their role as government partners to enable mainstream digital dollar adoption, against demands from crypto purists and watchdogs for decisive action against sanctioned entities.

This critique from the blockchain investigator suggests that Circle’s portrayal of seamless collaboration may be overly simplistic. Regulators expect not only eventual adherence but also timely enforcement by stablecoin issuers to prevent misuse by malicious actors. Delays in these efforts can be perceived as hesitation or, worse, prioritizing business interests over global security protocols.

For Circle, which markets USDC as a more regulation-friendly stablecoin compared to competitors like Tether, these allegations pose reputational risks. The company has consistently emphasized transparency, audits, and government cooperation. Nonetheless, critics argue that such claims require substantiation through clear evidence and consistent enforcement practices.

To date, Circle has not responded publicly to ZachXBT’s accusations. Whether the company issues a formal clarification or chooses silence may indicate its approach to handling criticism amid increasing regulatory pressure.

Fundfa Analysis

This dispute highlights the ongoing tension between regulatory compliance and the decentralized ethos of crypto. How stablecoin issuers like Circle navigate these challenges will significantly impact their credibility and adoption in regulated markets. Timely enforcement of sanctions is becoming a critical factor in maintaining trust and ensuring the integrity of digital financial systems.