“`html

Key Takeaways

- A significant partnership has been established between major players in the cryptocurrency space, marking a new era of collaboration.

- This integration is expected to reshape market dynamics by influencing liquidity, trading volume, and overall market influence.

- The move involves enhanced trading capabilities, including derivatives, which could lead to increased market activity.

- While volatility is present, recent data indicates a rise in network activity, suggesting underlying strength.

A groundbreaking deal has been finalized, effectively altering the competitive landscape of the crypto industry and signifying a new era of interoperability between once rival entities. This development represents a crucial first step in bridging the gap between two prominent forces in the digital asset ecosystem.

This strategic alliance is not merely symbolic; it has the potential to significantly alter the flow of liquidity, trading volume, and overall market influence across the cryptocurrency sphere.

Trading is slated to commence once adequate technical infrastructure and market-making support are fully established.

💡 Ensure you understand the implications of such major partnerships on asset liquidity and price discovery.

Market Dynamics and Derivatives

The integration of the main network token by a major exchange began with the introduction of perpetual futures. These derivatives enable traders to establish leveraged positions with no expiration date, closely resembling existing market structures. This move signifies a strategic expansion into more complex financial instruments.

💡 Stay informed about the launch of new derivative products, as they can significantly impact trading volumes and volatility.

The positive reception from prominent figures within the industry underscores the perceived benefits of broader accessibility, suggesting it enhances network liquidity and increases global reach.

Strong projects gain visibility through organic growth and market demand, not through listing fees.

Woke up to this. Thanks for the support from industry peers. Listing a 3rd largest market cap crypto should be a no-brainer. Excellent liquidity, volume and ecosystem. Not listing it is a loss for the exchange themselves. #BNB, keep building! pic.twitter.com/h7SptEBdLS

— CZ & BNB (@cz_binance) October 16, 2025

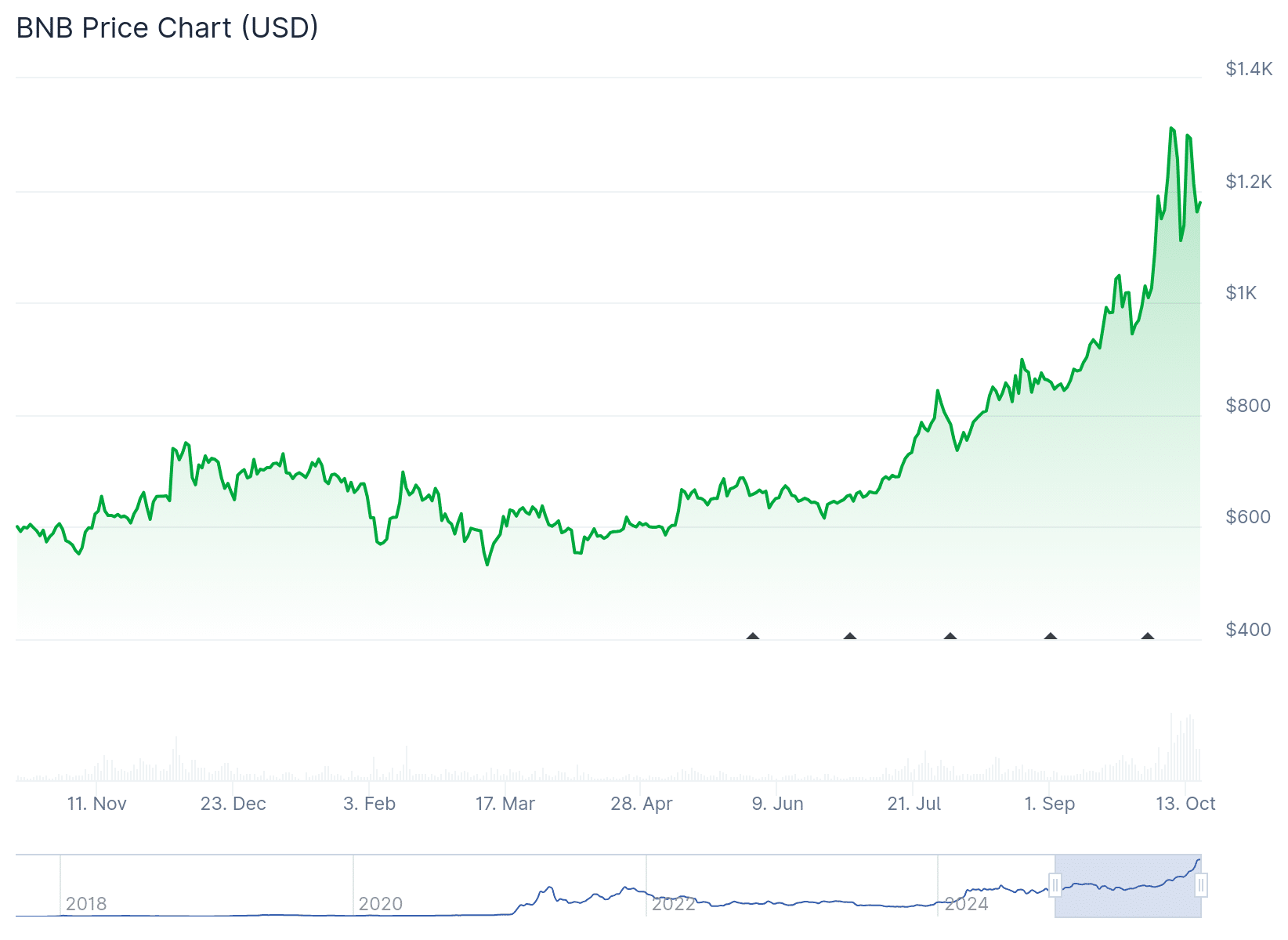

In parallel, there’s an accelerated push for multi-network compatibility, with promises of further integrations. Historical data suggests that newly listed assets on major platforms often experience significant price appreciation in their initial trading days, highlighting the platform’s influence on early market performance.

💡 Analyze historical listing performance of assets on major exchanges to gauge potential early-stage price movements.

Market Activity and Performance

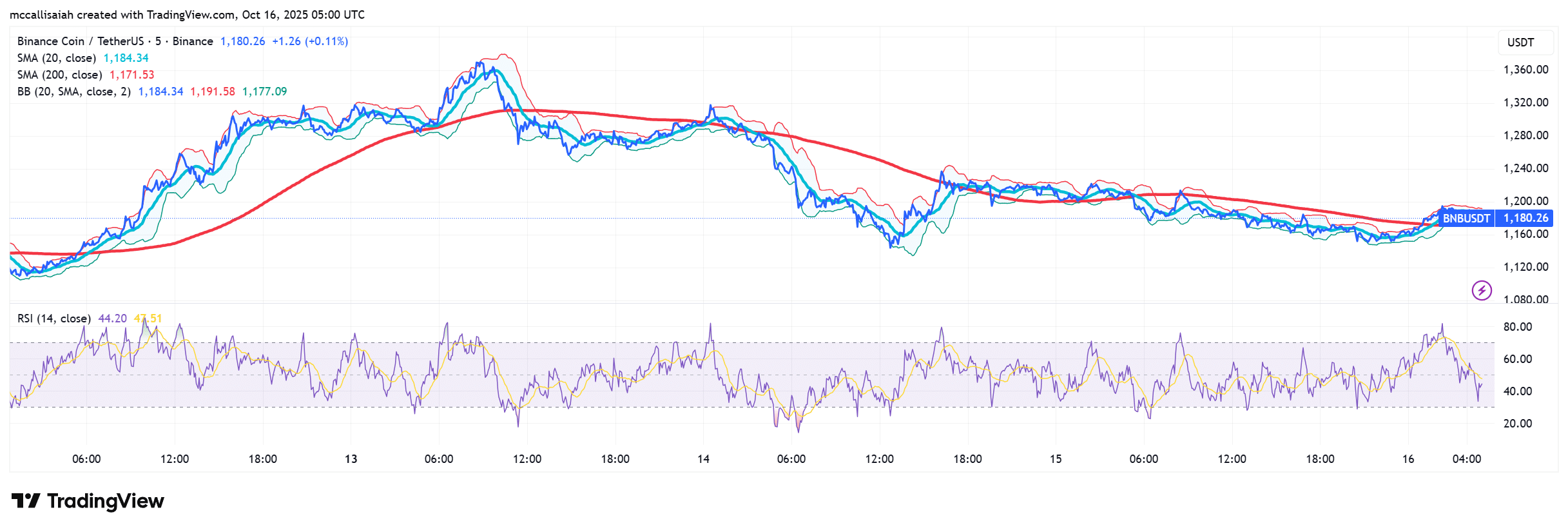

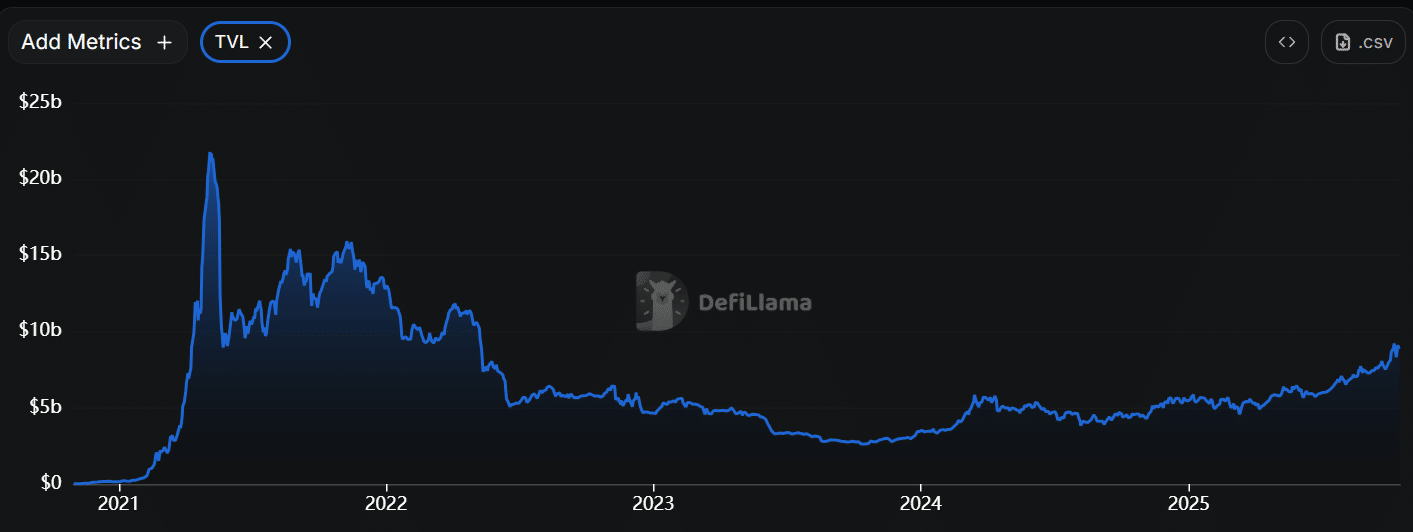

Despite recent short-term price fluctuations, underlying network activity shows signs of growth. While daily and weekly performance may indicate retracement, the monthly trend suggests a positive trajectory. Data regarding the total value locked on associated blockchain networks indicates a robust ecosystem, ranking it among the top platforms.

💡 Monitor both short-term price action and long-term network activity for a comprehensive view of an asset’s health.

This significant integration occurs amidst ongoing discussions regarding industry listing practices. Allegations have surfaced regarding stringent requirements for project listings, though these claims have been formally denied.

💡 Keep an eye on regulatory developments and public statements regarding industry practices, as these can influence market sentiment.

The Significance of the Alliance

This collaboration represents a truce in a long-standing rivalry, signaling a shift in priorities. For one exchange, it demonstrates that market liquidity is now paramount, potentially outweighing previous considerations.

For the other, it’s a testament to the growth and influence of its ecosystem, making it too significant to overlook. In a market where scale and credibility are key differentiators, the convergence of these forces was a logical progression.

💡 Understand the strategic motivations behind major industry collaborations to anticipate future market movements.

Fundfa Insight

The recent integration between major crypto players marks a pivotal moment, shifting focus from competition to collaboration. This strategic alliance is expected to unlock new avenues for liquidity and market development, benefiting the broader digital asset ecosystem.

“`