Main Highlights

- Looping strategies involve recursively borrowing assets against collateral to amplify returns and maximize airdrop opportunities.

- This method allows yield farmers to earn rewards on a larger capital base without continuously seeking new assets.

- Key looping methods include Classic Collateral, Liquid Staking, Stablecoin Yield, Cross-Asset, LP Token, and Liquid Restaking loops.

- Potential risks include liquidation, volatile borrowing rates, smart contract vulnerabilities, and fee drag.

- A disciplined approach with conservative leverage and diligent tracking is crucial for successful looping.

Yield farmers are constantly searching for innovative methods to enhance their returns from existing capital. Among these, looping strategies have emerged as a popular tactic, frequently discussed in airdrop communities and on cryptocurrency social platforms.

At its core, looping is about reinvesting your initial capital multiple times. It involves depositing assets as collateral, borrowing against that collateral, and then redepositing the borrowed funds to leverage even further. When executed correctly, this approach can significantly multiply your staking yields and accumulate airdrop points, all while reducing the need to constantly find new opportunities.

This guide will explore the fundamental concept of looping, its importance for yield farmers and airdrop hunters, and practical steps for implementing these strategies safely and effectively.

Explore comprehensive guides and content focused on airdrop farming.

What Is Looping?

Looping is essentially a recursive borrowing strategy. The process involves using an asset as collateral to borrow additional capital. This borrowed capital is then used to acquire or stake more of the original collateral asset, and the cycle is repeated.

Consider this straightforward example:

- You deposit Ether (ETH) as collateral.

- You borrow Tether (USDT), a stablecoin.

- You then use the borrowed USDT to purchase more ETH.

- This newly acquired ETH is deposited as additional collateral.

- The process repeats, allowing you to borrow again based on the increased collateral.

Each iteration, or “loop,” effectively increases the size of your overall position. This means you earn rewards on a larger asset base, even though your initial capital investment remains unchanged.

💡 Understanding the mechanics of each iteration is key to managing your leveraged positions effectively.

Why Farmers Love Looping

The appeal of looping for yield farmers and DeFi participants stems from two primary advantages:

- Amplified Yields – Looping enables users to earn staking or lending rewards on a substantially larger portfolio of assets than their initial deposit.

- Airdrop Point Accumulation – Many decentralized protocols reward user activity and trading volume. By increasing your position size and transaction frequency through looping, you can accumulate more points, potentially leading to larger airdrop allocations.

It’s akin to placing your capital on a dynamic treadmill; each revolution allows it to work harder and generate greater returns.

✅ This strategy can be particularly effective in ecosystems that heavily reward on-chain activity for potential airdrops.

Core Looping Methods

Classic Collateral Loop

- Deposit a blue-chip asset like ETH or Bitcoin (BTC) as collateral.

- Borrow a stablecoin, such as USDT, against your collateral.

- Use the borrowed stablecoin to purchase more of the collateral asset (e.g., more ETH).

- Deposit this additional asset and repeat the borrowing process.

This method is well-suited for users working with established cryptocurrencies and seeking straightforward leverage. Popular platforms for this strategy include Aave, Compound, and MakerDAO.

📍 Stick to well-audited platforms to minimize smart contract risk when employing this strategy.

Liquid Staking Loop

- Stake ETH to receive a liquid staking derivative token, such as stETH or mETH.

- Use this liquid staking token as collateral to borrow a stablecoin.

- Acquire more ETH, stake it, and repeat the process with the new liquid staking tokens.

This approach allows you to earn staking rewards on your underlying ETH while simultaneously generating yield on your borrowed stablecoins. It can be effectively implemented using platforms like Lido in conjunction with Aave, or Rocket Pool with Morpho.

⚡ Combining liquid staking with lending protocols can create powerful compounding effects.

Stablecoin Yield Loop

- Deposit stablecoins like USDC or DAI into a lending protocol to earn interest.

- Borrow a different stablecoin against your deposited collateral.

- Swap the borrowed stablecoin back to your original deposited asset and redeposit it.

This strategy focuses on maximizing yield from stablecoin holdings. It allows users to leverage their stablecoin positions for higher Annual Percentage Yields (APYs) while maintaining exposure primarily to stable assets. Platforms such as Aave, Morpho, and FraxLend can be utilized.

📊 This method is ideal for those seeking to compound lending APYs without introducing significant price volatility.

Cross-Asset Loop

- Deposit one asset, for instance ETH, and borrow another, like BTC.

- Utilize the borrowed BTC as collateral on a different platform to borrow ETH.

- Continue looping while carefully managing the loan-to-value (LTV) ratios across both assets.

This advanced strategy can be beneficial for those looking to hedge their positions or exploit differences in borrowing rates between various assets on different protocols.

💡 Diversifying collateral across different asset types might offer unique hedging opportunities.

LP Token Loop

- Provide liquidity to a Decentralized Exchange (DEX) pool, such as ETH/USDC, to receive Liquidity Provider (LP) tokens.

- Use these LP tokens as collateral on a lending protocol.

- Borrow a stablecoin against your LP token collateral and add it back to the liquidity pool.

This technique allows you to earn trading fees and potentially farming rewards from the LP position while simultaneously leveraging it to increase your exposure. Platforms like Curve combined with Convex, or Uniswap v3 with Aave are examples of where this can be implemented.

✅ Levering LP positions can significantly boost returns from both trading fees and yield farming incentives.

Liquid Restaking Loop

- Stake ETH to obtain a liquid staking token.

- Restake this token in a protocol like EigenLayer to earn additional yield.

- Use the restaked token as collateral on a lending platform, borrow assets, and repeat the cycle.

This sophisticated method allows for the accumulation of multiple layers of yield, combining standard staking rewards with the additional returns from restaking protocols.

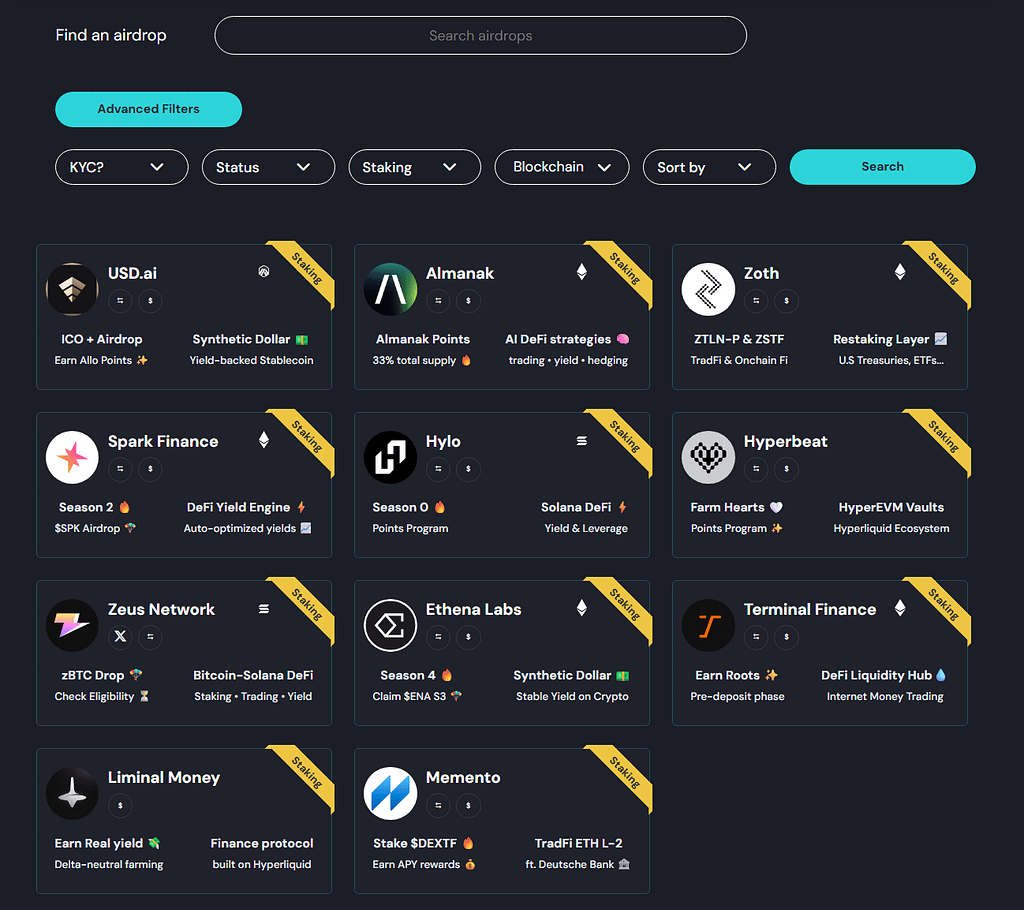

Ready to test your knowledge? Explore the latest staking airdrops and apply your skills. Visit our browse page and filter for staking opportunities.

Risks to Watch

While looping strategies can appear lucrative, it’s crucial to acknowledge that risk is an inherent part of decentralized finance. Several factors demand careful consideration:

- Liquidation Risk: A sharp decline in the price of your collateral can trigger an automatic liquidation of your position, leading to potential losses.

- Interest Rate Volatility: Borrowing rates on lending platforms can fluctuate rapidly, potentially increasing your costs and reducing profitability.

- Smart Contract Vulnerabilities: Stacking multiple protocols increases the attack surface; a vulnerability in any one protocol could impact your entire position.

- Transaction Fees (Gas) and Slippage: Frequent trading and borrowing activities can incur significant transaction costs, diminishing overall returns.

⚡ Always monitor your collateralization ratios and maintain a conservative leverage level to mitigate liquidation risks.

- Utilize tools like DeFiLlama to compare lending rates across various platforms.

- Monitor your collateral ratios diligently on platforms like Aave and Compound.

- Stay updated on real-time asset prices using resources such as CoinGecko and Dexscreener.

Maintaining a detailed spreadsheet is highly recommended. Many experienced DeFi users rely on tools like Excel or Google Sheets to meticulously track their positions, manage leverage, and monitor liquidation thresholds.

📊 Comprehensive tracking is non-negotiable when managing complex leveraged positions.

Pick a Chain and Loop!

With a solid understanding of looping strategies, you’re ready to explore potential yields and airdrop opportunities on your preferred blockchain network. Begin by selecting a chain and experimenting with these techniques. Consider reviewing specific guides for different networks to find a suitable starting point for your looping journey.

Personal Note

Implementing looping strategies is a common practice for maximizing returns in farming activities while actively managing risk. This involves a dedicated effort to monitor spreadsheets, rebalance positions, and optimize for yield farming points. While it may not offer overnight riches, the consistent daily income and potential airdrop rewards can accumulate significantly over time without the extreme volatility often associated with other crypto trading methods.

💡 Consistency and diligent management are key to long-term success with crypto yield strategies.

Step-by-Step Starter Plan

- Select a reliable blue-chip asset, such as ETH or stETH, as your initial collateral.

- Research current borrowing rates on established lending platforms like Aave or Compound.

- Determine a conservative loan-to-value (LTV) ratio, typically remaining below 60%, to maintain a safety buffer.

- Initiate the loop: deposit your collateral, borrow assets, purchase more of the collateral asset, and redeposit.

- Maintain a detailed spreadsheet to track all your positions, collateral values, and outstanding loans.

- Plan your exit strategy and unwind your positions gradually when you decide to realize your gains or mitigate risk.

Support Our Work

If you found this guide valuable, your support is greatly appreciated and helps us continue providing high-quality content. Consider exploring offerings from our partners.

Expert Summary

Looping strategies represent a sophisticated yet accessible method for amplifying cryptocurrency yields and maximizing airdrop potential. By strategically recycling capital through recursive borrowing and redepositing, users can effectively increase their earning base across multiple DeFi protocols. Careful risk management, diligent tracking, and a patient approach are essential for successfully navigating these leveraged positions.

For those looking to optimize their crypto assets beyond simple holding or basic staking, mastering looping techniques can unlock a new level of yield generation and reward accumulation.