Key Takeaways

- The cryptocurrency market is experiencing a notable uptrend, with Bitcoin achieving significant price milestones.

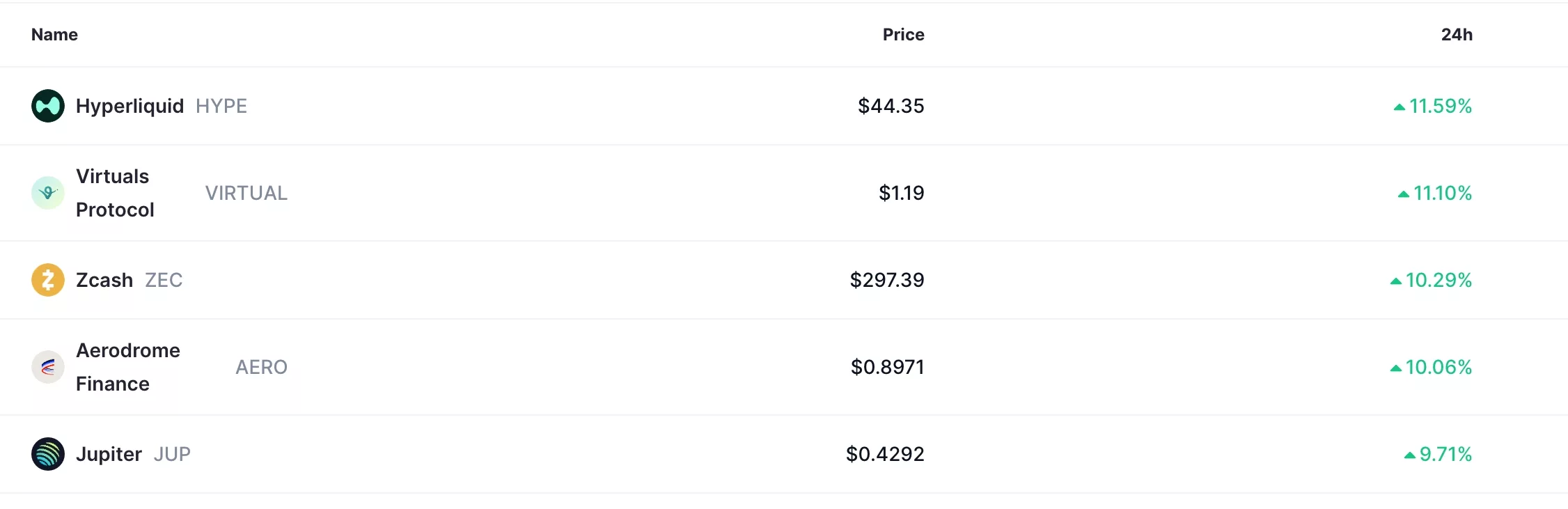

- Several altcoins, including Hyperliquid (HYPE) and Virtuals Protocol (VIRTUAL), have registered substantial gains.

- Positive U.S. inflation data has fueled market optimism, increasing expectations for Federal Reserve rate reductions.

- The potential easing of trade tensions between the U.S. and China is also contributing to a more positive market outlook.

- However, there’s a risk that the current market rally could be a dead cat bounce, indicating a possible temporary recovery before a decline.

Crypto Market Shows Strong Uptrend

The cryptocurrency market is currently exhibiting a significant upward trend, with Bitcoin and a majority of altcoins trading at their highest points in over a week. This surge in value has boosted the total market capitalization, demonstrating renewed investor confidence in digital assets.

Bitcoin (BTC) has experienced robust growth, climbing from approximately $107,088 to $112,866 over the past week, marking a 5.3% increase. Concurrently, the total crypto market capitalization has surged by 14%, rising from a monthly low of $3.24 trillion to $3.73 trillion. This broad-based market expansion indicates widespread positive sentiment across the digital asset space.

The upward momentum extends to many altcoins, with several top performers showing gains exceeding 10% in the last 24 hours. Notable gainers include Hyperliquid (HYPE), Virtuals Protocol (VIRTUAL), Zcash (ZEC), and Aerodrome Finance (AERO). These significant price movements in altcoins suggest that capital is flowing into various segments of the crypto market, not just Bitcoin.

Positive Economic Indicators Fuel Crypto Rally

A primary driver behind the current crypto market rally stems from encouraging inflation data released by the Bureau of Labor Statistics. The report indicated that the headline Consumer Price Index (CPI) saw a modest rise from 2.9% in August to 3.0% in September. More significantly, core inflation, which omits volatile food and energy prices, decreased from 3.1% to 3.0%.

💡 These inflation figures have bolstered the probability that the Federal Reserve will implement interest rate cuts during its upcoming meeting. Analysts from ING Bank have also predicted further rate reductions in December, alongside the potential conclusion of the Fed’s quantitative tightening program. The prospect of a more accommodating monetary policy is frequently viewed as a positive catalyst for risk assets like cryptocurrencies.

The anticipation of an easy-money policy is also credited with the concurrent surge in the stock market. Major indices such as the Dow Jones, S&P 500, and Nasdaq 100 have all reached record highs, reflecting a broader market optimism driven by favorable economic outlooks.

📌 Alongside the economic news, geopolitical developments are also playing a role in market sentiment. Ongoing trade talks and potential de-escalation of tensions between the United States and China are being closely watched. President Donald Trump’s tour in Asia, including an anticipated meeting with President Xi Jinping at the APEC Summit in South Korea, has raised hopes for eased trade relations.

⚡ Earlier trade threats, such as the proposed tariff on Chinese goods, had previously contributed to a market downtrend. The potential for more stable international trade relations could provide a tailwind for global markets, including cryptocurrencies.

Assessing the Risk of a Dead Cat Bounce

Despite the current positive momentum, a significant risk facing the crypto market is the potential for a dead cat bounce (DCB). A dead cat bounce refers to a temporary, short-lived recovery in the price of an asset that is otherwise in a downtrend. Such bounces can occur over days, weeks, or even months before the asset resumes its downward trajectory.

📍 One indicator suggesting the current rally might be a dead cat bounce is Bitcoin’s price action encountering substantial resistance at the 100-day moving average. This technical observation can signal a loss of momentum for the ongoing bull run, implying that the upward price movement might not be sustainable in the long term.

Looking ahead, market participants will be closely monitoring several key events that could influence cryptocurrency prices. Beyond the crucial Federal Reserve decision and the outcome of the Trump-Xi summit, upcoming earnings reports from major U.S. tech companies like Apple, Microsoft, and Meta Platforms are expected to impact overall market sentiment.

Expert Summary

The current crypto market uptrend, led by Bitcoin and several altcoins, is supported by positive U.S. inflation data and hopes for eased U.S.-China trade tensions. However, technical indicators suggest a potential risk of a dead cat bounce, warranting cautious observation of upcoming economic events and corporate earnings.