Main Highlights

- Samsung integrates Coinbase trading and staking into its Wallet for over 75 million Galaxy devices, enabling crypto payments.

- Several crypto airdrop opportunities are active, including those from Based, Aster, and Hyperlane, with Ethereal Mainnet launching soon.

- World Liberty Financial (WLFI) sold tokens to Hut 8 at a premium, signaling institutional confidence despite a unique deal structure.

- MetaMask Rewards program offers points for trading and bridging, with speculation of a significant airdrop potentially distributing over $30 million in LINEA tokens.

- Walmart’s OnePay plans to add Bitcoin and Ethereum trading and custody features by the end of 2025, facilitated by Zerohash.

- A U.S. court ruled that Bored Ape Yacht Club (BAYC) NFTs and ApeCoin are not securities, offering legal clarity for the NFT sector.

Samsung Wallet Brings Coinbase Trading to 75 Million Galaxy Devices

Samsung has announced a significant partnership with Coinbase, aiming to provide digital asset services to more than 75 million Galaxy device owners across the United States. This collaboration will allow users direct access to Coinbase One, an offering that includes zero-fee trading and high-yield staking, all managed through the Samsung Wallet application.

💡 This move is a substantial upgrade from Samsung’s 2020 integration with Gemini for its Blockchain Wallet, representing a much larger stride towards mainstream crypto adoption. Galaxy users will now be able to perform trading, staking, and crypto-based payments without needing to install any additional applications.

“Our mission is to bring more than a billion people on chain, and that starts with meeting them where they already are: on their phones,” stated Shan Aggarwal, Coinbase’s Chief Business Officer. 📍 This strategy highlights the growing trend of embedding financial services directly into the devices people use daily.

Furthermore, the integration extends to Samsung Pay, enabling users to make crypto-backed payments at checkout. While the initial rollout is focused on the U.S., global expansion is planned for the upcoming months. ✅ This development is a key indicator of the increasing fusion between traditional finance and digital assets, contributing to the overall optimistic sentiment in the market.

Airdrop Updates You Shouldn’t Miss

The past week has been particularly active for cryptocurrency airdrop participants, with numerous opportunities for claiming rewards and preparing for future distributions. 📊

- Users on Based can now claim the Upheavel Airdrop.

- Following the conclusion of Based Season 1, Season 2 commences today. Comprehensive updates will be provided on AirdropAlert listings shortly.

- The Aster Season 2 snapshot is scheduled for today, with Season 3 set to begin immediately afterward.

- The Hyperlane Expansion Rewards Season 3 snapshot has been completed, and claims will open on October 8th.

- Ethereal Mainnet is slated for launch on October 20th, and its waitlist is currently accessible.

⚡ With activity spanning multiple blockchain networks, remaining engaged and consistent during these farming periods can yield significant returns. Consulting the latest airdrop listings is crucial for staying informed and maximizing potential rewards.

Explore our recently updated list of the best DEX airdrops for 2025 to uncover more opportunities.

World Liberty Financial Sells WLFI at a 25% Premium to Hut 8

In a notable transaction, World Liberty Financial (WLFI), associated with the Trump family and its crypto initiative, has sold a portion of its locked token holdings to Bitcoin mining firm Hut 8. 📌

According to data compiled by Arkham Intelligence, the agreement covered approximately 100 million WLFI tokens. These were transacted at $0.25 per token, representing a 25% premium over the prevailing market price, and were valued at $25 million. 💡

Industry analysts interpret this deal as a strong endorsement of WLFI’s long-term value proposition. Hut 8 reportedly intends to incorporate these tokens into its corporate treasury reserves, a strategy reminiscent of MicroStrategy’s approach with Bitcoin. ✅

From WLFI’s perspective, this acquisition signifies institutional validation and enduring confidence in the project. However, the method of acquisition, a private sale above market value, raises questions compared to a public market purchase, which might have offered greater benefits to retail investors and potentially driven a broader community-driven price appreciation. Still, WLFI’s strategy, which includes tokenizing real estate and commodities and integrating retail payment systems, points towards a long-term vision. ⚡

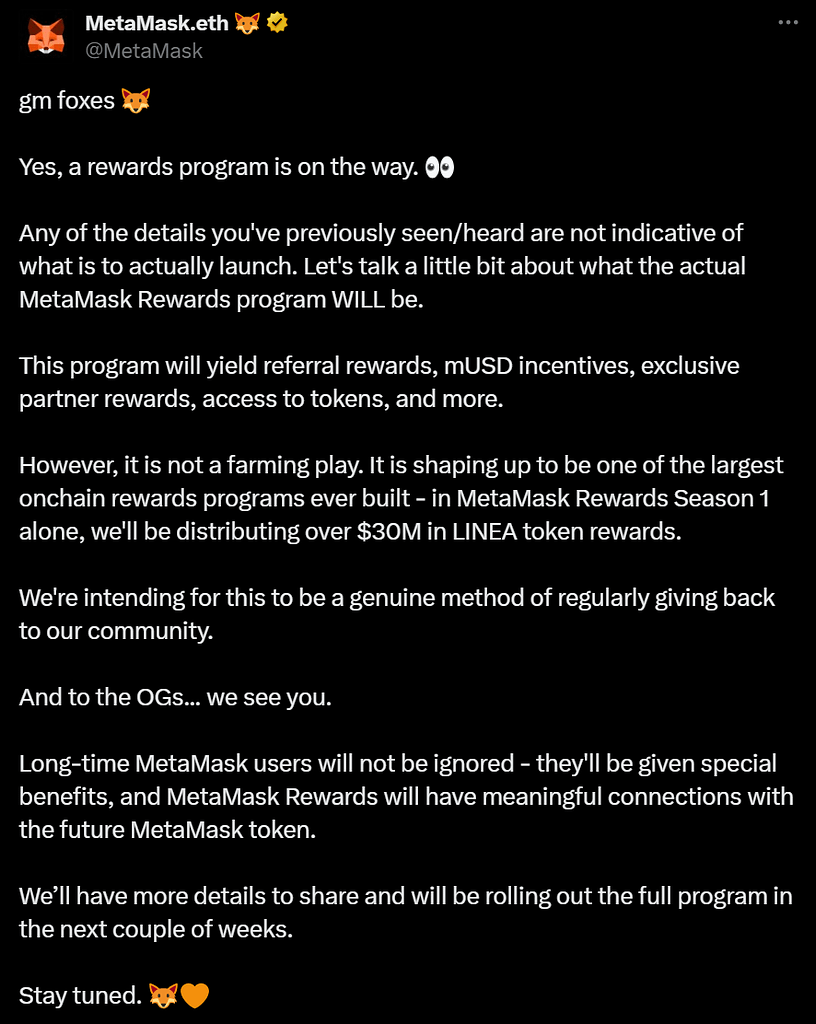

MetaMask Airdrop Rumors Heating Up

Speculation surrounding a potential MetaMask airdrop has intensified, particularly following the introduction of the MetaMask Rewards program. This program allows users to earn points for performing actions such as swapping, bridging, and trading within the MetaMask ecosystem. Early observations suggest that users’ past engagement within the platform could serve as a multiplier, potentially benefiting early adopters. 💡

Leaked information indicates that the value of rewards might be influenced by the type of activity undertaken:

- Spot trading: 80 points per $100

- Futures trading: 10 points per $100

- Past trading history: 250 points per $1,250

- Utilizing the LINEA chain for transactions: 100% bonus points

MetaMask has officially confirmed that the rewards program is set to distribute over $30 million in LINEA tokens during its first season. While the company describes it as a rewards program and not a farming play, the designation of Season 1 suggests ongoing airdrop potential. Consequently, airdrop enthusiasts are actively engaging in trading and bridging activities through MetaMask to maximize their potential earnings. 📍

If these MetaMask rewards are indeed linked to a future $MASK token, this initiative could evolve into one of the most significant airdrops in the history of the cryptocurrency space. 🚀

Walmart’s OnePay to Add Bitcoin and Ethereum

In another significant move by a traditional retail giant, Walmart-backed OnePay is reportedly planning to integrate cryptocurrency trading and custody features by the close of 2025. ✅

OnePay, currently serving approximately 1.5 million users with services spanning banking, payments, and credit, will soon allow its users to directly buy, hold, and convert Bitcoin (BTC) and Ethereum (ETH) within its application. This positions OnePay as one of the pioneering retail fintech platforms to offer comprehensive crypto integration. 💡

The technical infrastructure for these new features will be provided by Zerohash, a Chicago-based company specializing in blockchain infrastructure, which recently secured $104 million in funding with participation from Morgan Stanley. This partnership ensures a rapid and compliant deployment of crypto functionalities for OnePay. 📍

For Walmart, this represents a measured yet clear entry into the digital asset landscape. Given Walmart’s extensive retail footprint, the introduction of crypto payment options could fundamentally alter how consumers interact with digital currencies for everyday transactions, potentially enabling integrated experiences for purchases, bill payments, and investments all within a single application linked to their local stores. ⚡

U.S. Court Rules BAYC NFTs and ApeCoin Are Not Securities

In a landmark decision for the non-fungible token (NFT) and cryptocurrency sectors, a U.S. federal court has ruled that Bored Ape Yacht Club (BAYC) NFTs and ApeCoin do not qualify as securities. 🚀

The lawsuit, initiated in 2022, alleged that Yuga Labs, the creator of BAYC, had engaged in the sale of unregistered securities and misled investors. Judge Fernando Olguin dismissed the case, concluding that BAYC NFTs do not meet the criteria of the Howey Test, thus classifying them as collectibles rather than investment contracts. ✅

This ruling represents a significant victory for Yuga Labs and the broader NFT industry, offering much-needed legal clarity. It establishes that NFTs marketed primarily as cultural or creative assets, rather than as instruments for profit generation, fall outside the purview of securities regulations. 💡

Essentially, this decision helps solidify the recognition of NFTs as digital art, identity markers, and community-building tools, distinct from financial products. It may also set a precedent that could limit the Securities and Exchange Commission’s (SEC) regulatory authority over NFTs, thereby fostering greater innovation for creators in the Web3 space. 📌

The reaction on Crypto Twitter has been swift, with many hailing the verdict as a historic milestone for digital ownership and Web3 culture.

Review our latest coverage on American Express Travel NFTs.

Fundfa Insight

The current market momentum, dubbed Uptober, is being propelled by significant developments such as Samsung’s Coinbase integration, Walmart’s entry into crypto, and institutional backing for projects like WLFI. These events underscore a maturing crypto landscape where mainstream adoption and utility are increasingly prioritized. ⚡

While the bullish news indicates a robust bull market, seasoned traders often consider the timing of potential market peaks and the importance of having a well-defined exit strategy, especially when observing parabolic price movements. Navigating these volatile periods requires a disciplined approach, focusing on market analysis over emotional decision-making. 📊