Key Takeaways

- Changpeng Zhao (CZ) states that strong cryptocurrency projects do not need to pay for exchange listings.

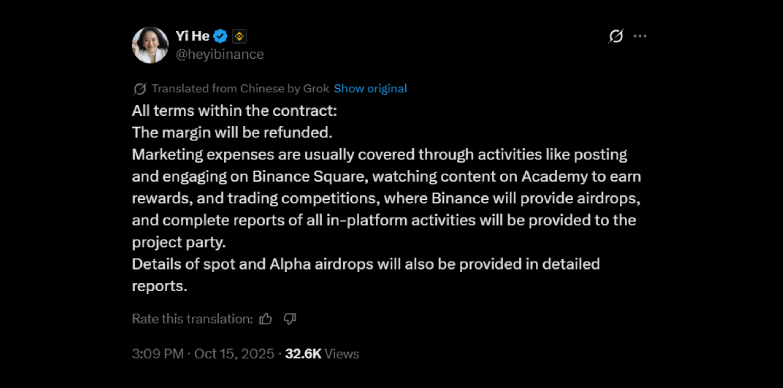

- He Yi detailed Binance’s approach to listings, confirming refundable deposits and use of marketing fees.

- CZ urges developers to focus on product growth and community building over industry criticism.

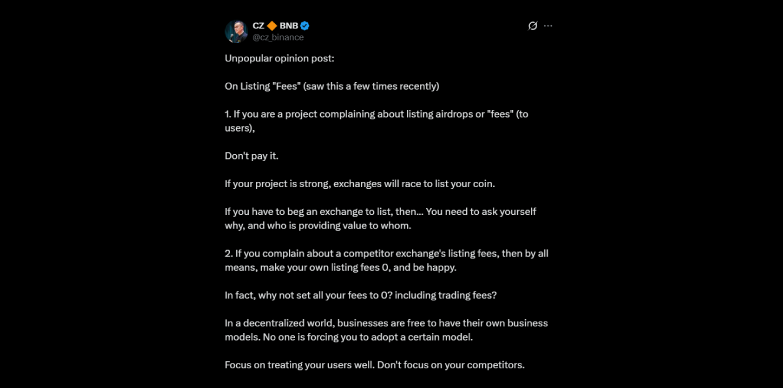

Former Binance CEO Changpeng Zhao, widely known as CZ, recently shared his perspective on cryptocurrency exchange listing practices and associated fees via the social media platform X. In his post, CZ stated that fundamentally strong crypto projects should not need to pay listing fees or actively solicit listings from exchanges. He further advised project developers to concentrate on enhancing their products and engaging with their communities, suggesting that top-tier exchanges will naturally seek out unique and valuable projects for listing.

CZ’s commentary emerges during a period of heightened discussion surrounding listing fees and airdrop mechanics, particularly concerning challenges faced by smaller projects with certain exchanges. He elaborated on the varied operational models of different exchanges and cautioned against what he described as unproductive criticism originating from projects and traders alike.

💡 This discussion highlights the ongoing effort to define fair and transparent listing practices within the crypto space.

However, some industry observers have pointed to a perceived inconsistency, citing the absence of Binance’s native token, BNB, on major platforms like Coinbase. Critics argue that if CZ advocates for fair listing practices, prominent tokens associated with his ventures should ideally be accessible on a wider range of exchanges as a precedent.

If Your Project Requires Begging, Reassess Its Value

CZ began his communication by addressing crypto startups that often express frustration regarding listing rules or airdrop expectations. He asserted, If your project is strong, exchanges will race to list your coin. He implored teams that exert excessive effort to secure listings to reassess their project’s core value proposition and its contribution to users.

✅ He further explained that exchanges function as businesses capable of generating revenue through various means, including listing fees, trading commissions, staking services, or user engagement tools. He emphasized that no single business model is inherently superior, and the principle of decentralization permits each exchange to operate autonomously.

⚡ If you complain about a competitor exchange’s listing fees, then by all means, make your own listing fees 0, and be happy, he suggested, humorously highlighting how competition and user choice can drive innovation. Rather than focusing on rivals, CZ recommended that projects treat your users well and focus on your project.

Exchanges Employ Diverse Listing Models

In his X post, CZ outlined three primary approaches exchanges take for token listings:

- Open Listing: Platforms that list a vast majority of tokens across various blockchains to capture market share, albeit with inherent risks.

- Fee-Based Listing: Exchanges meticulously select tokens and charge fees to support operations and conduct project due diligence, a common practice among smaller platforms.

- Deposit or Airdrop-Based Listing: Platforms that require refundable deposits or project airdrops to mitigate scam risks and safeguard users.

📍 CZ observed that many exchanges, including Binance, utilize a hybrid approach combining these models, adapting them based on the specific product market, such as spot trading, futures, or novel launch platforms. He underscored that within the decentralized ecosystem, there is no mandate for a single listing strategy, reinforcing the idea that exchanges are free to experiment with different fee structures and engagement methods.

Direct User Concerns to Project Teams, Not Exchanges

CZ also addressed user complaints, particularly from holders of undervalued or delisted tokens, urging them to direct their grievances towards the project teams rather than the exchanges. If you are a bag holder, complain to the project or use a DEX, he advised, referencing decentralized exchanges like PancakeSwap, which operate without charging listing fees while still facilitating significant trading volumes.

📌 Direct communication with project developers can often lead to clearer resolutions for holders experiencing issues with token value or exchange accessibility.

He Yi Clarifies Binance’s Listing Process

Following CZ’s remarks, Binance Co-founder He Yi provided further clarification on Binance’s listing process via an X post. She confirmed that all deposits associated with token listings on Binance are fully refundable. She explained that marketing fees are allocated to initiatives such as Binance Square, Binance Academy content, and trading competitions, and that project-led airdrops also receive support. Crucially, each listing process includes the delivery of comprehensive reports to project teams, ensuring transparency and equitable exposure for legitimate blockchain projects.

Prioritize Development Over Dissension

CZ’s core message emphasizes that projects demonstrating genuine value will naturally attract exchange listings and community backing, while those with weaker fundamentals may resort to raising complaints. His concluding advice, Work on your project, not other people, aligns with Binance’s long-standing ethos of focusing on building robust products, maintaining transparency, and allowing market forces to validate a project’s true worth.

📊 This perspective suggests that the long-term success of any cryptocurrency project hinges on its underlying utility and development, rather than its ability to navigate exchange politics or secure arbitrary listings.

Fundfa Insight

The recent discussions initiated by CZ and He Yi highlight a recurring theme in the cryptocurrency industry: the critical importance of project fundamentals. While listing fees and exchange policies are valid concerns for many, both Binance executives fundamentally advocate for a stronger focus on product development, community engagement, and delivering intrinsic value as the primary drivers of sustainable success for crypto projects.