Key Takeaways

- The Dow Jones Industrial Average experienced a significant drop, influenced by escalating US-China trade tensions.

- The US tech sector faces potential disruption due to proposed software export restrictions to China.

- Further instability in the lending sector was highlighted by PrimaLend’s bankruptcy filing.

- Domestic agricultural sectors voiced opposition to US trade policies impacting meat imports and tariffs.

Market Fluctuations Driven by Geopolitical and Economic Factors

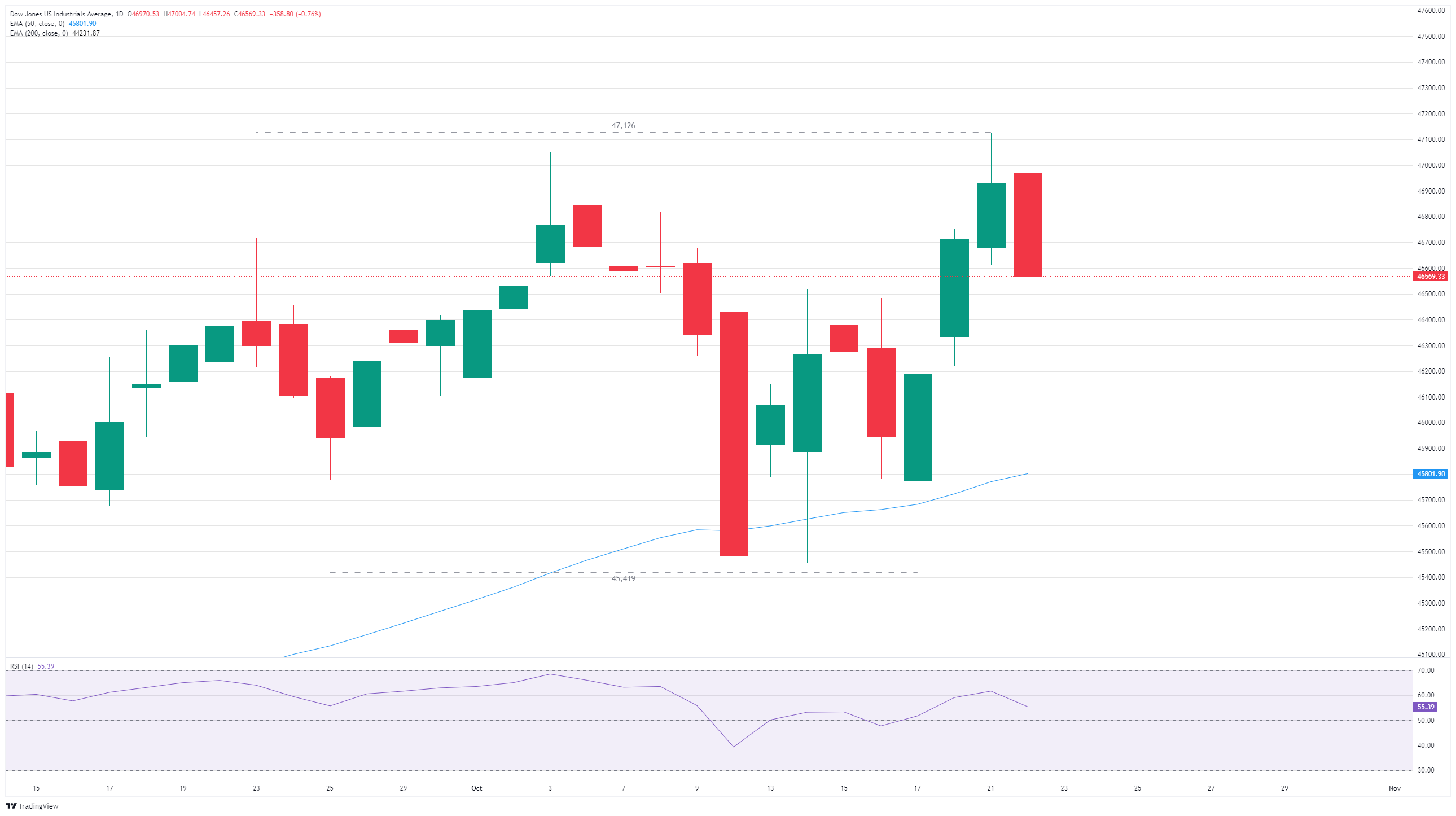

The Dow Jones Industrial Average (DJIA) faced considerable downward pressure on Wednesday, dipping over 500 points at its lowest point. This decline was largely attributed to renewed risk-off sentiment among investors, stemming from the Trump administration’s considerations to intensify trade friction between the United States and China.

💡 The ongoing trade disputes have created a climate of uncertainty, impacting investor confidence and leading to the stock market’s vulnerability. This dynamic highlights the interconnectedness of global economies and the significant influence of international trade relations on domestic market performance.

Adding to the market’s concerns was the bankruptcy declaration of another subprime lender, PrimaLend. This event underscores growing vulnerabilities within the credit and lending segments of the economy, further dampening investor sentiment and raising questions about the overall financial health of these sectors.

US-China Trade Relations Under Strain

Reports indicate that the Trump administration is exploring the possibility of imposing restrictions on software exports to China. This potential measure is seen as a retaliatory response to China’s recent actions to increase government oversight on the export of rare earth minerals.

📌 The tech industry in the United States has a critical reliance on unobstructed access to China’s rare earth metals markets. Any disruptions to this supply chain could have significant repercussions for key US industries, potentially impacting innovation and production capabilities.

The proposed export restrictions signal a deepening of trade tensions, suggesting a willingness from the administration to leverage technological and resource-based leverage in its trade negotiations.

Instability in the Lending Sector

PrimaLend’s recent filing for bankruptcy has added further pressure on investor sentiment regarding the health of the US lending landscape. This development follows the collapse of an automotive lender in recent weeks, indicating a potential broader issue within the credit market.

📊 These bankruptcies raise concerns about the tightening of credit conditions and the solvency of non-bank financial institutions. Investors are closely monitoring such events for signs of systemic risk or contagion within the financial system.

Agricultural Sector Criticisms

US farmers have expressed strong disapproval of President Donald Trump’s trade policy, particularly his plan to allow beef imports from Argentina to compensate for a shortfall. This shortfall was a direct consequence of the administration’s imposition of a 50% tariff on all Brazilian beef imports.

⚡ American cattle farmers have publicly criticized the move, arguing it undermines domestic production. President Trump, however, defended his tariffs, suggesting that American beef farmers were not understanding the broader benefits of his trade strategy.

This situation highlights the complex and often contentious relationship between trade policy, domestic industries, and agricultural producers, showcasing how tariffs and import/export regulations can create significant internal debates and economic challenges for specific sectors.

Understanding the Dow Jones Industrial Average

What is the Dow Jones Industrial Average?

The Dow Jones Industrial Average (DJIA) is one of the world’s oldest stock market indices, comprising the 30 most actively traded stocks in the United States. It is a price-weighted index, meaning higher-priced stocks have a greater influence on the index’s movement than lower-priced stocks, unlike market-capitalization-weighted indices. The DJIA was founded by Charles Dow, also a co-founder of The Wall Street Journal. While historically significant, it has faced criticism for its limited representation, as it only tracks 30 large-cap companies, unlike broader indices such as the S&P 500.

Factors Influencing the DJIA

Several key factors influence the performance of the Dow Jones Industrial Average (DJIA). The aggregate financial results of its component companies, as revealed in quarterly earnings reports, are a primary driver. Additionally, both US and global macroeconomic data play a crucial role, as they significantly impact investor sentiment.

📍 The Federal Reserve’s (Fed) interest rate decisions are also a major influencer. Interest rates affect the cost of borrowing money for corporations, a cost many businesses heavily rely on. Consequently, inflation and other economic indicators that could sway Fed decisions are significant variables for the DJIA.

Dow Theory and Market Trends

Dow Theory, developed by Charles Dow, is a methodology for identifying the primary trend of the stock market. A fundamental aspect of this theory involves comparing the performance of the Dow Jones Industrial Average (DJIA) with the Dow Jones Transportation Average (DJTA). Trends are considered confirmed only when both indices move in the same direction. Volume analysis serves as a confirmatory tool.

The theory utilizes peak and trough analysis to identify trend phases, which include: accumulation, where institutional investors begin making trades; public participation, marked by broader market involvement; and distribution, when smart money exits its positions.

Trading the Dow Jones Industrial Average

There are multiple avenues for trading the DJIA. Exchange Traded Funds (ETFs) offer a way to trade the index as a single security, eliminating the need to purchase shares of all 30 component companies. A prominent example is the SPDR Dow Jones Industrial Average ETF (DIA).

Furthermore, DJIA futures contracts allow traders to speculate on the index’s future value. Options provide the right, but not the obligation, to buy or sell the index at a specific price within a defined timeframe. Mutual funds also offer investors exposure to the DJIA by providing a share in a diversified portfolio of its constituent stocks.

Expert Summary

The Dow Jones Industrial Average experienced a notable decline, driven by heightened US-China trade disputes and concerns over the stability of the lending sector following PrimaLend’s bankruptcy. International trade dynamics and internal economic vulnerabilities continue to shape market sentiment.

Key industries, including technology and agriculture, are grappling with the impacts of US trade policies and tariffs. Understanding the factors that influence the DJIA, from macroeconomic data to specific industry pressures, remains crucial for navigating current market conditions.