Key Takeaways

- dYdX is currently trading around $0.28, experiencing some volatility.

- Price predictions suggest dYdX could reach a maximum of $3.55 by 2025.

- Long-term forecasts indicate a potential price of $29.58 by 2030.

The dYdX exchange has recently been in the spotlight due to its planned migration of dYdX tokens from Ethereum to its new mainnet. However, the platform also announced a significant workforce reduction of 35% in the fall of 2024. Amidst rising on-chain activities, many are wondering about dYdX’s future potential. This analysis provides a dYdX price prediction to address these questions.

Overview of dYdX

| Cryptocurrency | dYdX |

| Token | dYdX |

| Current Price | $0.28 (+2.4%) |

| Market Cap | $413.34 Million |

| Trading Volume (24h) | $11.92 Million |

| Circulating Supply | 787.63 Million dYdX |

| All-time High | $4.53 (March 8, 2024) |

| All-time Low | $0.4954 (April 9, 2025) |

| 24-hour High | $0.285 |

| 24-hour Low | $0.2515 |

dYdX Price Prediction: Technical Analysis

| Metric | Value |

| Current Price | $0.2777 |

| Predicted Price (24h) | $0.2729 (-0.03%) |

| Fear & Greed Index | 23 (Extreme Fear) |

| Sentiment | Bearish |

| Volatility | 26.18% (Extremely High) |

| Green Days (30-day) | 15 (50%) |

| 50-Day SMA | $0.4753 |

| 200-Day SMA | $0.5861 |

| 14-Day RSI | 30.56 (Neutral) |

dYdX Price Analysis: Facing Buying Pressure Near $0.28

TL;DR Breakdown:

- dYdX’s price analysis indicates buying pressure emerging around the $0.28 mark.

- The immediate resistance level for dYdX is identified at $0.3223.

- The support level for the dYdX/USD pair is positioned at $0.2543.

The price analysis for dYdX on November 5th suggests a recent surge as buyers gain confidence. Currently, buyers appear to be dominating the market, pushing the price towards the $0.28 level.

dYdX Price Analysis (Daily Chart): Surge Towards $0.28

The daily price chart for dYdX shows that the token experienced buying pressure after failing to hold below immediate Fibonacci levels. Consequently, buyers are now aiming to establish a sustained presence above $0.28. The 24-hour trading volume has increased to $8.59 million, indicating a rise in trading interest.

The Relative Strength Index (RSI) for the past 14 days has dropped from its previous level and is currently trading around 34, suggesting that sellers may be regaining momentum. The Simple Moving Average (SMA) over 14 days indicates potential volatility in the short term.

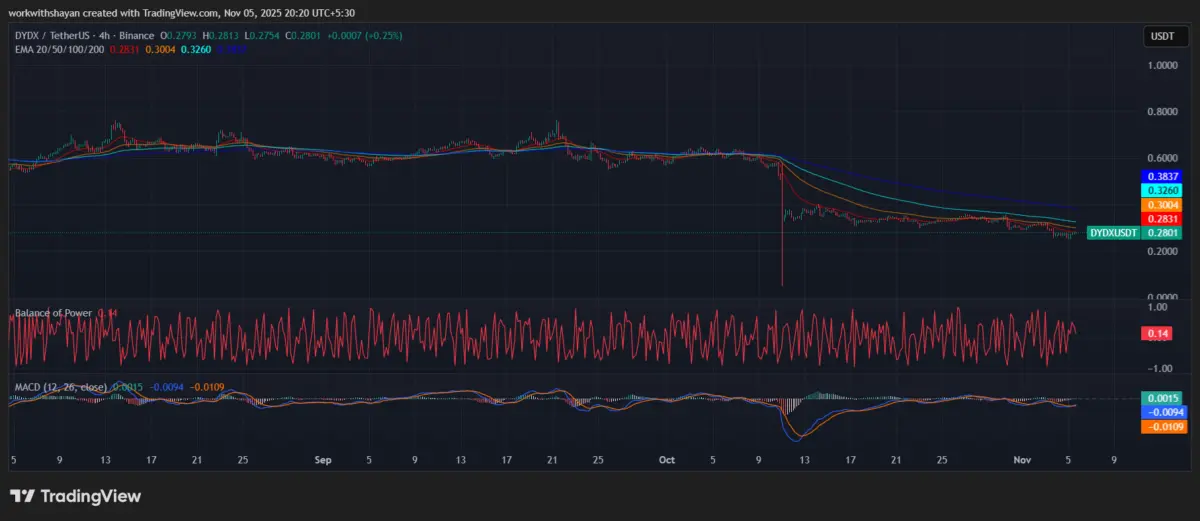

dYdX/USD 4-Hour Price Chart: Bulls Eyeing Correction

The 4-hour price chart for dYdX suggests strengthening bullish momentum as buyers attempt to hold prices above the Exponential Moving Average (EMA) trend lines. The price is currently being supported around the EMA20 trend line.

📍 The Balance of Power (BoP) indicator is in a bullish region at 0.14, suggesting that short-term buyers are looking to capitalize on potential upward movements.

⚡ Additionally, the Moving Average Convergence Divergence (MACD) indicator is forming green candles above the signal line, indicating positive momentum and potentially strengthening confidence among long-position holders.

dYdX Technical Indicators: Levels and Actions

Daily Simple Moving Average (SMA)

| Period | Value | Action |

| SMA 3 | $0.3977 | SELL |

| SMA 5 | $0.3669 | SELL |

| SMA 10 | $0.3615 | SELL |

| SMA 21 | $0.3461 | SELL |

| SMA 50 | $0.4753 | SELL |

| SMA 100 | $0.5492 | SELL |

| SMA 200 | $0.5861 | SELL |

Daily Exponential Moving Average (EMA)

| Period | Value | Action |

| EMA 3 | $0.3774 | SELL |

| EMA 5 | $0.4324 | SELL |

| EMA 10 | $0.5058 | SELL |

| EMA 21 | $0.5645 | SELL |

| EMA 50 | $0.5938 | SELL |

| EMA 100 | $0.6080 | SELL |

| EMA 200 | $0.6993 | SELL |

What to Expect from dYdX Price Analysis Next?

The hourly price chart indicates that dYdX is attempting to break below the immediate support line, although bulls are aiming for an upward recovery rally in the coming hours. If dYdX’s price can sustain momentum above $0.3223, it could fuel a bullish rally towards $0.3953.

Conversely, if bulls fail to initiate a strong surge, the dYdX price might fall below the immediate support level of $0.2543, potentially starting a bearish trend towards $0.1779.

Is dYdX a Good Investment?

The increasing institutional interest in dYdX suggests it could be a worthwhile investment for some. However, dYdX has a relatively short trading history marked by significant volatility. Whether it represents a good investment ultimately depends on an individual’s financial situation, risk tolerance, and investment objectives.

Why is dYdX Price Up Today?

The current bullish market sentiment for dYdX, driven by strong defense of support channels by buyers, has contributed to the price push towards $0.28.

Will dYdX Recover?

A strong recovery for dYdX could materialize if buyers consistently maintain a price level above $0.3.

What is the dYdX Price Prediction for 2025?

By the end of 2025, dYdX is projected to reach a minimum price of $0.2. Investors can anticipate a potential maximum price of $3.55 and an average price of $1.96, contingent on positive market momentum.

Will dYdX Reach $10?

Depending on market trends and developments, dYdX could potentially reach the $10 mark by the end of 2027. However, any significant negative news could impact this projection.

Will the dYdX Price Reach $100?

$100 would represent a significant milestone for dYdX. This target could become achievable if dYdX continues to attract substantial institutional investment in the coming years.

Is dYdX a Good Long-Term Investment?

Given the ongoing accumulation by various institutions and increasing global recognition, dYdX shows promise for the long term. However, it is crucial to consult with independent financial professionals for personalized investment advice before entering the highly volatile cryptocurrency market.

Recent News and Opinions on dYdX

The dYdX community has proposed a three-month experimental buyback program, scheduled from November 1, 2025, to January 31, 2026. This initiative will utilize the protocol’s net transaction fees to repurchase DYDX tokens. The program, expected to repurchase between $5 million and $10 million worth of tokens, aims to enhance token value and evaluate the protocol’s capital efficiency.

dYdX Price Prediction: November 2025

September was a challenging month for dYdX, with the altcoin experiencing a decline towards the $0.3 level. In the short term, dYdX’s price might attempt to rebound towards $0.44 and potentially reach $0.6 if strong selling pressure is absent. However, a bearish rejection could lead to consolidation around the $0.25 mark.

| dYdX Price Prediction | Minimum Price | Average Price | Maximum Price |

| November 2025 | $0.25 | $0.44 | $0.6 |

dYdX Price Prediction 2025

The price of 1 dYdX is projected to reach a minimum level of $0.2 by the end of 2025. Analysts anticipate a maximum price of $3.55 and an average trading price of $1.96, assuming positive market conditions.

| dYdX Price Prediction | Minimum Price | Average Price | Maximum Price |

| 2025 | $0.2 | $1.96 | $3.55 |

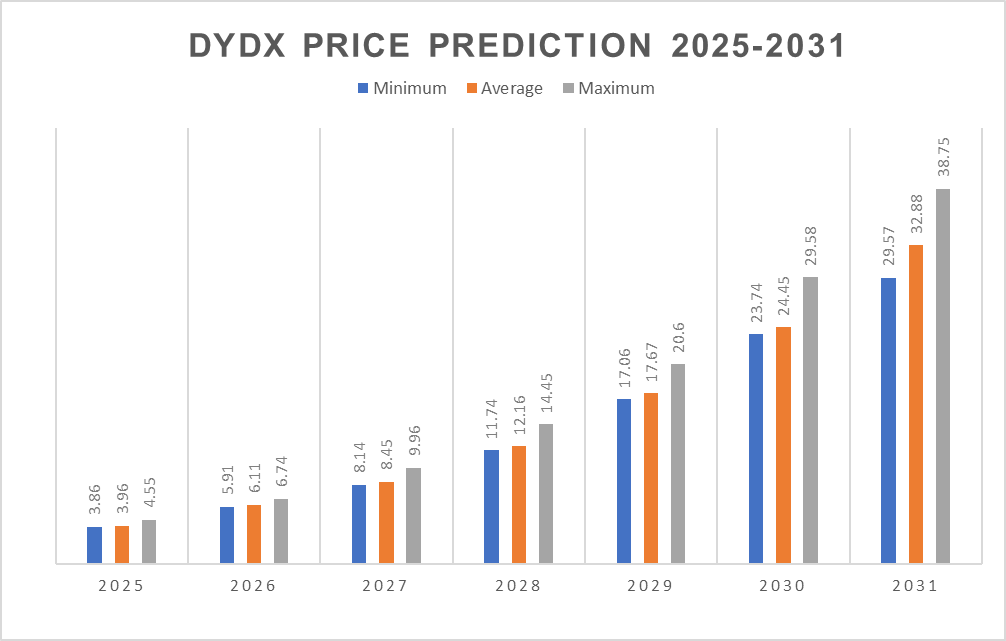

dYdX Price Predictions 2026-2031

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2026 | 5.91 | 6.11 | 6.74 |

| 2027 | 8.14 | 8.45 | 9.96 |

| 2028 | 11.74 | 12.16 | 14.45 |

| 2029 | 17.06 | 17.67 | 20.6 |

| 2030 | 23.74 | 24.45 | 29.58 |

| 2031 | 29.57 | 32.88 | 38.75 |

dYdX Price Prediction 2025 (Revisited)

The unit price of dYdX in 2025 is expected to reach a minimum of $3.86. Expert analysis suggests dYdX could potentially reach $4.55, with an average trading price around $3.96.

dYdX Price Prediction 2026

In 2026, dYdX’s price is forecasted to range between a minimum of $5.91 and a maximum of $6.74, with an average price of $6.11 throughout the year.

dYdX Price Prediction 2027

For 2027, the price forecast indicates a minimum level of $8.14 and a potential high of $9.96, with the average price settling around $8.45.

dYdX Price Prediction 2028

Looking ahead to 2028, projections suggest a minimum price of $11.74 and a maximum price of $14.45 for dYdX, with an average price anticipated at $12.16.

dYdX Price Forecast 2029

By 2029, the dYdX price is anticipated to trade within a range of $17.06 to $20.60, averaging approximately $17.67.

dYdX (DYDX) Price Prediction 2030

For 2030, the dYdX price is forecasted to potentially reach a minimum of $23.74, a maximum of $29.58, and an average trading value of $24.45.

dYdX Price Prediction 2031

Looking towards 2031, projections suggest a minimum price of $29.57 and a maximum price of $38.75 for dYdX, with an average price expected to be around $32.88.

dYdX Market Price Prediction: Analysts’ Forecast

| Firm Name | 2025 Prediction | 2026 Prediction |

| Coincodex | $2.5 | $3.8 |

| Digital Coin Price | $4.8 | $7.9 |

| Changelly | $5.4 | $12 |

Cryptopolitan’s dYdX (ethdYdX) Price Prediction

According to Cryptopolitan’s analysis, the price of dYdX is expected to reach a minimum of $5.91 and a maximum of $6.74 in 2026, with an average price of $6.11. If market conditions remain favorable, dYdX could trade significantly above $5 by 2027.

However, dYdX’s future market potential is highly dependent on factors such as buying demand, regulatory developments, and overall investor sentiment for long-term holdings.

dYdX Historical Price Sentiment

The historical price data for dYdX reveals the following trends:

- dYdX began trading in December 2023, initially staying below $3.5.

- In January 2024, the price experienced a decline, reaching a low of $2.4.

- March 2024 saw a significant surge, with dYdX touching a high near $4.3.

- Following this peak, dYdX entered a bearish trend, trading around $1 until November.

- A recovery occurred in December 2024, pushing the price towards $2.6.

- Since then, dYdX has been in a downtrend, consolidating below the $1 mark.

- By late April, dYdX showed an upward movement towards $0.68.

- In May, the price briefly rose to $0.76 before declining to $0.5 in early June.

- By the end of June, dYdX had fallen to $0.41.

- July saw a surge towards $0.7, but buying demand waned, leading to a drop below $0.6.

- In August, dYdX again moved towards $0.76 but later declined to $0.6.

- By the end of September, dYdX’s price decreased to a low of $0.55.

- October saw further decline, with the price of dYdX touching a low below $0.3.

Final Thoughts

dYdX’s price action currently shows signs of buying pressure near $0.28, despite overall bearish sentiment indicated by technical indicators. Future price movements will likely depend on its ability to overcome resistance levels and sustained market demand. Long-term predictions suggest significant growth potential, but the volatile nature of the cryptocurrency market necessitates cautious observation.