Summary:

- Ethereum (ETH) began October strongly, with prices rising into the mid-$4,000s, buoyed by Bitcoin’s surge and positive macroeconomic signals.

- Institutional interest in ETH ETFs showed a mixed but improving trend, with a slowdown in September followed by renewed demand in early October.

- Key technical resistance levels for ETH are identified around $4,400-$4,505 and $4,650-$4,700, with crucial support at $4,000-$3,900.

- Trading strategies focus on managing risk around key price levels, considering macro trends, ETF flows, and Ethereum’s fundamental supply dynamics.

- A realistic Q4 target for ETH is projected between $5.5k-$6k, with upside potential to $6.5k-$7k and downside risk to $3,700-$3,880.

Ethereum started October with significant momentum, climbing into the mid-$4,000s as the broader cryptocurrency market experienced a general positive trend. Bitcoin’s noteworthy advance above $120,000 provided additional support for ETH, contributing to a positive sentiment for risk assets across the board. Favorable U.S. economic data, which bolstered hopes for interest rate cuts, also played a role in initiating what is being termed “Uptober.” 💡

Signals from institutional flows presented a varied but gradually improving picture. Citi recently revised its outlook for Ether upwards, citing shifts in investor positioning as a key factor. Concurrently, data regarding Ether Exchange-Traded Funds (ETFs) revealed a contrasting trend: a notable deceleration in inflows during September was followed by early signs of recovery in October, indicating a potential rotation back into these instruments by traders. ✅

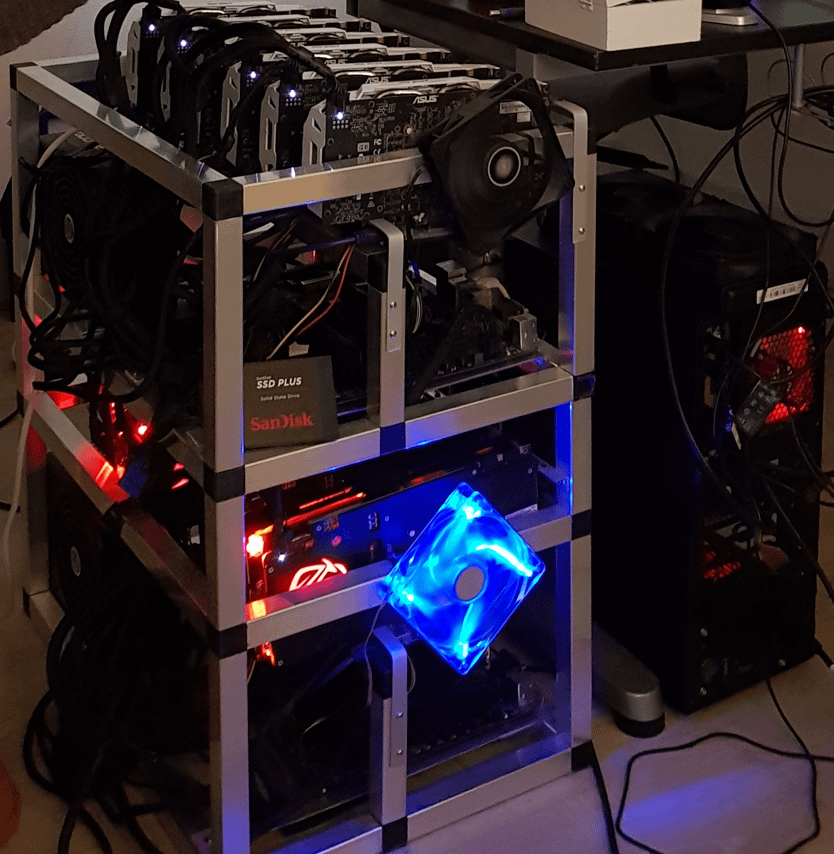

A Personal Look at ETH’s Origins

My personal journey with Ethereum began during the 2017–2018 period when I engaged in mining ETH. It was an experience characterized by noise, heat, and a degree of enjoyment. I even experimented with distributing a small airdrop from my mining operation, though it did not achieve the intended success. The gas fees during that era were indeed substantial. However, in the realm of cryptocurrency, experimentation is essential. This same spirit of exploration continues to influence my approach to trading ETH today. It evokes fond memories. 📊

Key Factors Influencing ETH in the Past 48 Hours

The recent price movements in ETH can be attributed to several factors. Firstly, the macroeconomic environment played a significant role. Bitcoin’s upward trajectory pulled major cryptocurrencies, including Ethereum, higher. This surge was prompted by softer private-sector economic data and increased optimism that the U.S. Federal Reserve might consider monetary easing measures later in the month. Generally, lower interest rates tend to benefit risk-sensitive assets, and the crypto market often reacts swiftly to such trends. ⚡

Secondly, investor flows also contributed. Citi’s observation of improved positioning in Ether, coupled with a decline in September’s ETH ETF inflows compared to August’s record highs, provided mixed signals. However, reports from some trading desks indicated a rebound in spot ETH ETF demand in early October, supported by major issuers. This combined data suggests a fragile yet recovering appetite for ETH investments. 📍

Thirdly, fundamental aspects of the Ethereum network remain relevant. Under the EIP-1559 protocol, Ethereum’s supply continues to be dynamic, with the balance between token burns and issuance fluctuating based on network activity and gas prices. Traders closely monitor platforms like ultrasound.money to track real-time net supply trends, gas consumption, and the rate of token burns. 📌

Learn how to use Funding Rates as a signal to trade by visiting this educational resource.

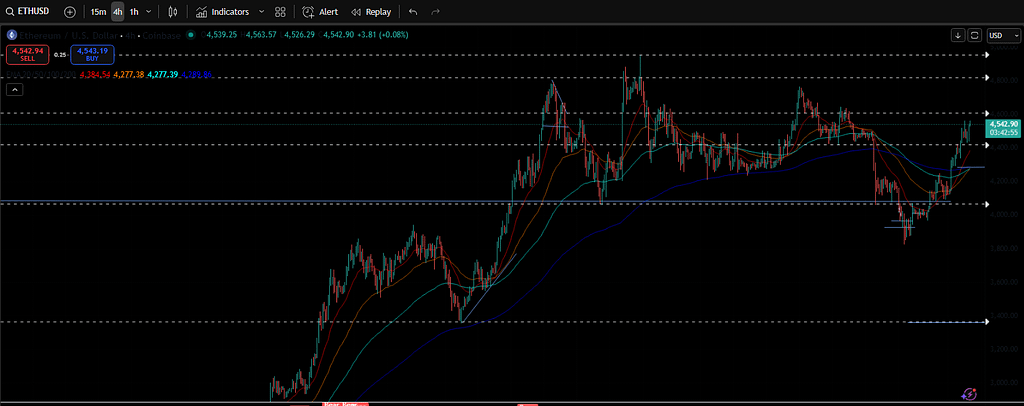

Technical Outlook for Ethereum

Ethereum has maintained a rising price structure through late September and into October. Support has been observed near key psychological price levels and previous breakout areas, with buyers stepping in to absorb selling pressure. Several market analyses have identified nearby resistance zones between the mid-$4,400s and $4,500, with a potential extension target in the $4,650–$4,700 band. Conversely, significant support levels are situated around $4,400 and further down at $4,000–$3,900, should momentum falter. 💡

Understanding these levels is crucial:

- $4,400–$4,505: This range represents prior supply pressure and a confluence of Fibonacci retracement and structural support identified in multiple analyses. A sustained close above this area could indicate further upward momentum.

- $4,650–$4,700: This zone aligns with measured move targets and previous price wick extensions. Acceptance above this resistance could open the door for a move towards $4,900–$5,000.

- $4,000–$3,900: This represents a critical support level that traders are watching closely for the establishment of higher lows. A break below this range could signal a significant loss of upward momentum.

Momentum indicators have shown improvement, aligning with broader market breadth. The correlation with Bitcoin remains strong during periods of significant price movement, which can amplify gains on positive days but also present risks during downturns. ✅

Trading Plan Considerations (Not Financial Advice)

A straightforward approach involves trading key price levels while diligently managing risk.

- Breakout and Retest Strategy: If ETH achieves a confirmed close above $4,505 on substantial trading volume, the strategy involves observing for a subsequent retest of this level. Targets would then be set at $4,650–$4,700, with partial profit-taking considered near $4,900–$5,000. Should the retest fail, exiting the trade and reassessing is recommended.

- Range-to-Trend Strategy: In scenarios where ETH trades within a range, such as between $4,000 and $4,500, fading extreme price points with strict stop-losses is a viable approach. A confirmed breakout from this range would then trigger a shift to a trend-following strategy in the direction of the breakout.

- Bitcoin-Led Correlation: When Bitcoin experiences a significant surge, ETH often follows suit. Monitoring Bitcoin ETF flow news and U.S. macroeconomic releases is crucial. If Bitcoin demonstrates sustained upward momentum, ETH is likely to exhibit similar strength intraday.

Fundamental risk management principles remain paramount. This includes controlling position size, pre-defining exit points (invalidations), and taking profits strategically across different price zones rather than attempting all-or-nothing trades. 📊

Key Macroeconomic Drivers for Q4

Interest rates and inflation data are expected to remain critical factors influencing the market. More subdued economic data and signals of a less hawkish stance from the Federal Reserve would generally provide a tailwind for cryptocurrencies, which are often considered risk assets. Conversely, any unexpected hawkish pronouncements could quickly lead to a tightening of liquidity. 💡

Exchange-Traded Fund (ETF) flows, for both Bitcoin and Ethereum, hold considerable importance. The slowdown observed in ETH ETF inflows during September highlights the potential for rapid shifts in demand. However, the renewed interest seen in early October from significant issuers suggests a potential recovery. Consistent weekly inflows would serve as strong confirmation for a sustained upward trend in Q4. ✅

The risk of market rotation is a valid concern. A substantial increase in Bitcoin’s dominance could temporarily cause ETH to underperform. However, the ongoing development and adoption within the Ethereum ecosystem, including Decentralized Finance (DeFi), restaking protocols, stablecoin volumes, and tokenization initiatives, could potentially alter this dynamic. Citi’s recent upward revision of its Ether outlook indicates that major financial players are closely observing these developments. 📍

Furthermore, supply dynamics on the Ethereum network are important. If network activity and gas fees increase, net issuance could tighten, potentially supporting price appreciation as dips are bought up. Monitoring this trend on platforms like ultrasound.money is advisable during periods of market volatility. 📌

Contextualizing Uptober

While seasonal patterns do not constitute a definitive trading strategy, the narrative of Uptober can instill confidence among crypto traders, potentially becoming a self-fulfilling prophecy for a period. Bitcoin’s recent strength has already set a positive tone, and Ethereum tends to benefit when broader risk appetite increases. ⚡

The 10k Conversation

The $10,000 price target for Ethereum has resurfaced in market discussions. Some analysts project this level in extended bullish cycles, particularly if market liquidity expands and Ethereum captures a greater share of real-world economic activity. While achievable in a strong melt-up scenario, the timing remains highly uncertain. 💡

For the remainder of Q4 2025, a more conservative price range appears more grounded.

Projected Q4 Target for ETH

Base Case Scenario: A realistic target is projected between $5.5k and $6k. This scenario assumes ETH successfully moves above $4,505, maintains support above $4,650–$4,700, and demonstrates higher lows during pullbacks. A supportive macroeconomic environment and consistent spot ETF inflows would be instrumental in pushing ETH towards and potentially within this range by year-end, especially with a firm Bitcoin backdrop. 📊

Upside Case Scenario: A more rapid ascent towards $6.5k–$7k is possible, driven by strong momentum, exceptionally high ETF inflows, and dovish signals from the Federal Reserve. This would necessitate consistent weekly closes above $5,000 and aggressive buying interest on any dips. ✅

Downside Case Scenario: Failure to overcome the $4,505 resistance and a subsequent break below $4,000 could lead ETH back towards the $3,880–$3,700 support levels. This outcome is more probable if macroeconomic conditions deteriorate or Bitcoin experiences significant weakness. The September ETF lull serves as a reminder of how vulnerable demand can be during periods of risk aversion. 📍

If you are actively trading, consider exploring opportunities within DEX airdrops.

Adapting Trading Positions

Position sizing should be increased gradually upon confirmation of a trend. Adding to positions on successful retests of key levels is a common practice. Trimming positions as they approach resistance levels and recycling risk capital are also important tactics. If price action breaks below a prior breakout level, reducing exposure or stepping aside is prudent. In highly volatile markets, it is advisable to avoid fixating on a single narrative, as market dynamics and flows can shift rapidly. Relying on price structure for guidance is often the most effective approach. ⚡

Fundfa Insight

The start of October signals a potentially positive period for Ethereum, driven by a more favorable macroeconomic outlook and Bitcoin’s strength. Key resistance levels must be cleared for further upside, while solid support must hold to maintain bullish momentum. Strategic trading, grounded in technical analysis and risk management, will be crucial for navigating the evolving landscape of ETH throughout Q4.