Key Highlights:

- The prominent Ethereum whale known as “7 Siblings” has recently transferred tens of millions of dollars in ETH to a new wallet.

- A portion of the moved ETH has already been sold through rapid transactions.

- Market participants are closely watching for signals that could influence short-term sentiment around Ethereum.

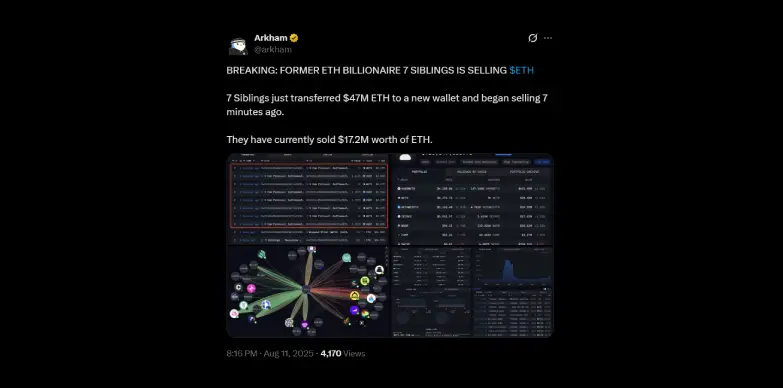

The Ethereum market is experiencing increased volatility as the notable whale wallet “7 Siblings” begins liquidating a significant portion of its ETH holdings. According to blockchain analytics from Arkham Intelligence, this wallet recently shifted $47 million worth of ETH to a new address just minutes ago and has already offloaded $17.2 million in ETH. This activity has sparked concerns of a possible broader sell-off in the market.

Who Are the “7 Siblings”?

The “7 Siblings” wallet is among the most recognized Ethereum whale accounts. Blockchain records indicate the wallet has been active for several years and once held crypto assets valued in the billions.

The true identity behind this wallet remains undisclosed, but the transaction patterns suggest a seasoned investor. This entity has engaged in large-scale DeFi strategies, maintains a diversified portfolio, and frequently interacts with Ethereum-based protocols.

Notable Characteristics of the Wallet Include:

Fund Management: Likely oversees substantial capital, potentially originating from early ETH investments or deep involvement in DeFi.

OpenSea Activity: The wallet has conducted significant NFT trading, demonstrating a sophisticated understanding of the Ethereum ecosystem beyond simple token holdings.

Tornado Cash Usage: Utilizes privacy-enhancing tools to obscure transaction history, probably for confidentiality rather than illicit purposes.

Large Transactions: Routinely moves millions in tokens and interacts with various smart contracts.

At its peak, the wallet’s net worth exceeded $1 billion. Presently, the portfolio is valued at roughly $726.5 million, diversified across assets such as staked Ethereum, governance tokens, and DeFi-related holdings.

Overview of Current Holdings

According to Arkham Intelligence, the “7 Siblings” portfolio currently consists of:

- AARBWETH – $631.95M (147,348 units)

- WETH – $38.45M (over 9,000 units)

- AETHSWETH – $24.59M

- LETHV2 – $17.4M

- WNXM – $10.61M

- COMP – $3.17M

- SWISE – $204.51K

- ETH – $47.35K

The majority of these assets are staked ETH derivatives, reflecting a long-term yield strategy. However, the recent withdrawal of $47 million in liquid ETH stands out as a significant and unusual move, especially as it was quickly followed by sales.

Market Implications

Activity from whales like “7 Siblings” can notably influence short-term market mood and price swings. Ethereum traders monitor such wallets closely because large sales can:

- Increase Market Supply: Introducing tens of millions of ETH to exchanges rapidly can create selling pressure, potentially pushing prices lower.

- Indicate Market Sentiment: A large holder liquidating assets might signal diminished confidence in the short-term outlook.

- Trigger Automated Responses: Significant transactions may activate algorithmic trading bots and stop-loss orders, accelerating price movements.

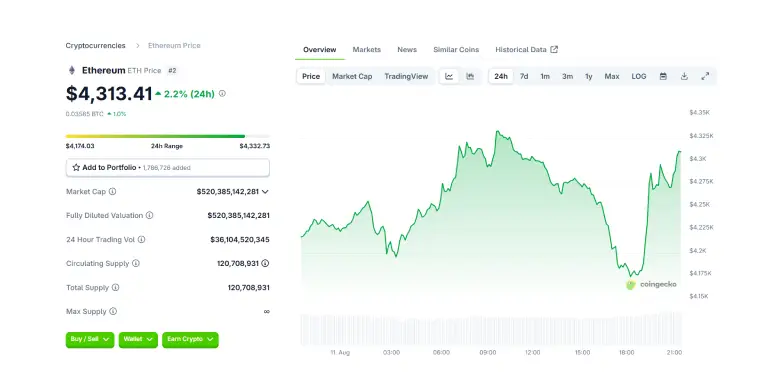

Thus far, Ethereum’s price has not experienced a sharp decline following this liquidation, likely due to the gradual execution of sales minimizing market impact. At the time of reporting, ETH is priced at $4,313.41, reflecting a 2.2% increase over the past 24 hours according to CoinGecko.

The rationale behind this sale remains unclear; it could represent portfolio rebalancing, liquidity needs, preparation for regulatory or economic uncertainty, or simply a strategic decision.

Fundfa Analysis

The activity of major whales like “7 Siblings” underscores the sensitivity of the Ethereum market to large holders’ moves. Their transactions can significantly shape short-term price dynamics and investor sentiment, highlighting the importance of monitoring whale behavior for market forecasting and risk management.