Key Takeaways: EUR/CHF Analysis

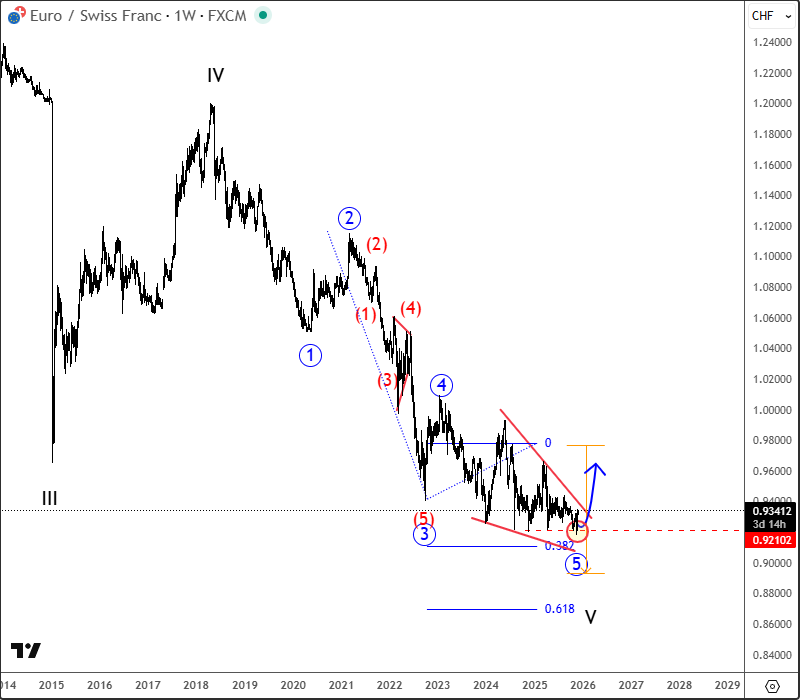

- The EUR/CHF pair is currently in a multi-year downtrend, showing signs of a potential wedge formation from the 2023 highs.

- A recent drop to a new low below 0.9210 suggests possible Swiss National Bank (SNB) intervention to weaken the Swiss Franc (CHF).

- The formation of five waves up on the intraday chart indicates a potential completion of the downtrend or a temporary recovery phase.

- Upcoming Swiss inflation data could be a catalyst for fresh upside movement.

- Potential buying opportunity may arise around the 0.9276–0.9305 area, with a stop-loss level at 0.9180.

The EUR/CHF currency pair has been navigating a persistent downtrend over several years. A noteworthy observation is the potential wedge formation that has emerged following the highs of 2023. The pair recently experienced a spike, plummeting to a new low below the 0.9210 mark.

The Swiss National Bank (SNB) closely monitors the strength of the CHF and typically prefers a weaker currency. This preference stems from the fact that Swiss exporters heavily depend on sales to both Europe and the United States. Consequently, the SNB stands ready to take action whenever the EUR/CHF exchange rate deviates excessively from its desired range. They have also stated that they are open to intervention or implementing tools involving negative interest rates.

⚡ Monitoring EUR/CHF trends is crucial due to the Swiss National Bank’s active role in managing the currency’s value. Their interventions can significantly impact the pair’s movements, creating opportunities and risks for traders.

Analyzing EUR/CHF Impulsive Rebound

A pivotal observation lies in the formation of five waves upward, evident on the intraday chart from the most recent lows. This specific type of impulsive structure often signals the conclusion of a higher-degree downtrend. Alternatively, it may indicate a temporary recovery phase, poised to extend higher following a period of consolidation.

The upcoming Swiss inflation report serves as a potential trigger for a renewed surge in EUR/CHF value. Market participants are keenly awaiting this economic indicator, which may well influence the pair’s trajectory. Understanding the nuances of the EUR/CHF pair can provide investors with opportunities for strategic positioning and informed decision-making.

📍 Keep an eye on the five-wave pattern. This formation is a key technical indicator. If confirmed, it suggests a potential trend reversal or at least a significant bullish correction in the EUR/CHF pair.

Strategic Opportunities in EUR/CHF Trading

If the market experiences a dip into the 0.9276–0.9305 range, this could present a strategic opportunity to capitalize on the emerging strength. Traders might consider entering long positions within this zone, targeting potential upward movements.

To mitigate risk, the market should maintain trading activity above the 0.9180 level, which serves as an invalidation point. Breaching this level could nullify the bullish outlook, prompting a reassessment of the trading strategy. The EUR/CHF pair’s sensitivity to economic data and central bank policy makes continuous monitoring essential for effective trading.

✅ For risk management, implement a stop-loss order slightly below the 0.9180 level. This can protect your capital in case the market moves against your position.

Frequently Asked Questions about EUR/CHF

What factors influence the EUR/CHF exchange rate?

The EUR/CHF exchange rate is influenced by various factors, including economic data releases from both the Eurozone and Switzerland, monetary policy decisions by the European Central Bank (ECB) and the Swiss National Bank (SNB), and global risk sentiment. Political events and geopolitical tensions can also play a role.

How does the Swiss National Bank (SNB) influence the EUR/CHF?

The SNB actively monitors the EUR/CHF exchange rate and is prepared to intervene in the currency market to prevent excessive appreciation of the Swiss franc. The SNB prefers a weaker franc to support Swiss exports and has used tools such as negative interest rates and direct intervention to achieve this.

What does the five waves up pattern indicate in EUR/CHF analysis?

The five waves up pattern observed on the intraday EUR/CHF chart suggests a potential completion of a downtrend or the beginning of a significant recovery phase. This pattern is based on Elliott Wave theory, which posits that prices move in specific patterns or waves.

What is the significance of the 0.9276–0.9305 support area for EUR/CHF?

The 0.9276–0.9305 area represents a potential support zone where buyers may step in to support the EUR/CHF. A dip into this area could offer a favorable opportunity to initiate long positions, assuming the overall technical and fundamental outlook remains constructive.

Final Thoughts on the EUR/CHF Outlook

In conclusion, the EUR/CHF pair presents an intriguing setup with a possible shift in trend. The combination of technical patterns, potential SNB intervention, and upcoming economic data releases creates a dynamic environment for traders. Prudent risk management is essential when navigating the EUR/CHF market.

Keep a watchful eye on the Swiss inflation report and any statements from the SNB, as these can act as catalysts for significant price movements. The suggested trading strategy, focusing on the 0.9276–0.9305 entry zone, provides a structured approach to potentially capitalize on upward momentum while maintaining appropriate risk controls.