Executive Summary

- GBP/USD experienced a decline for the fourth consecutive day, nearing the 1.3300 mark before a slight recovery.

- Global risk appetite weakened due to escalating trade tensions between the US and China, particularly concerning rare earths and software exports.

- Key economic data releases from both the UK and the US are anticipated for Friday, including Retail Sales, PMI, and CPI inflation.

- The US Consumer Price Index (CPI) data is particularly crucial as it precedes the Federal Reserve’s upcoming interest rate decision.

GBP/USD Trading Performance and Market Sentiment

The GBP/USD pair continued its downward trend on Wednesday, trading lower for the fourth day in a row. The pair briefly touched levels just above 1.3300 before recovering to the 1.3350 zone, though it ultimately closed the day with a negative bias. Traders now await a significant batch of economic data scheduled for release on Friday, which will provide updates from both the United Kingdom and the United States.

Global market sentiment took a hit on Wednesday. This downturn was primarily influenced by the US administration’s consideration of retaliatory measures against China. China had recently implemented stringent export controls on rare earth materials. The ongoing trade dispute has seen varied responses from the US, including the potential cancellation of trade talks with Chinese President Xi Jinping and threats of substantial tariffs on all Chinese goods. Reports that the US might impose export controls on its own software products have heightened investor concerns about the broader market impact of the US-China trade friction.

Upcoming Economic Data and Federal Reserve Interest Rates

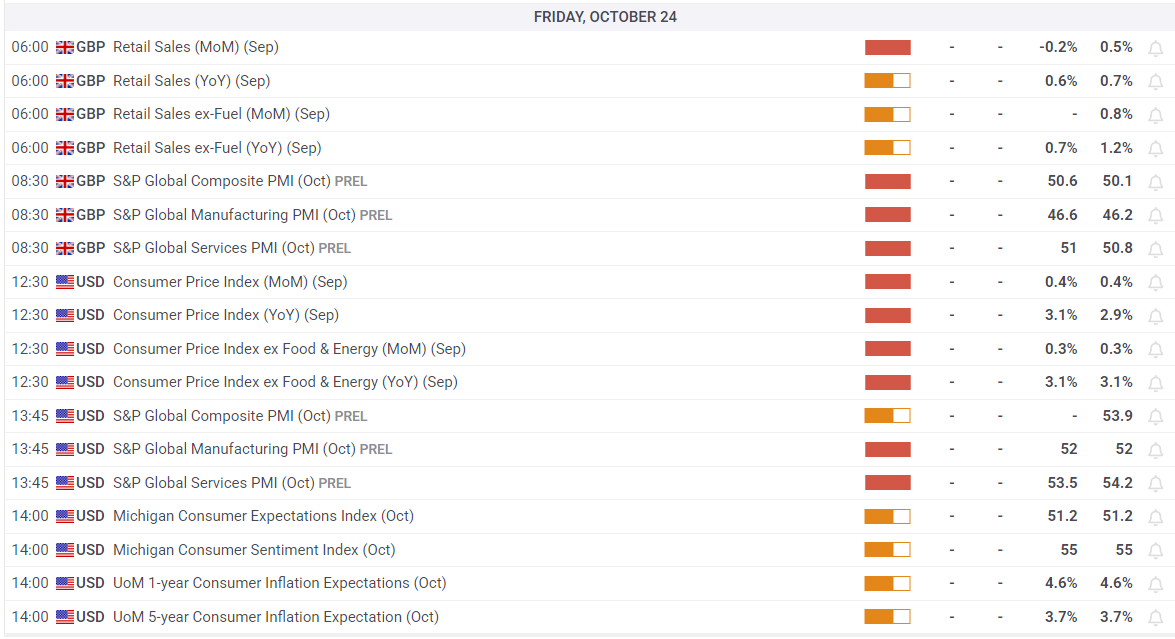

Following a quiet economic data calendar on Thursday, a series of influential releases are expected on Friday. The London market session will feature September data for UK Retail Sales and the S&P Global Purchasing Managers’ Index (PMI). Following these UK figures, the US will release its Consumer Price Index (CPI) inflation data for September. This CPI report is considered one of the final key inflation readings before the Federal Reserve’s next interest rate decision, scheduled for October 29.

Understanding the Pound Sterling (GBP)

Pound Sterling FAQs

The Pound Sterling (GBP) holds the distinction of being the world’s oldest currency, dating back to 886 AD. It is the official currency of the United Kingdom and ranks as the fourth most traded currency globally in the foreign exchange market. According to 2022 data, GBP accounts for approximately 12% of all FX transactions, averaging $630 billion daily. Its most significant trading pairs include GBP/USD, known as ‘Cable’ (11% of FX), GBP/JPY, referred to as the ‘Dragon’ by traders (3%), and EUR/GBP (2%). The Bank of England (BoE) is the issuing authority for the Pound Sterling.

The monetary policy set by the Bank of England is the most critical factor influencing the value of the Pound Sterling. The BoE’s primary objective is to maintain the price stability of the UK economy, aiming for a steady inflation rate of around 2%. Its main tool for achieving this goal is adjusting interest rates. When inflation rises above the target, the BoE typically increases interest rates to make borrowing more expensive, which can curb spending and cool down the economy. Higher interest rates often make the UK an attractive destination for international investors, potentially strengthening the GBP. Conversely, if inflation falls significantly below the target, indicating slowing economic growth, the BoE might consider lowering interest rates to encourage borrowing and investment, thereby stimulating economic activity.

Economic data releases play a vital role in shaping the value of the Pound Sterling by reflecting the health of the UK economy. Key indicators such as Gross Domestic Product (GDP) figures, Manufacturing and Services Purchasing Managers’ Index (PMI) surveys, and employment statistics can all influence GBP’s direction. A robust economy generally supports Sterling, attracting foreign investment and potentially prompting the BoE to raise interest rates, which directly benefits the currency. Conversely, weak economic data often leads to a depreciation of the Pound Sterling.

The Trade Balance is another significant economic indicator that impacts the Pound Sterling. This metric measures the difference between the value of a country’s exports and imports over a specific period. If a nation’s exports are in high demand globally, the currency tends to benefit from increased demand from foreign buyers. Therefore, a positive net Trade Balance typically strengthens a currency, while a negative balance can exert downward pressure.

Final Thoughts

The GBP/USD pair is facing downward pressure amid global trade tensions. Investors are closely watching upcoming UK and US economic data, particularly US inflation figures, as they could influence the Federal Reserve’s next monetary policy decision.