Key Takeaways

- Precious metals, including gold, silver, and mining stocks, are experiencing declines, with miners leading the downward trend.

- The US Dollar Index (USDX) is showing signs of a sustained rally, which typically correlates with a downturn in precious metals.

- Historical patterns suggest that when the USDX begins a significant upward movement, gold and silver can experience substantial declines.

- Previous strategic decisions to take profits on long-term precious metal investments appear validated by current market trends.

- The current market conditions suggest potential for significant declines in gold and silver prices, presenting new investment opportunities.

Precious Metals Sector Shows Weakness Amidst USD Index Strength

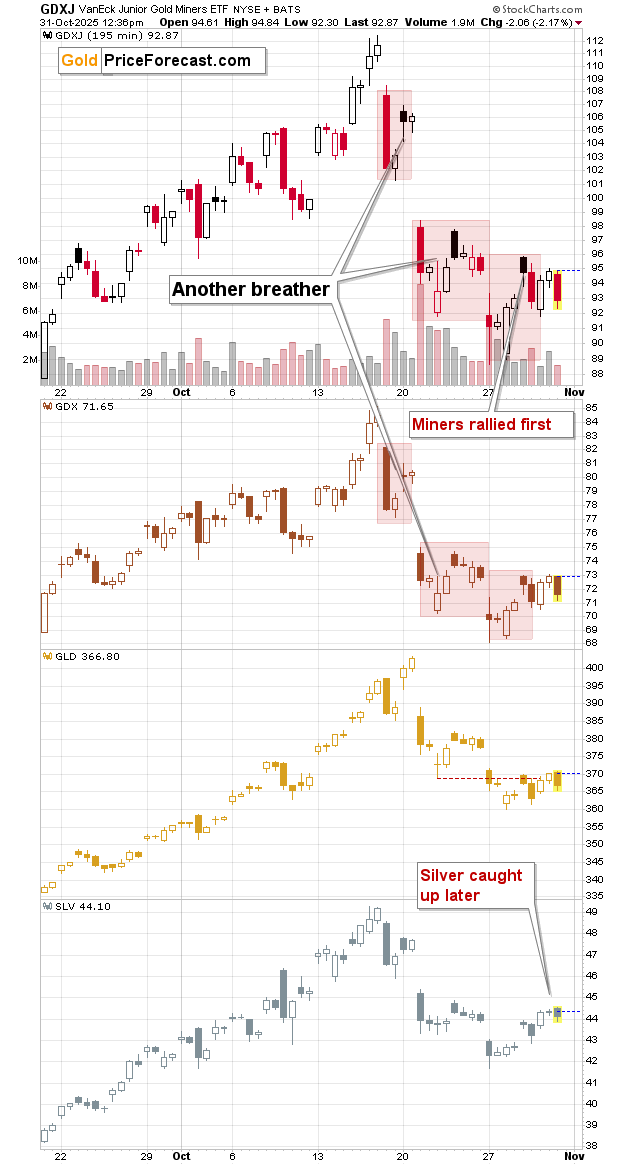

Gold, silver, and mining stocks are currently trading lower, a movement that, while seemingly stagnant, holds significant implications for the broader precious metals market. The synchronized decline across these assets, particularly with mining stocks leading the way, points towards potential further downward momentum.

Historically, the precious metals sector exhibits a typical pattern where miners lead any upward or downward movements, followed by silver, and then gold. With silver having recently mirrored the gains in miners, the current downturn suggests that the decline phase has likely commenced.

USD Index Rally Signals Potential Downturn for Gold

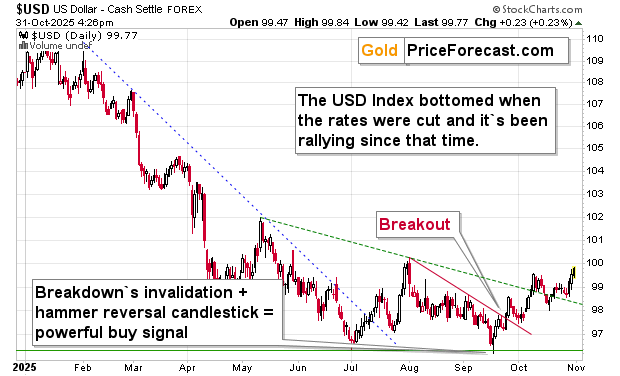

The US Dollar Index (USDX) is exhibiting a steady upward trend, a pattern reminiscent of its behavior following the Fed’s rate cuts in September. This suggests that the current short-term rally in the dollar may just be the beginning of a more significant upswing.

The USDX’s decline since April, despite escalating trade tensions, contrasted with market expectations. However, the recent reversal aligns with the theory that markets had already priced in maximum geopolitical chaos, leading to a subsequent market correction.

As the USDX’s rally becomes more pronounced, the precious metals sector is poised for a significant slide. The confirmed monthly gain in the USDX further supports this outlook.

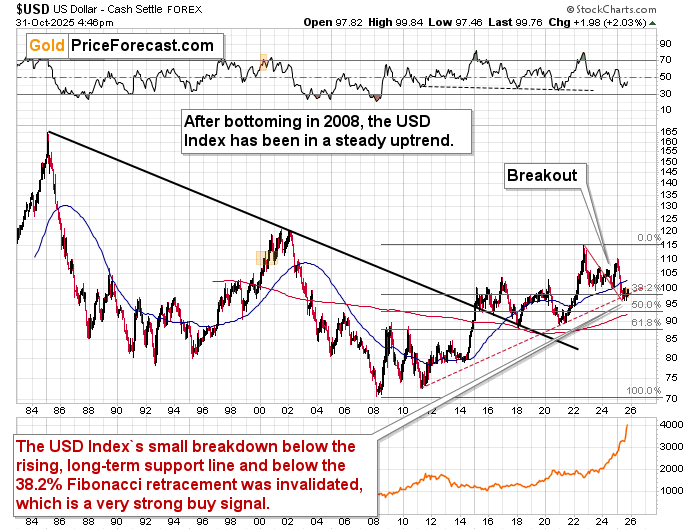

From a long-term perspective, this upward movement in the USDX invalidates the recent breakdown below its rising support line and the 38.2% Fibonacci retracement. This suggests that the current dollar rally could be the start of a substantial increase.

The decision to take profits on long-term investments in gold and silver when prices were significantly higher now appears judicious. When the USD Index decisively breaks above the 100 level, it is expected to surprise many market participants.

Gold’s Price Trajectory and Future Outlook

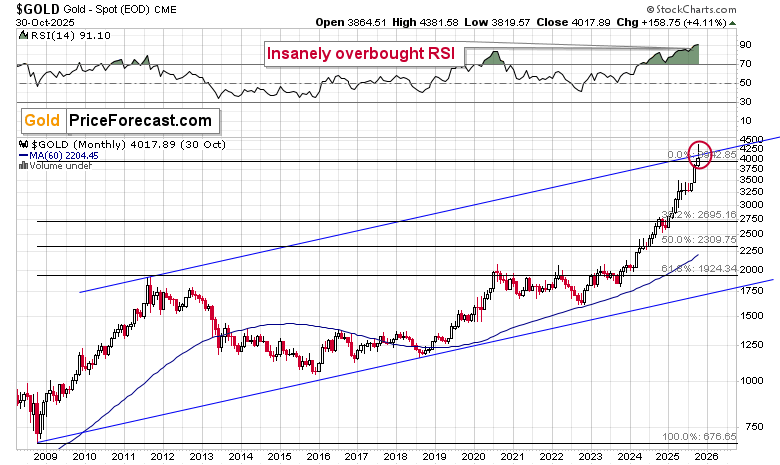

As the month draws to a close, gold is likely to experience a significant monthly reversal, potentially falling back towards target areas previously identified. This outlook aligns with the broader market sentiment and the strengthening US dollar.

A previous analysis highlighted that gold’s surge had placed it at or above key Fibonacci extension levels and the upper boundary of its long-term rising trend channel, while simultaneously being extremely overbought and with the USD Index poised for an upswing.

This confluence of factors indicated a high probability of a reversal, potentially leading to sharp declines. The market recalled similar patterns observed in 2011, where silver reversed months of gains within a single week.

Gold has since pulled back from its highs, and with the anticipated monthly reversal, significant declines appear imminent. This scenario fits well with the projection of a substantial rally in the US Dollar Index.

In summary, while gold and silver have experienced impressive rallies, these upward trends may have concluded. This market shift, however, can present unique investment opportunities for astute investors.

For those seeking deeper insights and exclusive details not widely available, subscribing to free analyses is recommended.

Expert Summary

The precious metals market is showing signs of weakness, coinciding with a strengthening US Dollar Index. This suggests a potential for significant declines in gold and silver prices, aligning with previous investment strategies focused on profit-taking.

The current market dynamics indicate that the recent rallies in gold and silver may be over, creating new opportunities for investors who can navigate the anticipated downturn.