Key Takeaways

- JP Morgan Cazenove reiterates an Underweight rating for GSK plc – Depositary Receipt (NYSE:GSK).

- The average one-year price target for GSK stands at $44.36, suggesting a potential upside of 2.59%.

- Projections indicate an annual revenue of $31,763 million and a non-GAAP EPS of $1.64.

- Institutional ownership of GSK has increased, with 1,053 funds holding positions.

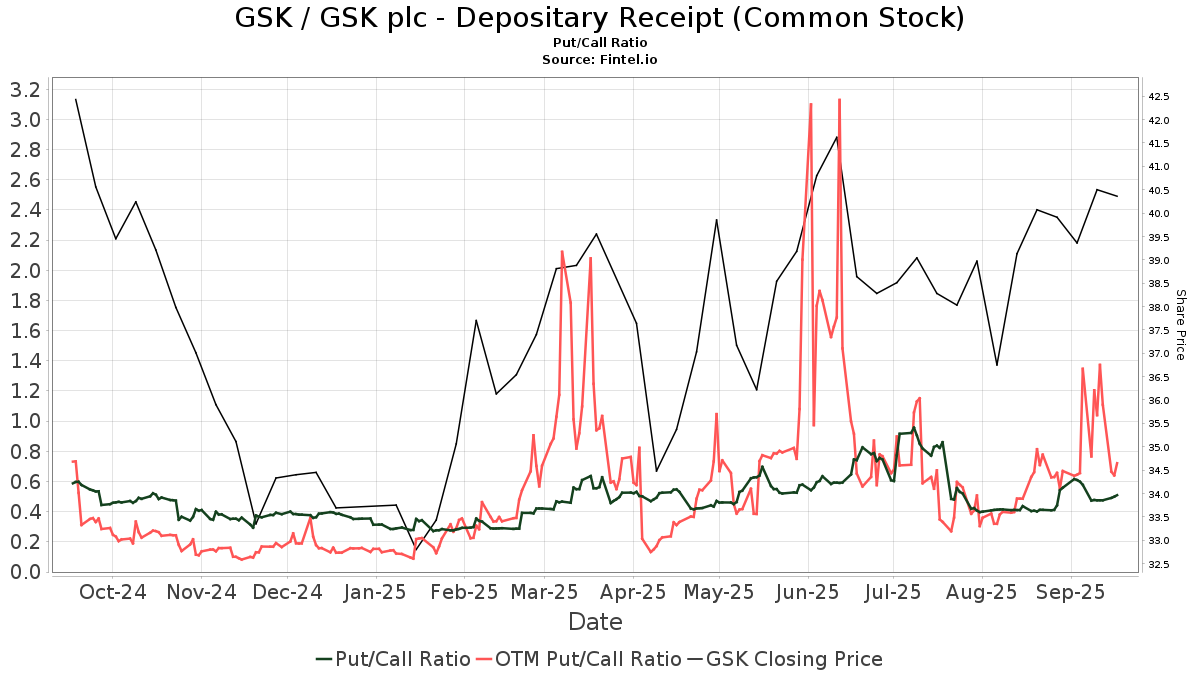

- The put/call ratio for GSK is 0.85, pointing to a bullish sentiment in the options market.

Analyst Outlook on GSK plc

JP Morgan Cazenove has maintained its Underweight recommendation for GSK plc – Depositary Receipt (NYSE:GSK) as of October 23, 2025. This reiteration from the financial firm provides insight into the current analyst sentiment surrounding the pharmaceutical company.

GSK plc Price Target and Forecast

The average one-year price target set for GSK plc – Depositary Receipt is $44.36 per share. This forecast, compiled as of September 30, 2025, indicates a range between a low estimate of $30.34 and a high estimate of $70.96. The current average price target suggests a potential upside of 2.59% from the stock’s last reported closing price of $43.24 per share.

Projected Financial Performance

Looking ahead, GSK plc – Depositary Receipt is projected to achieve an annual revenue of $31,763 million, marking a modest increase of 0.42%. Additionally, the company’s projected non-GAAP Earnings Per Share (EPS) is estimated to be $1.64.

Institutional Investor Sentiment

Current data reveals that 1,053 funds or institutions report holding positions in GSK plc – Depositary Receipt. This represents an increase of 17 owners, or 1.64%, over the previous quarter. The average portfolio allocation to GSK among all reporting funds is 0.40%, an uptick of 2.36%. Total shares held by institutions have seen a growth of 3.52% in the last three months, reaching 486,522,000 shares.

📍 The put/call ratio for GSK stands at 0.85, which is generally interpreted as a bullish signal in the options market, suggesting more call options are being traded than put options.

Key Holdings and Portfolio Adjustments

Major institutional investors are actively managing their stakes in GSK plc – Depositary Receipt. Dodge & Cox holds 78,758,000 shares, having increased its position slightly by 0.13% from the prior filing, though it decreased its portfolio allocation to GSK by 2.15% in the last quarter.

Similarly, Dodge & Cox Stock Fund (DODGX) reports holding 58,413,000 shares with no change noted in the last quarter. Fisher Asset Management has increased its holdings to 31,338,000 shares, representing a 4.17% rise, despite reducing its portfolio allocation in GSK by 5.14% over the same period.

Primecap Management has also boosted its investment, holding 27,727,000 shares, an increase of 7.28% in share count. This move was accompanied by a 2.48% increase in its portfolio allocation to GSK.

Vanguard PRIMECAP Fund Investor Shares (VPMCX) holds 19,891,000 shares, an increase of 8.91% in its reported share count. The fund also saw a 4.05% rise in its portfolio allocation to GSK during the last quarter.

Expert Summary

JP Morgan Cazenove maintains an Underweight rating on GSK plc – Depositary Receipt, with a price target suggesting modest near-term upside potential. Institutional interest in the stock remains active, with several significant funds adjusting their positions, and options market data indicates a bullish sentiment.