Key Takeaways

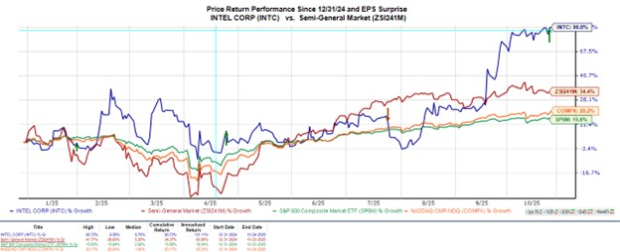

- Intel (INTC) stock rose significantly, driven by cooler September inflation data and better-than-expected Q3 earnings.

- The chipmaker reported positive net income in Q3, a notable shift from a loss in the prior year, though this was aided by one-time gains.

- Growth in AI-related products and improved operational discipline are cited as key drivers for Intel’s performance.

- Strategic investments from the government, Nvidia, and SoftBank, along with potential interest rate cuts, offer further support.

- While showing signs of a potential turnaround, the sustainability of Intel’s profitability relies on core business improvements beyond one-off events.

Intel’s Q3 Performance Shows Return to Profitability

Friday saw a market-wide rally, partly spurred by favorable September inflation readings. Among the notable performers was Intel (INTC), which announced strong Q3 results the evening prior, suggesting its turnaround strategy may be gaining traction.

Intel’s stock reached a new one-year high of $41 per share during Friday’s trading, marking an impressive recovery from a 52-week low of $17.

The positive inflation data could also influence the Federal Reserve’s decision on interest rates, potentially leading to cuts that would benefit Intel and other semiconductor companies.

Q3 Earnings Analysis: Profitability and Contributing Factors

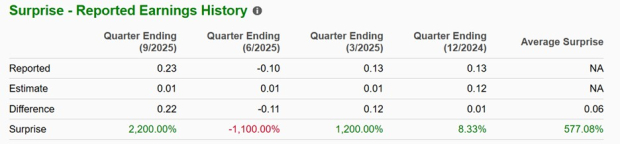

Intel reported a Q3 net income of $4.06 billion, or $0.23 per share. This marks a significant turnaround from a net loss of $16.64 billion, or -$0.43 per share, in the same quarter last year. The company’s earnings per share (EPS) significantly surpassed analyst expectations of $0.01, fueling an early rally in its stock.

💡 It’s important to note that Intel’s Q3 profit was substantially influenced by non-recurring operational gains. These included proceeds from the divestiture of a majority stake in its programmable chip unit, Altera, alongside favorable tax treatments and accounting adjustments related to restructuring and asset sales.

While Intel reported positive adjusted EPS in Q4 of the previous year ($0.13) and Q1 2025 ($0.13), its net income for those quarters was -$129 million and -$887 million, respectively, highlighting the one-time nature of the recent profit gain.

Key Drivers Behind Intel’s Potential Growth

Intel’s CEO, Lip-Bu Tan, emphasized improved operational discipline and strategic focus, particularly in manufacturing and research and development (R&D). Lower interest rates can also provide a significant boost to technology companies like Intel by reducing the cost of capital for R&D, expansion, and hiring.

⚡ Intel is observing strong momentum in its AI-related product lines, including specialized ASIC chips, accelerators, and AI PCs. The Data Center and AI (DCAI) division’s revenue increased by 5% year over year to $4.1 billion, driven by AI chips and compute infrastructure. Overall Q3 sales grew by 3% to $13.65 billion, outperforming the estimated $13.11 billion.

Strategic collaborations and investments are further bolstering Intel’s position. The company received a $5 billion equity investment from Nvidia (NVDA) and $2 billion from SoftBank (SFTBY). While Intel currently appears to have sufficient capital, a rate reduction could make future borrowing more attractive than equity financing if additional funds are needed. A significant development reshaping investor sentiment is the U.S. Government becoming Intel’s largest shareholder through the conversion of its $11.1 billion CHIPS Act grant into equity.

Intel’s Financial Guidance and Future Outlook

For the fourth quarter, Intel anticipates revenue between $12.8 billion and $13.8 billion, aligning with Zacks’ projection of $13.37 billion. The company forecasts Q4 EPS at $0.08, which is in line with the Zacks Consensus Estimate.

📊 Intel projects Q4 gross margins of approximately 36.5% and full-year gross capital investments around $18 billion. Due to the deconsolidation of Altera, Intel has revised its full-year adjusted operating expense forecast downward to $16.8 billion from $17 billion.

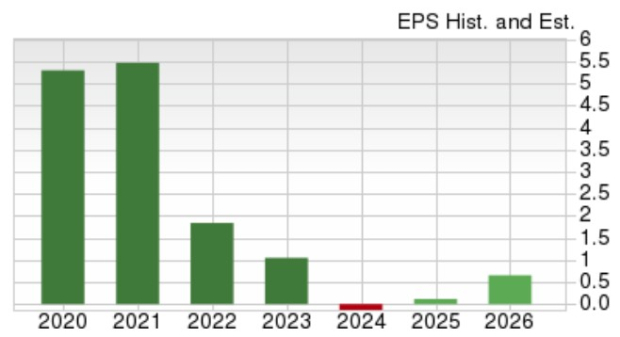

Based on Zacks’ estimates, Intel’s total sales are expected to decrease by 2% in fiscal year 2025 but are projected to rebound with a 3% increase in FY26, reaching $53.76 billion. The annual EPS is slated to shift to $0.12 in FY25, compared to an adjusted loss of $0.13 per share in the prior year. Optimistically, FY26 EPS is projected to recover to $0.64, though this figure remains below Intel’s historical earnings potential.

Expert Summary and Final Thoughts

On the surface, Intel’s Q3 results might suggest a promising turnaround. However, a closer examination reveals that the return to profitability was largely driven by exceptional items, such as the Altera divestiture, rather than organic growth in core operations.

📍 Despite these caveats, the modest growth in AI-related products and evidence of disciplined cost management are encouraging. Coupled with the potential for further interest rate cuts and significant equity investments from the government, Nvidia, and SoftBank, the outlook appears cautiously optimistic.

Given these factors, it may be premature to dismiss the recent rebound in INTC stock. Nevertheless, a sustained upward revision in EPS estimates for FY26 would be crucial to warrant a definitive buy rating. Currently, Intel stock holds a Zacks Rank #3 (Hold).

See This Stock Now for Free >>

Intel Corporation (INTC) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

SoftBank Group Corp. Unsponsored ADR (SFTBY) : Free Stock Analysis Report