Key Takeaways

- Shore Capital reiterated a Hold rating for Lloyds Banking Group plc – Depositary Receipt (NYSE:LYG) on October 23, 2025.

- The average one-year price target for LYG stands at $5.03, suggesting a potential upside of 10.11% from its latest closing price.

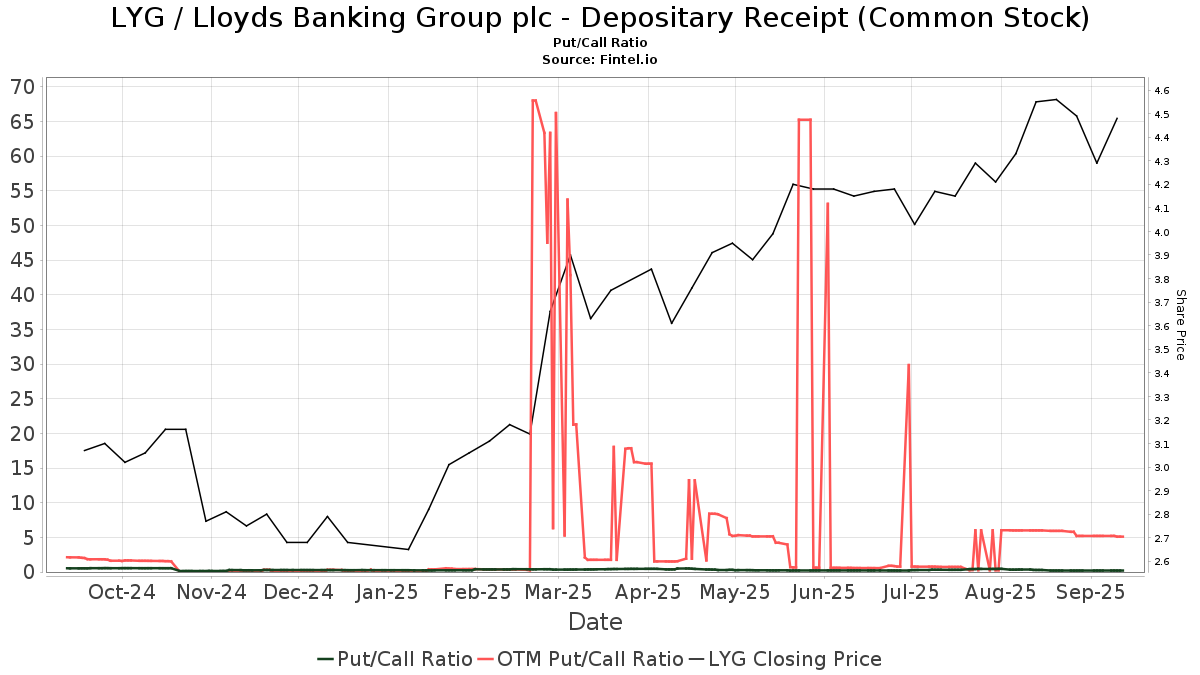

- Fund sentiment is predominantly bullish, with an increasing number of institutions holding LYG shares and a low put/call ratio.

- Several institutional investors, including Fisher Asset Management and L1 Capital Pty, have recently increased their holdings in LYG.

Shore Capital’s Latest Rating for Lloyds Banking Group

On October 23, 2025, Shore Capital reaffirmed its Hold recommendation for Lloyds Banking Group plc – Depositary Receipt (NYSE:LYG), according to a report by Fintel. This analyst coverage provides insight into the potential short-term performance of the company’s stock.

Analyst Price Target and Upside Potential

The current analyst price target for Lloyds Banking Group plc – Depositary Receipt is set at $5.03 per share for the next year. This forecast falls within a range of $4.03 to $5.84. Compared to the latest closing price of $4.57 per share, this price target indicates an estimated upside of 10.11%.

Projected Financial Performance

Looking ahead, the projected annual revenue for Lloyds Banking Group plc – Depositary Receipt is estimated at $19,462 million, marking an anticipated increase of 8.53%. The projected non-GAAP Earnings Per Share (EPS) is $0.09.

Institutional Investor Sentiment for LYG

The institutional investor landscape for Lloyds Banking Group plc – Depositary Receipt shows significant activity. Currently, 518 funds and institutions report holdings in LYG. This represents an increase of 32 owners, or 6.58%, in the past quarter. The average portfolio allocation dedicated to LYG by these funds has risen by 29.20% to 0.09%.

Total institutional ownership of LYG shares saw a substantial increase of 24.44% over the last three months, reaching 685,830,000 shares. Furthermore, the put/call ratio for LYG stands at 0.16, which is often interpreted as a bullish signal, suggesting more call options are being traded than put options.

Key Institutional Holder Movements

Several notable institutional investors have adjusted their positions in LYG recently.

Fisher Asset Management

Fisher Asset Management currently holds 148,829,000 shares. In the previous filing, the firm reported owning 132,123,000 shares, an increase of 11.22%. Their portfolio allocation to LYG also saw a boost of 14.93% in the last quarter.

L1 Capital Pty

L1 Capital Pty has increased its stake significantly, now holding 129,076,000 shares. Previously, the firm held 0 shares, marking a 100% increase.

Mondrian Investment Partners

Mondrian Investment Partners holds 66,050,000 shares, down from 72,734,000 shares reported in their prior filing, a decrease of 10.12%. Despite this, the firm increased its portfolio allocation to LYG by 17.69% over the last quarter.

Goldman Sachs Group

Goldman Sachs Group now holds 26,748,000 shares, an increase from 24,154,000 shares in the previous filing, representing a 9.70% rise. The firm also increased its portfolio allocation to LYG by 3.41% recently.

Arrowstreet Capital, Limited Partnership

Arrowstreet Capital, Limited Partnership’s holdings decreased by 44.49% to 23,094,000 shares from 33,369,000 shares. Consequently, their portfolio allocation to LYG decreased by 32.94% over the last quarter.

Expert Summary

The latest analyst reports indicate a steady outlook for Lloyds Banking Group plc – Depositary Receipt, with Shore Capital maintaining a Hold rating. Positive institutional investor sentiment, evidenced by increasing holdings and a bullish put/call ratio, combined with a projected upside in share price, suggests potential positive momentum for LYG.