Quick Summary

- NEAR Protocol is projected to reach a maximum price of $6.64 by the end of 2025.

- By 2028, NEAR’s price could climb to $13.63, fueled by increasing mainstream adoption.

- The forecast for 2031 suggests NEAR Protocol may surge to $31.64 or higher.

Despite a recent bearish sentiment among traders, NEAR Protocol continues to advance technologically and form strategic partnerships. This analysis explores NEAR’s price potential and future prospects.

Overview

| Cryptocurrency | NEAR Protocol |

| Ticker | NEAR |

| Price | $2.06 (-10%) |

| Market Cap | $2.63 Billion |

| Trading Volume 24-h | $240 Million |

| Circulating Supply | 1.24 Billion NEAR |

| All-time High | $20.42 Jan 17, 2022 |

| All-time Low | $0.526, Nov 04, 2020 |

| 24-h High | $2.34 |

| 24-h Low | $2.06 |

NEAR Protocol Price Prediction: Technical Analysis

| Sentiment | Bearish |

| 50-Day SMA | $2.65 |

| 200-Day SMA | $2.55 |

| Price Prediction | $4.55 (119.17%) |

| Fear & Greed Index | 22.72 (Extreme Fear) |

| Green Days (30-day) | 18/30 (60%) |

| 14-Day RSI | 46.14 |

NEAR Protocol Price Analysis: NEAR Falls to $2.06

TL;DR Breakdown:

- NEAR Protocol price analysis indicates a recent fall to $2.06 before a potential recovery.

- NEAR’s price had dropped by 10.51% at the time of this report.

- NEAR Protocol faces immediate support at $2.05 and resistance at $2.10.

The price analysis for NEAR Protocol on October 30 shows the token’s value receding to $2.06.

NEAR Protocol Price Analysis: 1-Day Chart

The 1-day NEAR/USD chart shows that after reaching approximately $3.20, NEAR encountered significant resistance, leading to a sharp decline below $2.00. It briefly recovered to the $2.60 level before falling to $2.15, then rose again to $2.23. However, the price experienced a sharp drop to $2.05, where it is currently trading.

Technical indicators suggest a waning bearish momentum as NEAR dips to the $2.05 level after a notable drop from $2.20.

The Exponential Moving Averages (EMAs) are positioned below the mean, and recent data indicates weakening bearish pressure. The Relative Strength Index (RSI) mirrors this sentiment, having fallen to 36.08 from 45.00, suggesting potential for further short-term downward movement. The converging Bollinger Bands indicate decreasing volatility, which could challenge the $2.05 support level over the weekend.

NEAR Price Analysis: 4-Hour Chart

The 4-hour chart for NEAR reveals that the token found short-term support around the $2.20 mark, allowing for a rapid recovery to $2.60 before declining again. Subsequently, the price dropped to $2.15 before rallying back to $2.20. However, a significant crash brought the price back down to $2.05 today.

The RSI is currently at 26.54, indicating strong bearish market sentiment as the $2.20 support level failed. The Moving Average Convergence Divergence (MACD) displays increasingly bearish candles, with the MACD line at -0.024, signaling rising bearish momentum.

NEAR Protocol Technical Indicators: Levels and Actions

Daily Simple Moving Average (SMA)

| Period | Value | Action |

|---|---|---|

| SMA 3 | $2.36 | SELL |

| SMA 5 | $2.38 | SELL |

| SMA 10 | $2.34 | SELL |

| SMA 21 | $2.38 | SELL |

| SMA 50 | $2.66 | SELL |

| SMA 100 | $2.63 | SELL |

| SMA 200 | $2.63 | SELL |

Daily Exponential Moving Average (EMA)

| Period | Value | Action |

|---|---|---|

| EMA 3 | $2.45 | SELL |

| EMA 5 | $2.51 | SELL |

| EMA 10 | $2.55 | SELL |

| EMA 21 | $2.57 | SELL |

| EMA 50 | $2.58 | SELL |

| EMA 100 | $2.60 | SELL |

| EMA 200 | $2.88 | SELL |

What to Expect from NEAR Protocol Price Analysis?

NEAR has encountered strong resistance at the $2.60 mark, causing its price to drop below $2.10. While there was a brief recovery to $2.20, the price has since fallen back to $2.05. As long as NEAR holds the $2.05 level, significant declines below $2.00 are unlikely in the short term.

Traders should anticipate NEAR to trade within the $2.00-$2.10 range in the coming days. Key levels to monitor for potential breakouts are $1.95 and $2.15.

Is Near Protocol a Good Investment?

NEAR Protocol stands out in the cryptocurrency market with its focus on scalability, usability, and developer-friendliness. It is designed to simplify the creation of decentralized applications (dApps) and smart contracts, appealing to both developers and end-users. NEAR’s innovative technology and user-oriented approach position it well for the mainstream adoption of blockchain applications.

By prioritizing user experience and providing robust developer tools, NEAR Protocol is poised to drive significant medium-term growth within the dApp ecosystem. Its potential to disrupt established industries and capture market share in the blockchain space makes it an attractive prospect for investors interested in cutting-edge technological solutions.

Why is NEAR Down?

NEAR’s price initially found short-term support at $2.20, allowing for a rapid recovery to $2.60, but it subsequently declined. Following this, the price fell back to $2.20 before crashing to the current $2.05 level.

Will NEAR Recover?

NEAR Protocol has experienced a notable sell-off over the past month, with its price dropping from near the $3.00 mark to the current $2 level. Despite this bearish trend, analysts suggest that this momentum may be short-lived, with price predictions ranging between $2.25 and $5.5 by the end of 2025.

Will NEAR Reach $10?

In recent days, NEAR saw a quick recovery to the $2.80 level, where it met short-term resistance and subsequently fell back below $2.70.

Will NEAR Reach $20?

The NEAR Protocol price is anticipated to surpass the $20 threshold by 2031. This long-term forecast is supported by the increasing mainstream adoption of blockchain technology. NEAR’s vision for a scalable, user-friendly, and developer-centric architecture is expected to drive this bullish trend.

Will NEAR Reach $50?

The possibility of NEAR Protocol reaching the $50 mark depends on several factors, including ongoing network development, evolving market regulations, and the overall growth of the cryptocurrency market. Sustaining its current development trajectory could see NEAR reaching $50 in the coming years.

Does NEAR Have a Good Long-Term Future?

Yes, NEAR has a promising long-term future due to its innovative technology, emphasis on scalability, and robust ecosystem development, which contribute to a positive price outlook. However, continuous adaptation to industry advancements will be crucial for NEAR to maintain its competitive edge in the digital landscape.

Recent News/Opinions on Near Protocol

NEAR announced that NEAR House of Stake is developing verifiable AI delegates aimed at scaling voter participation and enhancing governance tools across the ecosystem.

NEAR is pioneering AI-driven governance to supercharge how DAOs operate.

NEAR House of Stake is developing verifiable AI delegates to scale voter participation and rapidly allocate resources to the most impactful products and tooling across the ecosystem.— NEAR Protocol (@NEARProtocol) October 3, 2025

NEAR Price Prediction: October 2025

The NEAR Protocol price forecast for October 2025 anticipates trading within a range, with a minimum price of $2.52, an average price of $3.01, and a maximum price of $3.79.

| Month | Minimum Price | Average Price | Maximum Price |

| October | $2.52 | $3.01 | $3.79 |

NEAR Price Prediction: 2025

For the year 2025, the NEAR price prediction indicates a minimum price of $2.14, an average price of $4.93, and a maximum price of $6.64.

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2025 | 2.14 | 4.93 | 6.64 |

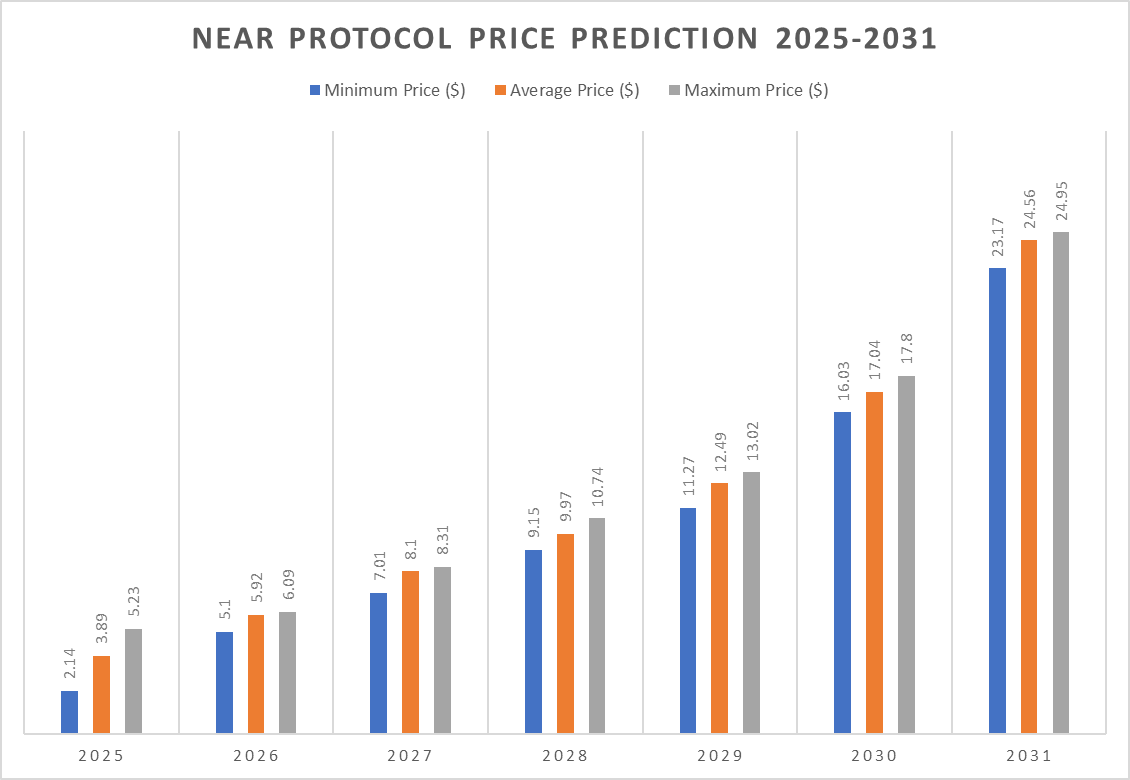

NEAR Price Prediction: 2026-2031

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2026 | 6.47 | 7.51 | 7.73 |

| 2027 | 8.90 | 10.27 | 10.54 |

| 2028 | 11.61 | 12.64 | 13.63 |

| 2029 | 14.29 | 15.85 | 16.52 |

| 2030 | 20.34 | 21.61 | 22.58 |

| 2031 | 29.39 | 31.15 | 31.64 |

NEAR Price Prediction 2026

The forecast for 2026 suggests continued price appreciation, with a minimum projected price of $6.47, an average of $7.51, and a maximum of $7.73.

NEAR Price Prediction 2027

Technical analysis and projections for 2027 estimate the minimum NEAR price to be around $8.90, with an average trading price of $10.27, and a maximum value reaching $10.54 by year-end.

NEAR Price Prediction 2028

For 2028, NEAR Protocol’s price is predicted to trade between a minimum of $11.61 and an average of $12.64, potentially reaching a maximum of $13.63.

NEAR Protocol Prediction 2029

The NEAR Protocol price prediction for 2029 indicates sustained bullish sentiment, with a minimum price of $14.29, an average trading price of approximately $15.85, and a maximum value of $16.52.

NEAR Price Prediction 2030

In 2030, NEAR Protocol is forecasted to trade between a minimum of $20.34 and an average of $21.61, with a potential maximum value of $22.58.

NEAR Price Prediction 2031

The NEAR Protocol forecast for 2031 suggests continued bullish momentum, with a minimum value of $29.39, an average trading price near $31.15, and a potential maximum value of $31.64.

NEAR Market Price Prediction: Analysts’ NEAR Price Forecast

| Firm | 2025 | 2026 |

| Coincodex | $11.79 | $14.28 |

| DigitalCoinPrice | $11.09 | $12.92 |

Cryptopolitan’s NEAR Protocol (NEAR) Price Prediction

Cryptopolitan’s predictions suggest that the price of NEAR Protocol could reach a high of $6.64 in the latter half of 2025. For 2026, the price is expected to range between $6.47 and $7.73. By 2030, the prediction is for prices between $20.34 and $22.58, with an average of $21.61. Please note that these predictions are not financial advice, and independent research or professional consultation is recommended.

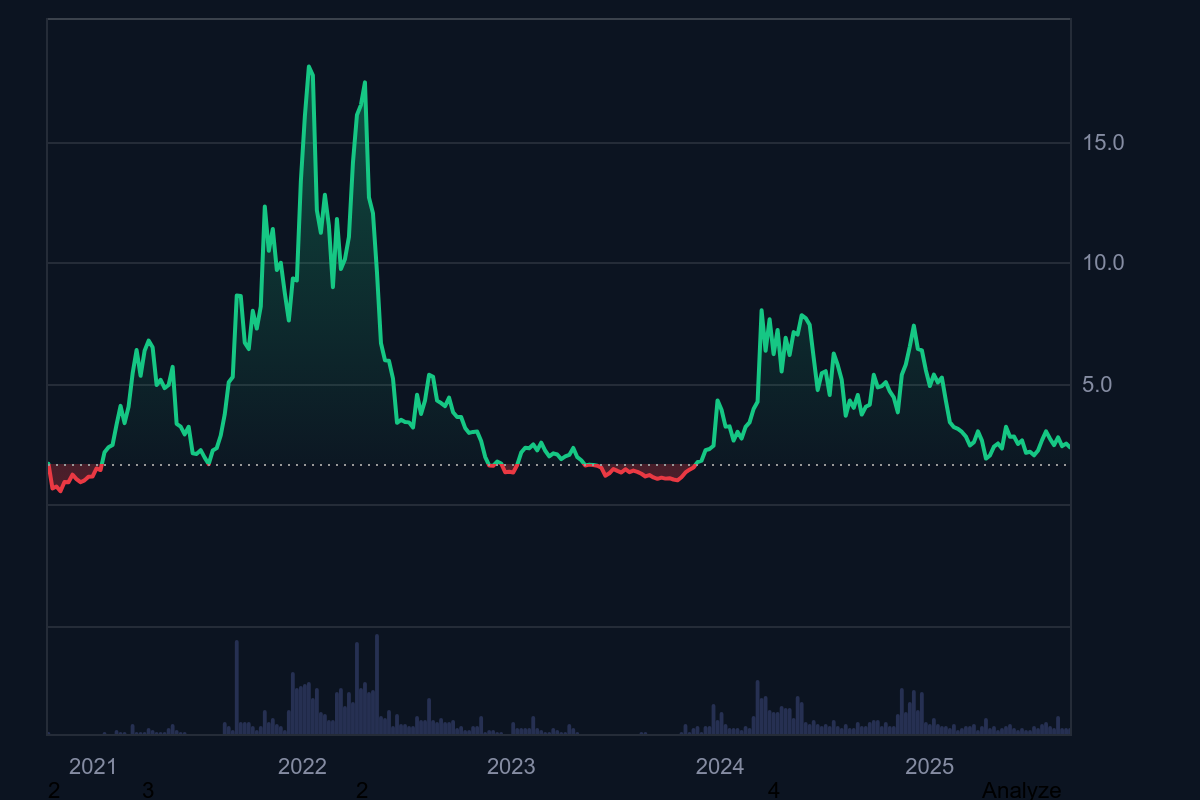

NEAR Protocol Historic Price Sentiment

NEAR Protocol (NEAR) launched in August 2020 with the goal of establishing a scalable and permissionless blockchain. Its initial recorded trading value in October 2020 was $1.072, closing the year at $1.459 following a recovery.

In 2021, NEAR experienced an upward trend, starting the year at $1.305 and reaching an all-time high (ATH) of $7.572 on March 13. A subsequent market downturn pushed the price to $1.537 by July 19, but it rebounded to $11.776 on September 9 and further to $13.168 on October 26.

By 2022, NEAR’s price had fallen below $2.00, losing over 90% of its peak value. Throughout 2023, NEAR exhibited low volatility, with prices remaining below $2.50 for most of the year.

Since the beginning of 2024, NEAR has shown a strong recovery, climbing to $7.80. However, after reaching the $8.00 mark in mid-May, it declined to $5.60. In June, NEAR traded between $4.48 and $7.66. It rose from $5.20 to $6.04 in July but closed the month below $5.00. NEAR began August at $5.00, dropping to $3.89 by month-end.

In September 2024, the asset rebounded, closing the month above $5.20. In October, the price trended downwards, falling to $4.850 in the early days before closing the month below the $4.00 mark, indicating a negative outlook at the start of November.

November saw NEAR making significant gains as bulls dominated the market, a trend expected to continue into December. However, the month concluded with NEAR plummeting from heights of $7.00 to below $5.00.

In January, the price struggled to find stability, continuing its decline and closing the month just above $4.00.

February saw a significant price drop towards the $3.00 mark, with the trend continuing to end the month at $2.80. March continued this decline, closing near $2.50, a pattern that persisted into April, ending the month at $2.35. In May, the price saw a partial recovery, reversing April’s losses but closing the month below $2.50.

June witnessed a further decay in price; despite early bullish signals, bears dominated, and NEAR closed the month around $2.12.

In mid-July, NEAR Protocol’s price surged towards the $3.00 mark but began to decline in the latter half of the month. This trend continued into August, with NEAR closing the month at $2.38. In September, the price rose sharply to the $3.40 level but failed to sustain it, ending the month at $3.00.

Final Thoughts

NEAR Protocol’s price trajectory shows a fluctuating pattern, influenced by general market sentiment and project developments. While recent technical indicators suggest bearish pressure, future projections indicate substantial growth potential driven by technological advancements and increasing adoption.