Quick Summary

- Nvidia CEO Jensen Huang stated that no discussions are underway for selling the company’s new Blackwell AI chips to Chinese firms.

- Huang indicated that future sales to China are contingent on policy changes by the Chinese government.

- Nvidia recently achieved a $5 trillion market capitalization, leading the AI race despite some recent stock momentum loss.

- Competition in the AI hardware space is intensifying with companies like AMD and Broadcom developing competing products.

- US trade restrictions currently prevent Nvidia from selling its high-end AI chips in China, a market previously identified as a significant revenue opportunity.

Nvidia CEO on Blackwell Chip Sales to China

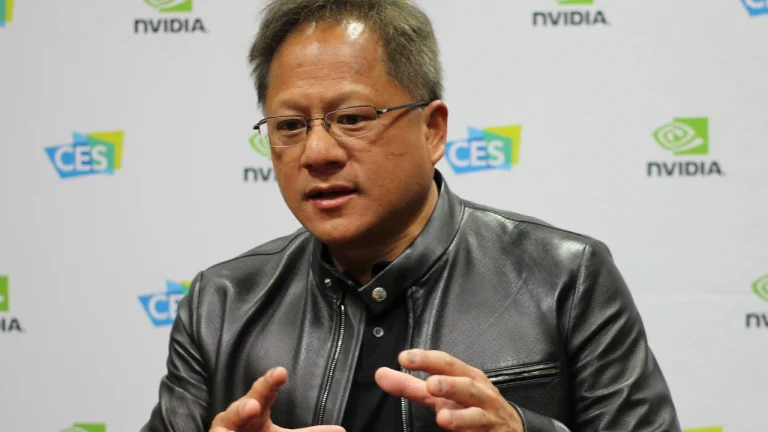

Nvidia CEO Jensen Huang has clarified the company’s position regarding the sale of its latest Blackwell AI chips, stating that there are no active discussions with any firms in China concerning these advanced products. Huang made these remarks on Friday while in Tainan, a city in southern Taiwan.

He emphasized that Nvidia is not currently preparing shipments or arranging any return to the Chinese market for its new hardware. Currently, we’re not planning to ship anything to China, Huang stated. He added that the decision for Nvidia’s products to re-enter the Chinese market rests with China itself, expressing his anticipation for policy changes. It’s up to China when they would like Nvidia products to go back to serve the Chinese market. I look forward to them changing their policy.

Huang’s Global Tour Amidst AI Leadership

Jensen Huang’s visit to Taiwan precedes his attendance at TSMC’s annual sports day event on Saturday, where he is expected to meet with the long-time manufacturing partner. This trip is part of a broader global tour that has recently included stops in Washington and South Korea, where he met with companies seeking access to Nvidia’s cutting-edge artificial intelligence hardware capabilities.

The 62-year-old founder has been actively engaged in international meetings as the demand for advanced computing systems continues to surge across various industries and geographical regions. Nvidia has seen a substantial increase in its market capitalization over recent months, briefly becoming the first company to reach a $5 trillion valuation.

Nvidia’s Dominance and Market Position

Despite some recent fluctuations in its stock performance, Nvidia continues to hold its position as the world’s most valuable company, surpassing tech giants like Apple and Microsoft. Jensen Huang is focused on expanding the adoption of AI hardware and addressing concerns that the current intense investment in AI might be inflating a market bubble.

Huang aims to demonstrate that the significant spending by numerous companies on data centers and specialized AI chips will yield tangible, beneficial results. This strategic focus is crucial as competition in the advanced computing sector intensifies.

Growing Competition in the AI Hardware Sector

The artificial intelligence hardware landscape is becoming increasingly competitive. Companies such as Advanced Micro Devices (AMD) and Broadcom are actively developing their own hardware solutions to capitalize on the booming demand for AI technologies. These competitors are targeting the same corporate clients that Nvidia serves, striving to offer faster training systems and large-scale computing clusters.

Nvidia’s ability to sell its high-end AI chips in China remains restricted due to existing trade regulations. Despite recent diplomatic efforts, a trade agreement between the U.S. and China did not include provisions for Blackwell chip sales. U.S. officials have indicated that such shipments are not currently under consideration.

💡 During a previous earnings call in August, Jensen Huang noted that if Nvidia’s chips were permitted for sale in China, it could unlock a market opportunity worth approximately $50 billion. He had previously highlighted the rapid growth of AI computing demand in China, estimating an annual increase of about 50%.

The ongoing restrictions have raised concerns among Wall Street investors. There is apprehension that the substantial investments in hardware, data centers, and AI infrastructure may not generate sufficient new revenue to justify the considerable expenditures.

Consequently, some investors fear that current expectations for AI systems might outpace actual commercial outcomes. This concern is amplified by the inability to access major markets like China with Nvidia’s most advanced chips.

Final Thoughts

Nvidia CEO Jensen Huang has confirmed that sales of the new Blackwell AI chips to China are not currently being discussed, placing the onus on China to alter policies for future market access. While Nvidia leads the AI hardware race and has achieved significant market valuation, increasing competition and U.S. trade restrictions pose challenges.