Key Highlights:

- OpenLedger’s token surged by more than 200% on September 8, 2025.

- The token’s limited circulating supply, combined with lockup periods for team members and early investors, restricts liquidity and supports price increases.

- Strategic tokenomics and integration plans are driving expectations for long-term adoption.

On September 8, 2025, OpenLedger (OPEN) posted an impressive 200% increase, significantly outperforming the broader crypto market’s modest 1.23% gain. This strong rally is largely attributed to OpenLedger’s highly anticipated listing on Binance and growing enthusiasm surrounding its AI-powered blockchain platform and distinctive tokenomics.

At the time of reporting, OPEN’s price is $1.45, reflecting a 187.33% rise over the past 24 hours according to CoinMarketCap.

Binance Listing Triggers Immediate Momentum

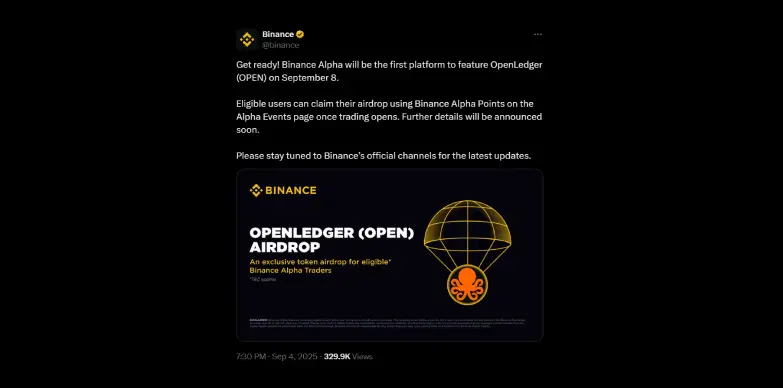

A key factor behind OpenLedger’s rapid price increase is the liquidity boost and visibility gained from its Binance debut. Binance, the world’s largest cryptocurrency exchange, commenced spot trading for OPEN on September 8 at 13:00 UTC, following deposit availability that opened three days prior.

The listing includes trading pairs with USDT, USDC, BNB, FDUSD, and TRY, offering broad access across stablecoins and popular cryptocurrencies.

Binance has allocated 10 million OPEN tokens, representing 1% of the total supply, for its HODLer Airdrop program targeting BNB holders who staked between August 18-21, 2025. This airdrop generated significant interest, encouraging recipients to capitalize on post-listing price volatility. Binance Alpha, the platform hosting the listing, actively supports early liquidity and community engagement for projects like OpenLedger.

While the listing has increased trading volume and reduced price slippage, some volatility is anticipated as early airdrop recipients might sell their tokens, creating short-term downward pressure. Nevertheless, the circulating supply remains low at approximately 21.55% of the total 1 billion OPEN tokens, which helps mitigate immediate dilution risks.

AI Blockchain Innovation Drives Enthusiasm

Beyond the Binance listing, OpenLedger’s price surge reflects rising interest in its AI blockchain capabilities. The OPEN token serves multiple functions: covering gas fees, rewarding data sharing, and granting holders governance rights within its decentralized AI ecosystem.

Recent milestones such as OpenLedger’s mainnet launch and its August partnership with Trust Wallet demonstrate rapid progress. With Trust Wallet’s user base exceeding 200 million, OPEN is well-positioned to enable AI-powered wallet features and facilitate decentralized data validation on a large scale.

Tokenomics and Market Sentiment Overview

Examining the tokenomics reveals that only 21.55% of OPEN’s total supply is currently circulating. About 33% of tokens are held by the team and early investors, who are subject to a 12-month lockup period, preventing sales and reducing near-term selling pressure.

The limited availability of tokens for trading causes significant price volatility, which explains the recent 200% surge. However, negative shifts in sentiment could lead to equally rapid price declines.

OPEN’s market capitalization stands at $312 million, but factoring in the fully diluted valuation (FDV), it reaches approximately $1.5 billion. This elevated valuation depends heavily on the successful expansion of its AI blockchain ecosystem.

In summary, the constrained supply supports rapid price increases but also heightens the risk of sharp downturns. Sustainable growth hinges on genuine adoption and ecosystem development.

Fundfa Analysis

OpenLedger’s recent surge, driven by its Binance listing and AI blockchain innovations, highlights the importance of strategic tokenomics and ecosystem partnerships in driving market interest. The token’s low circulating supply fuels volatility, suggesting that sustained growth will require ongoing adoption and network expansion to maintain investor confidence.