Key Takeaways

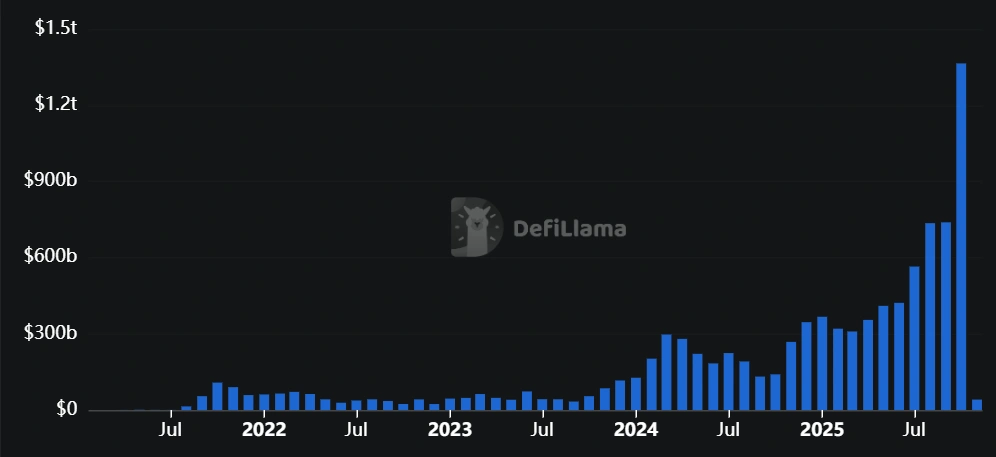

- Decentralized perpetual futures (perps) achieved a record monthly trading volume exceeding $1.3 trillion in October.

- This milestone marks the first time DEX monthly trading volume surpassed $1 trillion, showing significant growth relative to centralized exchanges.

- Factors contributing to this surge include stricter risk controls on centralized exchanges pushing liquidity on-chain and U.S. Federal Reserve rate cuts.

- Market volatility on October 10th, including a major liquidation event, also highlighted the capabilities and reliability of DEXs.

- Open interest in perpetual futures reached approximately $17.9 billion during this period.

Perpetual Futures on DEXs Surpass $1 Trillion Monthly Trading Volume

Decentralized perpetual futures (perps) have reached an impressive milestone, with October’s monthly trading volume soaring past $1.3 trillion. This figure nearly doubles September’s volume and represents the first time decentralized exchanges (DEXs) have achieved over $1 trillion in monthly trading volume, underscoring their growing challenge to centralized exchange dominance.

📊 The open interest (OI) for perpetual futures stood at approximately $17.9 billion. Data from DeFiLlama shows that the on-chain perpetuals’ monthly trading volume in September exceeded $738 billion.

From Niche to Trillion-Dollar Market: The Rise of DEX Derivatives

Perpetual futures, crypto derivatives enabling speculation on price movements without an expiration date, were historically dominated by major centralized exchanges (CEXs) such as Binance, Coinbase, and OKX. However, increased regulatory scrutiny and more stringent risk management protocols on CEXs over the past year have prompted a significant shift of liquidity towards on-chain platforms.

Decentralized platforms, including Hyperliquid, Lighter, and EdgeX, alongside those built on Ethereum and Arbitrum, have increasingly gained user adoption. Collectively, these platforms handled over $1 trillion in notional trading volume last month. Juan Pellicer, a researcher at Sentora, observed that this migration to on-chain trading is a direct consequence of tighter risk controls and reduced market-making activities on CEXs.

💡 On-chain protocols are now introducing innovative execution models designed to attract a broader spectrum of traders, including those employing slower, more strategic approaches often referred to as the long tail of the market. The inherent transparency and composability of these platforms further enhance their appeal to users.

According to a Sentora report, on-chain derivatives are transcending their niche status to become the marginal venue for leverage in crypto, influencing how risk is transmitted throughout the ecosystem.

Federal Reserve Rate Cuts Influence Leverage Demand

Recent interest rate cuts by the U.S. Federal Reserve have indirectly boosted the demand for leverage across various risk assets. By reducing the cost of dollar funding, these cuts make holding fully collateralized spot positions less attractive compared to leveraged positions via perpetual futures. This occurs because lower base rates increase the shadow value of collateral and diminish the appeal of alternative USD funding methods, thereby making perpetual futures exposure more cost-effective relative to holding spot assets.

October 10th Market Volatility Boosts Record Volumes

The record trading volume in October may also be linked to the brief market downturn experienced on October 10th. This event, reportedly triggered by an announcement of increased tariffs on China, led to the largest liquidation event recorded in the crypto market to date.

⚡ During this period, several major CEXs encountered downtime and technical issues due to the overwhelming trading volume and user pressure. This disruption prompted a greater number of traders to utilize DEXs for their trading activities.

Hyperliquid, a prominent perpetual DEX, reported the liquidation of over 1,000 wallets on October 10th alone. On that single day, on-chain perpetual markets achieved a record single-day trading volume of $78 billion, showcasing the scalability and readiness of decentralized platforms to compete effectively with their centralized counterparts.

Final Thoughts

The decentralized perpetual futures market has shown remarkable growth, surpassing $1 trillion in monthly trading volume for the first time in October. This expansion is fueled by a confluence of factors, including the migration of liquidity from CEXs due to stricter regulations and an increasing demand for leveraged trading opportunities, further influenced by evolving central bank monetary policies.

The resilience of DEXs was notably demonstrated during periods of market stress, highlighting their capacity to manage high volumes and significant liquidation events, positioning them as increasingly vital players in the derivatives landscape.