Key Takeaways

- GBP/USD is trading subdued around 1.3315 as investors await US-China trade talks and key US economic data.

- Upbeat UK Retail Sales and flash PMI data provided a boost to Sterling.

- US CPI and S&P Global PMI data for October are scheduled for release, with market consensus expecting higher inflation.

- Technical analysis suggests a bearish near-term trend for GBP/USD, with support at 1.3140 and resistance at 1.3500.

Market Snapshot: GBP/USD and Investor Caution

The Pound Sterling (GBP) is experiencing subdued trading against the US Dollar (USD), hovering near the 1.3315 level during Friday’s European session. The GBP/USD pair is consolidating as market participants adopt a cautious stance, awaiting crucial trade discussions between US Treasury Secretary Scott Bessent and China Vice Premier He Lifeng. These talks are set to commence on Friday, coinciding with the Association of Southeast Asian Nations (ASEAN) summit in Malaysia.

Top negotiators from the United States and China are anticipated to address ongoing trade frictions, which escalated following China’s imposition of export controls on rare earth minerals. In response to these actions, Washington had previously signaled potential curbs on software-powered exports, affecting a range of products from laptops to jet engines.

Focus on US Economic Data Releases

Investors are also closely monitoring significant economic data releases from the United States scheduled for Friday. These include the September Consumer Price Index (CPI) data, delayed due to the government shutdown, and the preliminary S&P Global Purchasing Managers’ Index (PMI) data for October, expected during the North American trading session.

The market consensus forecasts a notable increase in US headline inflation for September, with an annualized rise projected at 3.1% compared to the previous 2.9%. Core CPI, which excludes volatile food and energy prices, is also expected to show a steady increase of 3.1%.

💡 On a monthly basis, both headline and core CPI are estimated to have risen by 0.4% and 0.3%, respectively. These figures could influence the Federal Reserve’s perspective, though recent commentary suggests policymakers are more concerned about labor market risks.

In addition to inflation data, the US S&P Global PMI is expected to indicate moderate expansion, primarily due to a potential slowdown in the services sector. The Services PMI is forecast to dip to 53.5 in October from 54.2 in the previous month.

Pound Sterling Gains Momentum on Positive UK Data

The Pound Sterling has seen a positive reception against its major currency peers on Friday, largely driven by encouraging flash S&P Global Purchasing Managers’ Index (PMI) data for October and robust Retail Sales figures for September.

The S&P Global report indicated that overall private sector business activity expanded at a rate exceeding expectations. The Composite PMI climbed to 51.1 in October, surpassing the forecasted 50.6 and the prior reading of 50.1.

This stronger-than-anticipated performance was bolstered by healthy growth in the services sector and an improvement in the Manufacturing PMI. The Services PMI was reported at 51.1, slightly higher than the estimated 51.0 and the previous 50.8. Meanwhile, the Manufacturing PMI rose to 49.6, significantly exceeding expectations of 46.6 and the September figure of 46.2. While manufacturing activity continues to contract, the pace of decline has decelerated, with the figure remaining below the 50.0 threshold that signifies contraction.

Earlier in the day, the Office for National Statistics (ONS) revealed that Retail Sales, a key indicator of consumer spending, unexpectedly increased by 0.5% month-on-month. Although this rate is slower than August’s revised 0.6%, it comfortably beat economists’ projections of a 0.2% decline.

📊 On an annualized basis, this measure of consumer spending demonstrated a strong growth of 1.5%, contrasting with market consensus of 0.6% and the prior reading of 0.7%.

The positive signals from Retail Sales and PMI data are expected to provide some reassurance to Bank of England (BoE) officials who have expressed concerns about the UK economic outlook. This comes after BoE policymaker Swati Dhingra recently warned that potential US tariffs could exert downward pressure on inflation and economic growth in the medium term.

Technical Outlook for GBP/USD

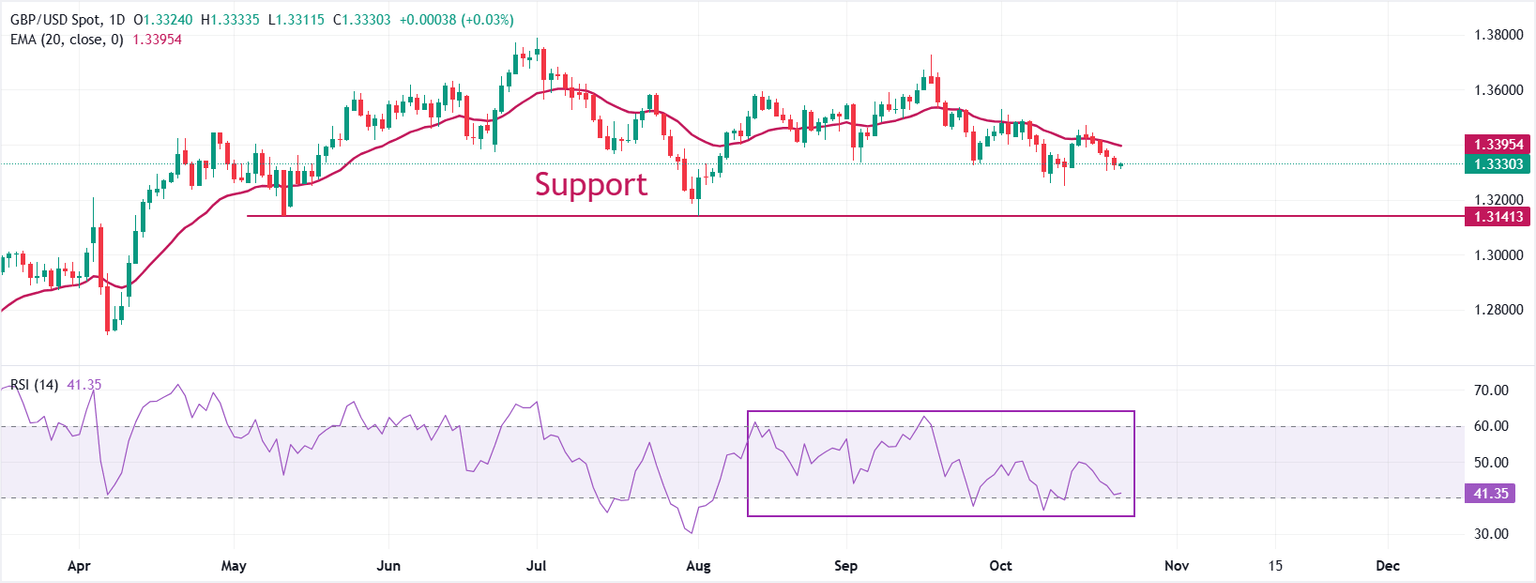

The Pound Sterling is trading near 1.3315 against the US Dollar on Friday, indicating caution in the market. The near-term trend for the GBP/USD pair appears bearish, as it remains below the 20-day Exponential Moving Average (EMA), which is currently positioned around 1.3395.

⚡ The 14-day Relative Strength Index (RSI) is hovering close to the 40.00 level. A decline below this threshold could signal the emergence of fresh bearish momentum.

Looking at support levels, the low recorded on August 1, at 1.3140, is expected to serve as a significant support zone. Conversely, the psychological level of 1.3500 is anticipated to act as a key resistance barrier.

Economic Indicator Spotlight: US Consumer Price Index

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as The Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier.The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Expert Summary

The GBP/USD pair is trading with caution as key US-China trade talks and critical US economic data releases loom. Positive UK economic indicators, including Retail Sales and PMI figures, have provided some support for Sterling.

Traders are closely watching the upcoming US CPI and S&P Global PMI data for insights into inflation and economic growth. Technical indicators suggest a short-term bearish trend for GBP/USD, with defined support and resistance levels.