Key Highlights:

- Pudgy Penguins’ floor price declined by 19.6% over the past week, triggering around 175 loan liquidations on Blur.

- The Canary Capital PENGU ETF aims to include both Pudgy Penguins NFTs and PENGU tokens.

- Such market turmoil raises questions about NFT volatility and valuation, potentially complicating the ETF approval process.

The Pudgy Penguins NFT collection has experienced a notable drop, with its floor price decreasing by 19.6% in the last seven days according to CoinGecko. This downturn has led to heightened volatility and forced liquidations on the Blur NFT lending platform. Influencers and market analysts have issued warnings about cascading defaults, which could introduce significant uncertainty.

Liquidations Impact Pudgy Penguins

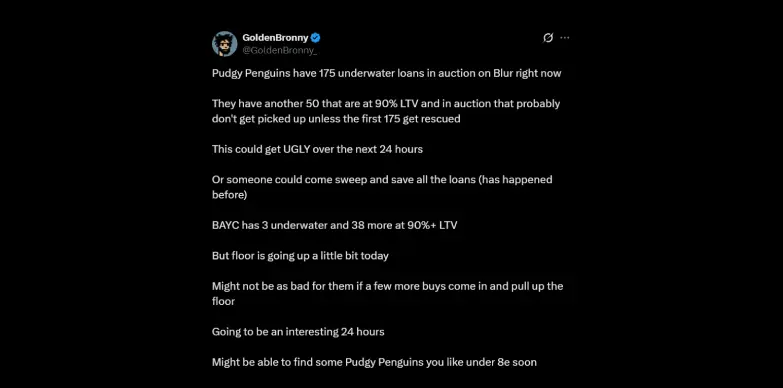

Currently, approximately 175 Pudgy Penguins loans are underwater and actively being auctioned on Blur, signaling that borrowers are unable to repay their debts and lenders are opting to sell the collateral NFTs in the open market.

Additionally, there are about 50 loans with Loan-to-Value (LTV) ratios near 90%, placing them at high risk of liquidation should asset prices decline further.

If no buyers intervene during the liquidation auctions, lenders may end up holding these NFTs instead of recovering their funds. Historically, investors have occasionally stepped in to prevent further price declines by purchasing large quantities of these NFTs, as noted by NFT expert Golden Bronny on X (formerly Twitter).

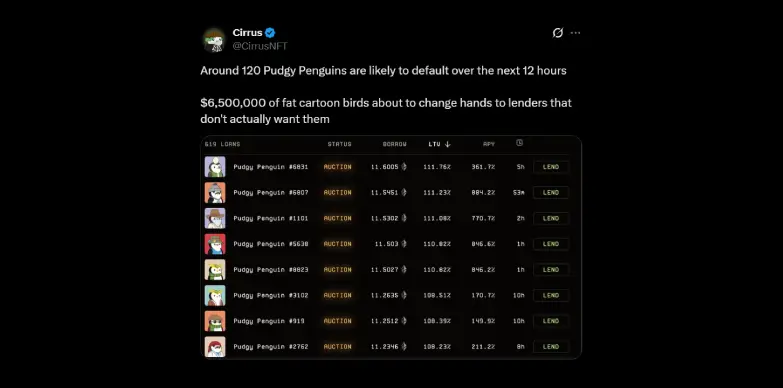

Another NFT analyst, Cirrus NFT, emphasized the severity of the risk, noting on X that nearly 120 Pudgy Penguins loans are expected to default within the next 12 hours. This could result in approximately $6.5 million worth of NFTs transferring from borrowers to lenders, many of whom likely do not intend to hold these “fat cartoon birds” long term.

BAYC Shows More Stability

In contrast, the Bored Ape Yacht Club (BAYC), another leading blue-chip NFT collection, appears to be faring better than Pudgy Penguins. According to Golden Bronny, only three BAYC NFTs are valued below their loan amounts, and 358 loans are close to 90% LTV, indicating a comparatively lower risk profile.

The BAYC floor price has demonstrated resilience over the years, with cautious buyers stepping in to support the market. Continued purchasing activity could help contain the situation for BAYC holders and reduce the severity of any price corrections.

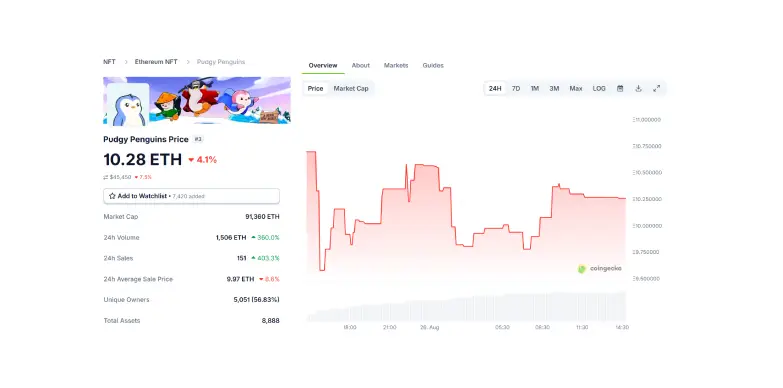

The forced liquidations on Blur are exerting downward pressure on the Pudgy Penguins floor price, which currently stands at 10.28 ETH (approximately $45,450), down 4.1% in the past 24 hours and 19.6% over the last week according to CoinGecko.

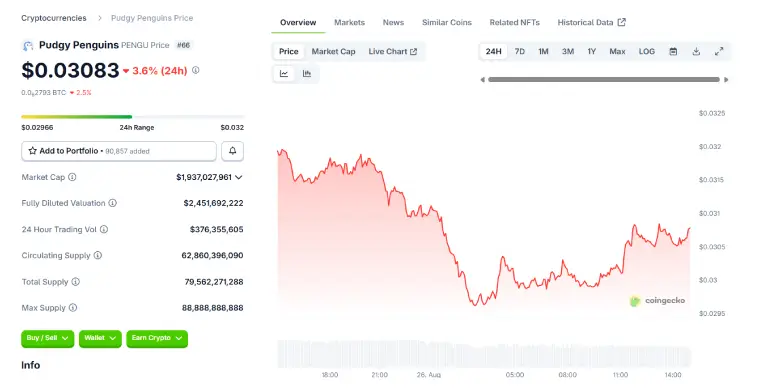

These liquidations may also undermine investor confidence in the PENGU token, potentially causing short-term price declines. Currently, the PENGU token is priced at $0.03083, down 3.6% in the last 24 hours.

Potential Impact on Canary Capital PENGU ETF

The Canary Capital PENGU ETF remains pending approval and is currently under review by the U.S. Securities and Exchange Commission (SEC). The decision has been deferred until October 12, 2025. This delay reflects the SEC’s cautious approach toward cryptocurrency and NFT-related ETFs as it evaluates regulatory, custody, and valuation concerns.

The recent Pudgy Penguins liquidations could negatively influence the ETF’s approval prospects. The forced sales highlight the volatility and valuation challenges inherent in NFTs, raising concerns about market stability, investor protection, and liquidity within the ETF structure. Such factors may slow regulatory progress. Conversely, effective market stabilization or intervention could improve the outlook.

Fundfa Analysis

The recent downturn in Pudgy Penguins NFTs and ensuing loan liquidations underscore the high volatility and risks present in NFT markets, which may impact investor confidence and regulatory decisions regarding related financial products. This situation highlights the need for robust valuation frameworks and risk management strategies to support sustainable growth in NFT-linked assets and ETFs.