Key Takeaways

- Quantum computing poses a significant, near-term threat to Bitcoin’s current encryption.

- Experts estimate that quantum computers could break Bitcoin’s cryptography within 2-8 years.

- A successful quantum attack could lead to mass theft of Bitcoin, potentially causing its value to plummet and impacting the entire crypto market.

- Transitioning to quantum-resistant algorithms is crucial for Bitcoin’s long-term survival.

The revolutionary potential of quantum computing, while exciting for many technological advancements, presents a significant and imminent threat to the fundamental security of Bitcoin. Many in the digital asset space may underestimate how quickly this sophisticated technology could undermine Bitcoin’s encryption, potentially sending its value to zero much sooner than commonly anticipated.

💡 Stay informed about emerging technologies that could impact blockchain security.

During a recent industry event, a concerning perspective was shared: Bitcoin faces a substantial risk from quantum computing, and the window for developers to implement necessary defenses is rapidly closing. This highlights the urgency for the crypto community to proactively address these quantum concerns.

📊 Monitor expert analyses and forecasts regarding advancements in computing power and cryptography.

Bitcoin’s current market performance shows it trading down, reflecting the broader market volatility influenced by geopolitical tensions.

⚡ Keep a close eye on macroeconomic factors and their potential influence on digital asset prices.

Here is the truth bomb everyone is ignoring.

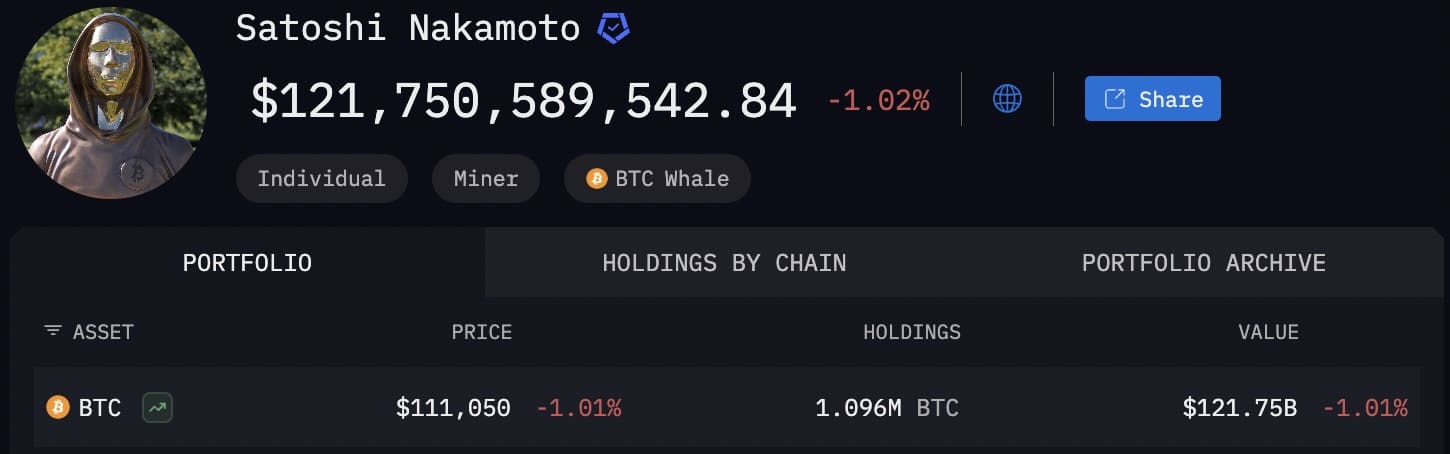

20-30% of Bitcoin will be taken by a Quantum Machine within 2-8 years and there is absolutely nothing we can do to stop this. These are P2PK addresses, like Satoshis $125B, and many other old/lost coins.

Bitcoiners have a painful…— Charles Edwards (@caprioleio) October 15, 2025

The Quantum Computing Threat to Bitcoin

A prominent figure in the Bitcoin community recently shared a stark warning at a major blockchain conference, emphasizing not only the potential for significant price appreciation but also the critical need for Bitcoin to become quantum-resistant. The urgency stems from the belief that existing cryptographic methods used by Bitcoin are vulnerable to quantum attacks.

📌 Explore strategies for enhancing the security of digital assets against emerging technological threats.

The assertion is that within a timeframe of two to eight years, quantum machines will possess the capability to break Bitcoin’s current elliptic curve cryptography. This timeline, presented by an expert at the event, suggests that the development of large-scale quantum computers is progressing faster than many anticipate, posing a direct challenge to the security infrastructure of numerous cryptocurrencies.

⚡ Research and understand cryptographic principles like elliptic curve cryptography and their potential vulnerabilities.

Further support for this looming threat comes from analyses by various experts. Opinions from a Bitcoin developer and a doctor specializing in quantum computing align on the probability and timeframe of such an event. These perspectives suggest a significant risk within the next few years, indicating that the window for action is narrow.

💡 Diversify your understanding by consulting multiple expert opinions on technological risks.

Leading global consultancies have also projected timelines for Q-Day, the anticipated point at which quantum computers will be capable of breaking widely used encryption standards, including ECC, which is fundamental to Bitcoin’s security. These forecasts reinforce the notion that the threat is not a distant possibility but a foreseeable challenge.

✅ Review projections from reputable firms regarding technological advancements and their impact on cybersecurity.

Academic and industry research, including a notable paper from a few years ago, has detailed the computational power required to break Bitcoin’s ECC. These studies indicate that a relatively modest number of logical qubits could be sufficient, with projections suggesting this capability could emerge within the next decade. This academic backing underscores the technical feasibility of a quantum attack.

📊 Familiarize yourself with the technical underpinnings of blockchain security protocols.

To preemptively counter this threat, a crucial recommendation is the immediate transition to quantum-resistant algorithms. Such algorithms, like those based on lattice cryptography or hash-based signatures, are designed to withstand quantum attacks. This strategic shift is vital for future-proofing the network.

🚀 Consider the importance of proactive security upgrades in the evolving digital landscape.

Following the implementation of new cryptographic standards, users would be required to migrate their funds to new addresses secured by this quantum-resistant encryption. A failure to undertake this migration could expose users to unprecedented levels of theft and erode confidence in the digital asset ecosystem, potentially destabilizing a market valued in trillions.

🔒 Understand the implications of network upgrades for user security and asset protection.

Satoshi’s Legacy and Market Stability at Risk

If the Bitcoin community and its developers do not adequately address the quantum computing threat, the very existence of BTC could be jeopardized. A failure to transition to quantum-resistant measures creates a significant vulnerability, potentially allowing malicious actors to exploit weaknesses and gain unauthorized access to valuable Bitcoin holdings, including those historically significant wallets.

💡 Explore how network participants can collectively advocate for essential security upgrades.

The potential breach of large, early Bitcoin wallets, such as those believed to belong to Satoshi Nakamoto, could have a catastrophic impact. The value held in these wallets is immense, and their compromise could trigger a massive sell-off, leading to a dramatic decline in Bitcoin’s price and profoundly affecting investor confidence across the entire digital asset market.

💹 Assess the potential market impact of significant security breaches in digital assets.

The immediate aftermath of such a breach would likely see a widespread panic. Investors, financial institutions, and even governments would rush to divest their holdings, fearing further exploitation. This widespread selling pressure could rapidly devalue Bitcoin and potentially trigger a systemic crisis across the entire digital asset market.

🔴 Understand how market sentiment and fear can amplify the impact of significant events.

Beyond the financial implications, a successful quantum attack would severely damage public trust in Bitcoin and, by extension, the entire cryptocurrency industry. If the foundational security of the leading digital asset is compromised, confidence in other projects would likely erode, potentially leading to a prolonged bear market or even the collapse of the nascent digital economy.

💡 Assess the role of trust and security in the long-term viability of any financial system.

Exploring Quantum-Resistant Solutions

I missed the big move on $QRL, but it's a long term game for sure. The security technologies that the project is developing, their blockchain, their vision of the future is amazing. I think that in the long run, many will start to pay attention to the $QRL ecosystem and adopt… pic.twitter.com/FYKeS6bqzg

— Omniscius Invest (@OmnisciusInvest) October 9, 2025

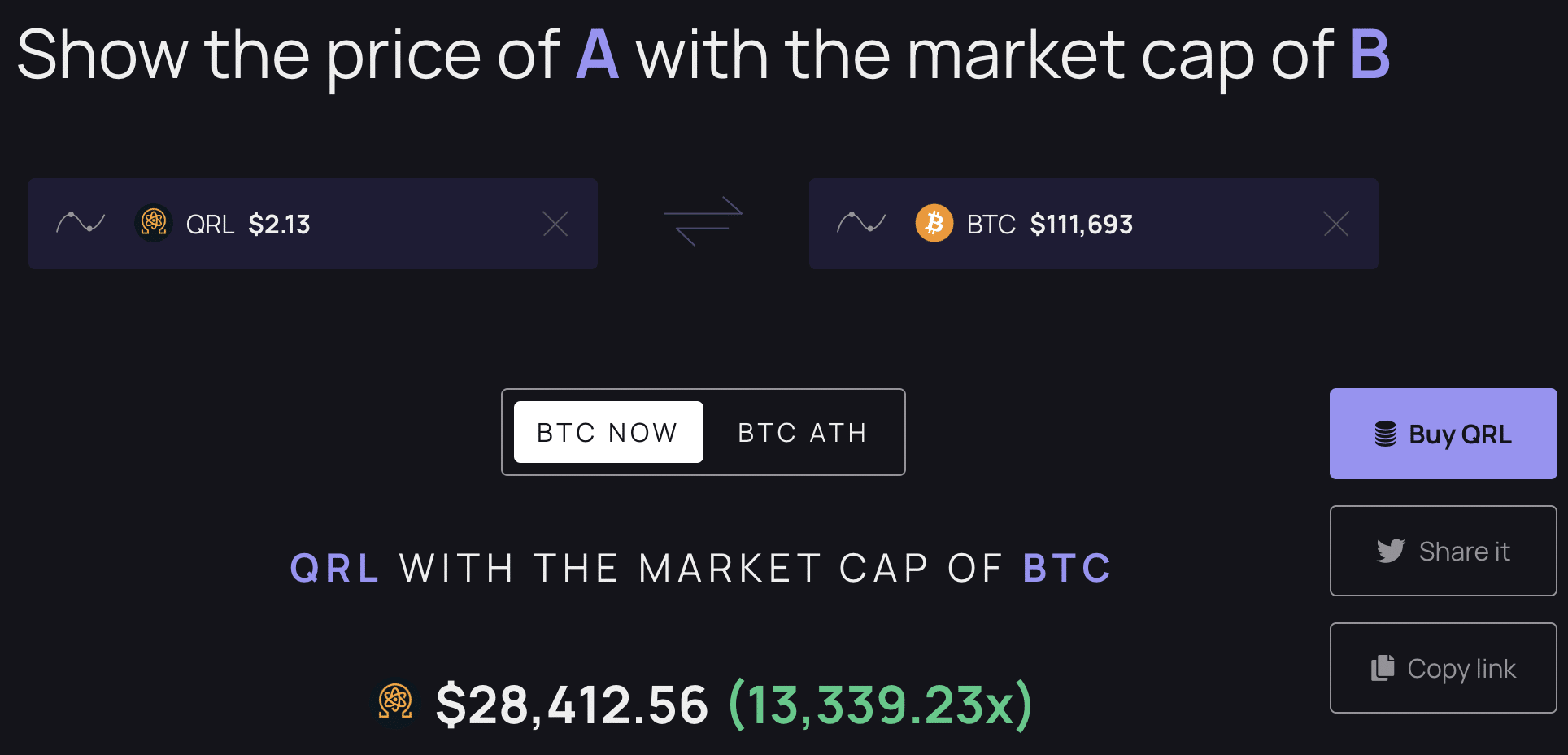

Recognizing the potential threats, specific digital assets are being developed with built-in quantum resistance. One such project utilizes post-quantum cryptography, specifically advanced signature schemes designed to thwart attacks from quantum computers. This proactive approach positions it as a potential safe haven in a future quantum-enabled landscape.

🟥 Investigate projects that are pioneering security solutions for the quantum era.

If the broader digital asset community, particularly Bitcoin, delays in implementing adequate defenses against quantum computing, projects that have already prioritized quantum resistance could gain significant prominence. Their early adoption of secure technologies might make them a preferred choice for investors seeking safety and resilience.

📍 Research the adoption rates and technological advantages of quantum-resistant cryptocurrencies.

Given the potential for substantial financial losses due to quantum attacks on existing cryptocurrencies, digital assets engineered for quantum security could present compelling investment opportunities. These projects are taking preventative measures now, potentially positioning them favorably should widespread quantum breaches occur.

⚡ Evaluate potential investment opportunities based on their proactive approach to cybersecurity threats.

Recent market performance indicates significant investor interest in such quantum-resistant assets, with a notable price increase over the past month, even during broader market downturns. Current trading activity and market capitalization suggest potential for substantial growth if the quantum threat materializes as predicted.

📈 Analyze asset performance data in the context of emerging technological risks.

The potential for a quantum-resistant asset to surpass Bitcoin in market capitalization, given its current valuation, represents an astronomical gain for early investors. While this scenario may seem speculative, the accelerating pace of quantum computing development makes it a plausible future if current security measures are not proactively upgraded.

🚀 Consider long-term investment theses based on technological disruption and adoption curves.

The accelerating development of quantum computing necessitates urgent action to secure Bitcoin and the broader digital asset ecosystem. Failure to implement robust quantum-resistant solutions swiftly could lead to severe financial repercussions for Bitcoin and have a cascading negative effect on the entire digital asset market, potentially benefiting those assets that have prioritized quantum security.

📊 Stay informed about the timeline and impact of quantum computing advancements on financial markets.

Why You Can Trust Fundfa

Our team comprises seasoned experts with extensive experience in financial markets, blockchain technology, and cryptocurrency analysis since the early days.

Weekly In-depth Research

100k+

Monthly Engaged Readers

Expert Contributors

2000+

Projects Reviewed

Follow Fundfa on Your Google News Feed

Get the latest updates, trends, and insights on finance and digital assets delivered straight to your fingertips. Subscribe now!

Fundfa Insight

The emergence of quantum computing presents a critical, near-term challenge to Bitcoin’s security infrastructure. Proactive migration to quantum-resistant cryptography is essential not just for Bitcoin’s survival, but for the overall stability and trustworthiness of the digital asset industry.