At a Glance

- Sequans Communications (SQNS) has become the first digital asset treasury (DAT) company to sell Bitcoin (BTC) to manage its debt obligations.

- The company sold 970 BTC, reducing its holdings to 2,264 BTC, to redeem 50% of its convertible debt.

- This strategic move improved Sequans’ debt-to-asset ratio from 55% to 39%.

- Despite the treasury sale, Sequans maintains its long-term conviction in Bitcoin as a strategic reserve asset.

- The company’s stock (SQNS) is currently trading near an all-time low, reflecting broader market sentiment towards DAT companies.

Sequans Communications Sells Bitcoin to Service Debt

Sequans Communications (SQNS) has set a precedent among companies holding Bitcoin on their balance sheets by selling a portion of its BTC holdings to manage outstanding debt. The company divested 970 BTC at a time when the cryptocurrency market experienced significant volatility, further extending its downward trend.

This move marks a significant development as Sequans becomes the first playbook company—firms that follow a strategy of issuing debt and stock to acquire Bitcoin—to utilize its crypto treasury for debt reduction. Following the announcement of the sale, Bitcoin (BTC) prices dipped below $102,000, reflecting bearish market sentiment.

The French firm is part of a group of 18 companies that have adopted the playbook strategy, leveraging Bitcoin as a treasury asset. Sequans referred to this action as a strategic asset reallocation aimed at redeeming 50% of its convertible debt.

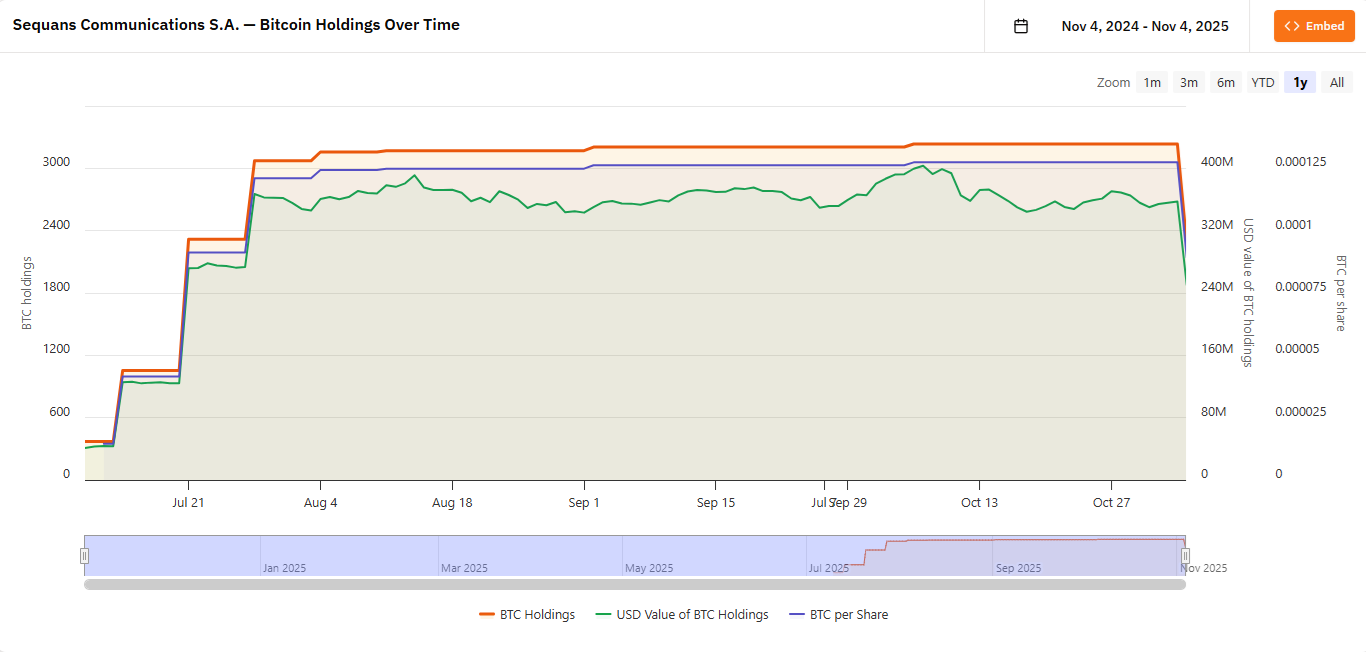

Following the sale, Sequans now holds 2,264 BTC. The company initially acquired 370 BTC in July 2025, accumulating up to a peak of 3,324 BTC before this recent divestment.

Sequans Adjusts Debt-to-Asset Ratio

💡 Through the strategic sale of Bitcoin, Sequans has successfully improved its financial standing. The company’s debt-to-net asset ratio has been reduced from 55% to a more conservative 39%.

Our Bitcoin treasury strategy and our deep conviction in Bitcoin remain unchanged, stated Georges Karam, CEO of Sequans. This transaction was a tactical decision aimed at unlocking shareholder value given current market conditions. It strengthens our financial foundation and removes certain debt covenant constraints, enabling us to pursue a wider set of strategic initiatives to prudently develop and grow our treasury, with Bitcoin as a long-term strategic reserve asset.

Sequans, a more recent entrant into the playbook treasury model, acquired its Bitcoin holdings during a period of heightened market enthusiasm. The decision to sell occurred as Bitcoin faced downward pressure from profit-taking activities by both large and retail investors.

⚡ Sequans’ action mirrors recent trends where companies are reconsidering the hold all assets strategy, even in less favorable market conditions. While the playbook approach has proven successful in bullish crypto cycles, the current environment may challenge companies’ commitment to holding their treasury assets.

A notable comparison is EthZilla’s recent move to sell a portion of its Ethereum (ETH) holdings to fund share buybacks. This indicates a growing flexibility among treasury companies in managing their digital asset reserves.

Sequans Stock Performance

📊 SQNS shares experienced a brief surge in July 2025, reaching a year-to-date high of over $53. However, by November, the stock was trading at $6.22, near its all-time low. The share price has declined by nearly 20% over the past year.

The performance of SQNS reflects broader challenges faced by digital asset treasury (DAT) companies. These companies, which collectively attracted around $17 billion in liquidity from Wall Street based on the treasury hype, saw their stock valuations become stretched. In retrospect, some DAT companies were considered overvalued, with their stock prices exceeding the market value of the Bitcoin held in their treasuries.

🐻 The current bear market conditions highlight the potential difficulties DAT companies may face in accessing liquidity and finding buyers if Bitcoin’s price does not trend upward. Furthermore, the pace of new treasury purchases has slowed, diminishing their impact as a catalyst for Bitcoin price growth.

📉 Sequans also reported a decline in its third-quarter revenues, falling to $4.3 million from $8.1 million in the previous quarter. The company recorded a net loss of $6.7 million for Q3, a significant shift from the $72.6 million net gain recorded in the third quarter of 2024.

Final Thoughts

Sequans Communications’ decision to sell Bitcoin for debt management signifies a pragmatic shift for digital asset treasury companies facing market headwinds. While the company reaffirms its long-term Bitcoin strategy, this move underscores the evolving approach to treasury management in the current economic climate.