Main Highlights

- Solana (SOL) is showing strong recent momentum, trading near $226 after a nearly 17% gain last week.

- The cryptocurrency recently surpassed the $220 mark, triggering significant short liquidations, but faces historical resistance around $250.

- Forward Industries has made a substantial move by pivoting to become a Solana treasury, committing approximately $1.65 billion in support.

- Despite recent gains, broader market conditions and macro uncertainties impacted SOL negatively in September, with a 14.3% decrease.

- The outlook for Uptober appears positive, with analysts considering Q4 potential driven by institutional interest, technical momentum, and ecosystem growth.

Solana’s Recent Performance and Outlook

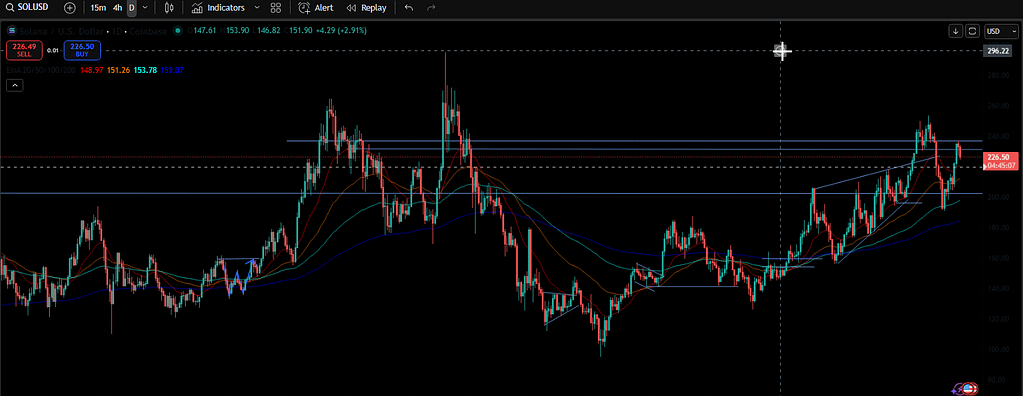

Solana (SOL) is currently trading around the $226 mark, exhibiting significant positive momentum. The past week has been particularly strong for SOL, marking one of its best performances of the year with an approximate 17% increase. This surge has applied pressure to key resistance levels, including the significant $250 zone. Recently, SOL successfully broke through the $220 level, leading to over $17 million in short liquidations, indicating that a considerable amount of bearish positioning had been built up against it. However, the $250 level has historically acted as a formidable barrier, with previous attempts to break through it resulting in rejections. 💡 Understanding these historical resistance points is crucial for any trader looking to capitalize on potential upward movements.

Adding to the narrative around Solana is the notable pivot by Forward Industries, which has announced its transition to a Solana treasury. This strategic move injects a substantial posture of approximately $1.65 billion in support behind SOL. ✅ This significant backing from a corporate entity could signal increased confidence and potential for further ecosystem development.

It’s important to acknowledge the broader market context. September presented challenges for the crypto market, with Solana experiencing a roughly 14.3% decline amid wider market drawdowns and prevailing macroeconomic uncertainty. 📊 This underscores the sensitivity of digital assets to global economic factors and central bank policies.

Despite these headwinds, the stage appears to be set for a potentially strong performance in the upcoming period, with many eyes on Uptober. ⚡ The term Uptober itself suggests a period of bullish sentiment and potential price appreciation in October.

Trader Strategies and Opportunities

For traders like many in the Solana community, the approach often involves a blend of speculation and risk management. Some utilize Solana primarily for trading meme coins and engaging in perpetual futures swing trading, rather than holding SOL as a long-term investment. Many are observing the growth of DeFi and yield farming opportunities within the Solana ecosystem, suggesting a potential shift towards holding a portion of SOL for farming while remaining adaptable to shorting or hedging if market sentiment deteriorizes. 📌 The potential for an explosive fourth quarter (Q4) makes adding a calculated level of risk and riding an upswing an attractive strategy for some.

The ecosystem is also fostering new opportunities; for instance, the newly listed DoubleZero AIrdrop offers staking and yield opportunities specifically on the Solana network. 📍 Exploring such emerging platforms can uncover unique ways to engage with the Solana economy.

Key Factors Influencing Solana’s Q4 Performance

Several key drivers and macro themes are critical to monitor as we move through the latter part of the year:

- Institutional Interest and ETFs: Some analysts suggest that Solana could benefit significantly from increased institutional inflows and treasury allocations in Q4, particularly if exchange-traded funds (ETFs) gain traction.

- Technical Momentum and Chart Structure: The recent break above the $220 level is a significant technical development. Sustained weekly closes above the $250 resistance level would further strengthen the bullish case and open up potential upside.

- Network and Ecosystem Growth: Continuous expansion of DeFi protocols, yield farming opportunities, and staking services solidifies Solana’s narrative as a robust functional layer, moving beyond its perception as solely a meme coin platform.

- Macroeconomic Conditions and Liquidity: As with the broader cryptocurrency market, Solana’s performance remains susceptible to Federal Reserve decisions, inflation data, and overall global risk sentiment.

- Volatility and Rotation Risk: Solana is known for its volatility. There’s always a risk of money rotating out of SOL into other assets like Ethereum (ETH), AI-focused tokens, other Layer 1 blockchains, or meme coins, which could lead to price detours.

Technical Analysis and Key Price Zones

From a technical standpoint, several chart zones are of particular interest for traders:

- Support Levels: The $200–$220 range has now become a crucial support base. A failure to hold this level could reintroduce downside risk towards the $180–$160 zones.

- Resistance Zones: $250 remains a significant resistance area. Beyond this, the $275–$300 range becomes a target. Some optimistic forecasts even suggest the possibility of a breakout towards $350–$400.

- Trend Structure: Many charts indicate that SOL is currently within an ascending channel. Maintaining support within this channel while driving higher would provide a clear bullish path.

- Potential Extensions and Targets: Fibonacci extensions and momentum indicators suggest that the $350–$400 zone is achievable if current momentum is sustained.

Current sentiment among some traders is that a multi-month breakout pattern could indeed bring targets in the $350–$400 range back into play. While more extreme cycle projections even suggest $500 or $1,000, these are considered highly speculative scenarios rather than base case expectations. 💡 It’s always prudent to distinguish between base case scenarios and outlier predictions in any market analysis.

Q4 Target Projections and Scenarios

Looking ahead to the fourth quarter, different scenarios offer varying target ranges for Solana:

- Realistic/Base Case: A target range of $350–$400 by year-end appears achievable if SOL can maintain levels above $220–$230, demonstrate higher lows, and experience continued demand.

- Optimistic/Cycle Stretch Case: Projections of $500 to $1,000 are considered if macroeconomic conditions are exceptionally favorable, significant ETF inflows occur, momentum breaks key resistance levels, and SOL regains narrative dominance.

- Bearish/Risk Case: If the $200–$220 support fails decisively, downside risk could extend to $180–$150, driven by a loss of technical structure and potential capital flight.

While Solana may have experienced speculative peaks earlier in the year, the current phase could be one of consolidation and continuation rather than a sustained breakout. However, if the market setup aligns favorably, a strong push into Q4 remains a distinct possibility. 📈 Staying informed about these potential scenarios allows for better strategic planning.

Trading and Positioning Strategies

For active traders, a potential approach to positioning in Solana might involve:

- Taking partial positions as key levels are confirmed (e.g., holding above $230).

- Riding momentum waves but strategically taking profits at established resistance zones.

- Employing hedges or short positions against the broader crypto market if SOL exhibits excessive frothiness.

- Maintaining exposure to farming and yield opportunities with capital allocated for longer-term holding.

- Strictly managing risk based on break-down events; for example, if SOL fails to hold $220 decisively, exiting the position would be a prudent risk management step.

An example of tactical trading: a trader might have held a substantial long position initiated in the $200 range, closing it prematurely at $221 and missing a subsequent move to $235. While this highlights the difficulty of perfect timing, prioritizing risk management and securing scalp profits is a valid strategy. 📊 Another approach could involve taking partial profits, such as closing 50% of a position at a resistance level like $220 while holding the remainder to capture potential breakout gains. This is a valuable lesson in position management.

Expert Summary

Solana (SOL) is currently navigating a complex landscape of speculative interest and genuine infrastructure development. The recent breakout above $220 signals a squeeze on short positions, although the historical $250 resistance remains a key hurdle. Achieving projected Q4 targets of $350–$400 will depend on sustained momentum, increased inflows, and the absence of major macro shocks. While ambitious projections exist, a pragmatic approach to trading and positioning, emphasizing risk management and adaptable strategies, is advisable.