Key Takeaways

- The Q1 earnings season is underway, with over 800 companies, including major tech players, set to report.

- Magnificent 7 (Mag 7) members like Microsoft, Meta, and Alphabet report this week, with Apple and Amazon following.

- AI investment, cloud business performance, and search dominance are key focus areas for these tech giants.

- Overall S&P 500 Q3 earnings are showing strong growth, exceeding initial expectations.

- The finance sector has delivered robust Q3 results, with high percentages of companies beating earnings and revenue estimates.

Upcoming Earnings Season Analysis

This week marks a significant period as the Q1 earnings season reaches its peak, with more than 800 companies scheduled to announce their financial results. Notably, five of the Magnificent 7 (Mag 7) members are among those reporting. Investors will be closely watching Microsoft, Meta Platforms, and Alphabet, all due to report on Wednesday. Apple and Amazon are slated to release their results the following day, Thursday.

With Tesla having already released its Q3 earnings, the spotlight now shifts to Nvidia, whose results are anticipated on November 19th. This intense earnings period provides critical insights into the health and trajectory of major market players.

Mag 7 Performance and AI Focus

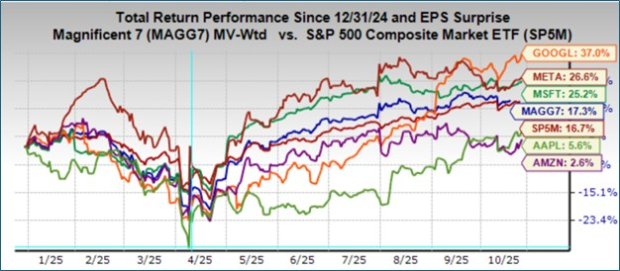

As a collective, the Mag 7 stocks have mirrored the broader market’s performance year-to-date. However, individual performance varies, with Alphabet, Meta, and Microsoft significantly outperforming, while Amazon and Apple have lagged behind. This disparity is partly attributed to differing investment strategies, particularly in the artificial intelligence (AI) sector.

Apart from Apple, the Mag 7 companies reporting this week are heavily invested in the AI landscape. They are actively deploying capital into data centers and the necessary infrastructure to support large language models. A key indicator of thisAI race has been the escalating capital expenditures, a segment where Apple has notably been absent, contributing to its recent stock underperformance.

Alphabet’s Momentum and Cloud Prospects

Alphabet’s stock has experienced positive momentum recently. A favorable resolution in the Department of Justice’s case has been a significant catalyst, bolstered by two consecutive strong quarterly reports.

The market’s focus will be on Alphabet’s cloud division, where enhanced capacity is expected to continue the acceleration observed in the previous quarter. Management’s commentary in July regarding their cloud business was highly optimistic, suggesting a robust demand environment and potential market share gains. Although technical challenges faced by Amazon’s AWS clients occurred after the Q3 reporting period, they are likely to be a topic of discussion during the earnings calls.

A persistent concern for investors regarding Alphabet concerns the future of its search business amidst the rise of AI. Many worry about Alphabet’s ability to maintain its dominance in this lucrative market. While the July results offered some reassurance, a strong upcoming report will be crucial for solidifying investor confidence.

Mag 7 Q3 Earnings Expectations

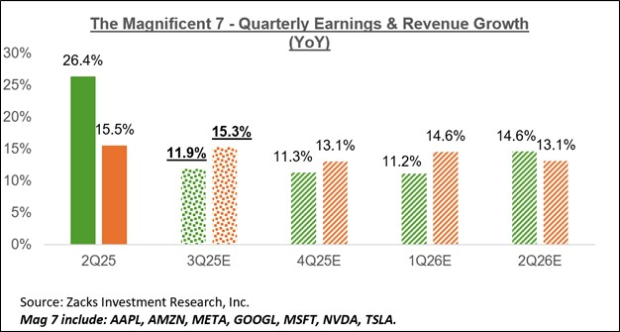

For the Mag 7 group as a whole, Q3 earnings are projected to increase by 11.9% compared to the same period last year, with revenues expected to rise by 15.3%. These figures incorporate Tesla’s actual results and estimates for the remaining six companies, five of which are reporting this week.

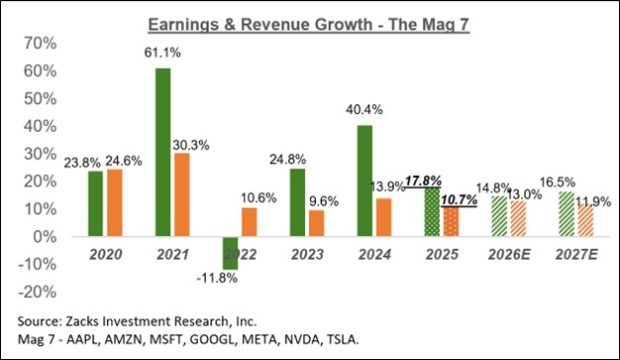

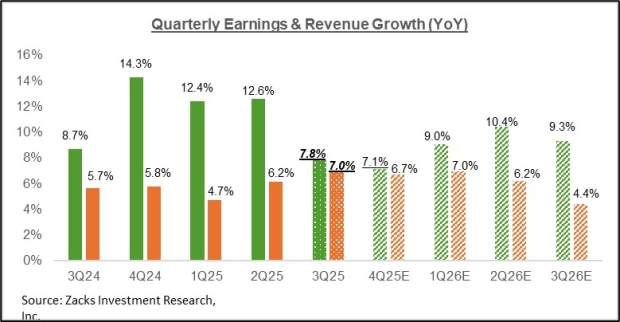

The chart below illustrates the Mag 7 group’s earnings and revenue growth picture on an annual basis, showing a trend of gradually improving outlooks backed by upward estimate revisions from analysts.

This positive trend in earnings outlooks was evident leading up to the Q3 earnings season and is anticipated to continue into Q4.

Q3 Earnings Season Scorecard

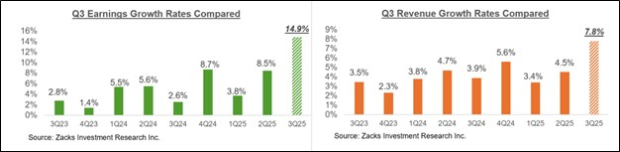

As of Friday, October 24th, 145 S&P 500 companies, representing 29% of the index, have reported their Q3 results. These companies collectively posted a 14.9% increase in earnings over the prior year, accompanied by a 7.8% rise in revenues. Impressively, 86.9% surpassed Earnings Per Share (EPS) estimates, and 82.1% exceeded revenue forecasts.

The charts below offer a historical perspective on these Q3 growth rates and the percentages of companies beating EPS and revenue estimates.

Finance Sector’s Strong Q3 Performance

The Finance sector has emerged as a strong performer in Q3, with results from 58.6% of its market capitalization within the S&P 500 index now available. This sector has seen earnings growth of 22.7% year-over-year, with revenues up 11.9%. A striking 97.5% of finance companies beat EPS estimates, and 87.5% surpassed revenue expectations.

The combined beat rate for both EPS and revenue in the Finance sector stands at 87.5%. The following charts highlight the sector’s Q3 revenue growth and its historical ‘blended’ beat percentage.

The Broader Earnings Picture

The S&P 500 index is projected to experience a blended earnings growth rate of +7.8% for Q3. This figure combines the actual results from reported companies with estimates for those yet to announce. The chart below provides context for this growth rate against preceding and upcoming quarters.

Looking at earnings on a calendar-year basis, the S&P 500’s EPS is estimated at $257.83 for 2025 and projected to reach $290.48 for 2026.

Expert Summary

The current earnings season is marked by significant activity from major tech companies, particularly the Magnificent 7, with a strong focus on AI investments and cloud computing infrastructure. Overall earnings for the S&P 500 are demonstrating robust growth, exceeding earlier expectations, with the finance sector showing particularly strong results. The market will continue to monitor these trends as more companies report and provide forward-looking guidance.