Main Highlights:

- Prominent cryptocurrency trader TechnoRevenant has contributed $7 million in liquidity to Uniswap.

- The $15 million transaction underscores sustained confidence in WLFI, despite ongoing disputes surrounding the token.

- This calculated move has alleviated concerns over decentralization and strengthened trust in WLFI’s broader ecosystem.

WLFI has recently drawn considerable attention in the cryptocurrency market, driven not only by a notable price increase but also by significant strategic actions from a well-known trader. Despite the uncertainty sparked by Justin Sun’s freeze on WLFI tokens, the market has shown unexpected resilience.

According to DeBank data, TechnoRevenant transferred approximately 81.675 million WLFI tokens — valued at around $15.2 million — into Dolomite, a decentralized finance (DeFi) platform. This transaction took place between 13:06 and 16:30 UTC+8 on Thursday, shortly after Justin Sun’s tokens were frozen. Using these tokens as collateral, the trader secured multiple assets, including 1.35 million DAI, 300 WETH, 5 WBTC, 250,700 USDC, and 227,000 USDT.

Instead of liquidating or passively holding, the trader combined the borrowed assets with additional WLFI tokens to create a $7 million liquidity pool on Uniswap V4.

Importance of the Action

While on the surface this appears to be a standard DeFi approach — pledging tokens, borrowing assets, and providing liquidity for fee generation — the context of recent WLFI disputes gives it heightened significance.

The freezing of a substantial number of WLFI tokens associated with Justin Sun raised questions about the degree of decentralization within the World Liberty Financial network. It also fueled concerns over whether liquidity would remain adequate for healthy market operations if such a large portion could be locked.

By injecting $7 million in liquidity, TechnoRevenant directly addressed these apprehensions. Enhancing trading depth on Uniswap helped stabilize WLFI’s market performance, curbing sharp price swings and reinforcing investor confidence. This move also served as a visible endorsement of the project’s long-term prospects.

Price Momentum Amplifies Effect

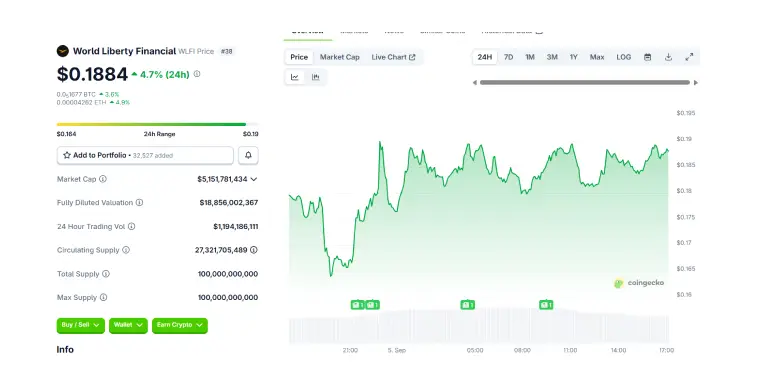

Concurrently, WLFI’s price has been on a steady upward trend, making the timing of this maneuver particularly favorable. Leveraging WLFI as collateral during a price rally allowed the trader to maximize borrowing capacity without selling their holdings.

This strategy reflects a commitment to maintaining a stake in WLFI while utilizing its value to access further liquidity. It highlights ongoing support for the token’s stability and growth potential.

As of the latest update, WLFI is trading at $0.1884, marking a 4.7% increase over the past 24 hours, according to CoinGecko.

Market Outlook

Despite its association with Justin Sun and related governance debates, WLFI appears to be regaining investor interest. While it remains uncertain if this momentum will persist, overall sentiment is showing gradual improvement.

Fundfa Analysis

TechnoRevenant’s liquidity provision illustrates the willingness of market participants to reinforce WLFI during uncertain periods. This action not only mitigates short-term volatility but also fosters greater confidence among holders, potentially stimulating increased on-chain engagement and contributing to the ecosystem’s expansion.