Key Takeaways

- Theta price predictions indicate a potential high of $0.87 by the end of 2025.

- By 2028, THETA is expected to trade between $2.03 and $2.32, averaging $2.18.

- Projections for 2031 suggest a price range of $3.49 to $3.78, with an average of $3.63.

Despite its innovative approach, Theta is often considered an undervalued cryptocurrency. While it has already surpassed many older cryptocurrencies in market capitalization, questions remain about its future value potential.

This analysis explores Theta’s price trajectory, providing insights into its potential to outperform major cryptocurrencies like Bitcoin or Ethereum in the coming years. We will delve into Theta price predictions, how to acquire THETA, and its outlook up to 2031.

Overview

| Cryptocurrency | Theta |

| Ticker | THETA |

| Current Price | $0.4838 |

| Market Cap | $484.02M |

| Trading Volume (24h) | $14.88M |

| Circulating Supply | 1 Billion THETA |

| All-Time Low | $0.03977 (March 13, 2020) |

| All-Time High | $15.90 (April 16, 2021) |

| 24-Hour Low | $0.4728 |

| 24-Hour High | $0.4961 |

Theta Price Prediction: Technical Analysis

Technical Indicators Snapshot:

| Volatility (30-day variation) | 14.70% (Very High) |

| 50-day SMA | $0.6769 |

| 200-day SMA | $0.8201 |

| Sentiment | Bearish |

| Fear and Greed Index | 29 (Fear) |

| Green Days (30-day) | 16/30 (53%) |

Theta Price Analysis

TL;DR Breakdown:

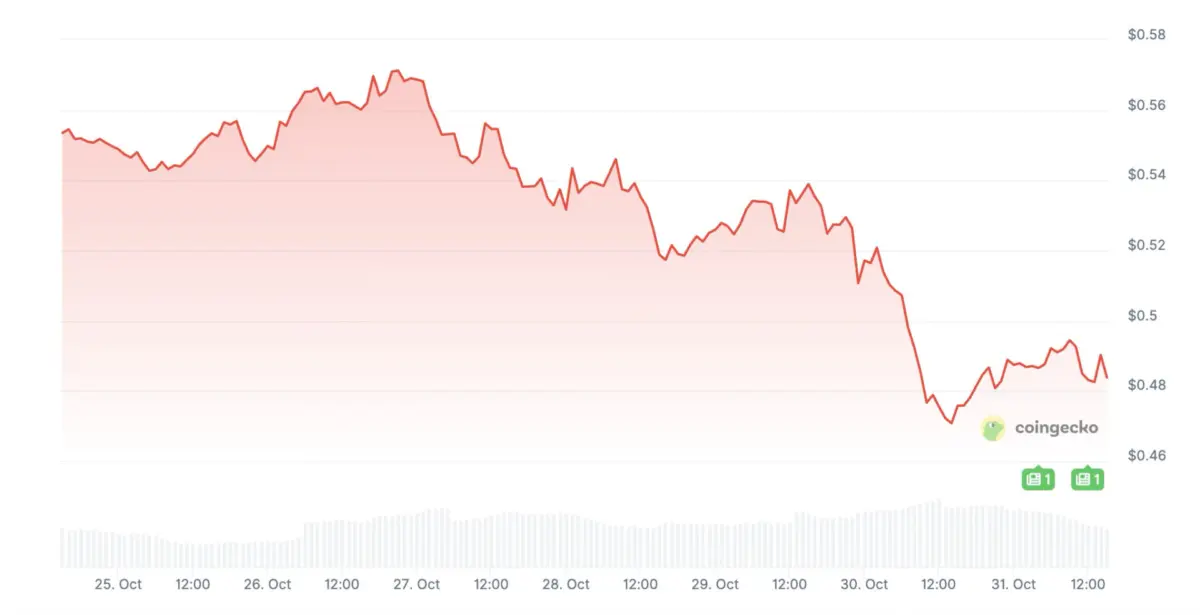

- Theta is currently consolidating around the $0.48 mark following a recent price dip.

- A sustained move above $0.50 could initiate a recovery towards $0.54 or higher.

As of October 31st, Theta (THETA) is trading at approximately $0.484, showing a slight increase. The price action indicates stabilization near the lower Bollinger Band ($0.492), with the upper band suggesting resistance around $0.600. The narrowing of the Bollinger Bands points to decreasing volatility, a common precursor to a directional price move after a period of consolidation.

The Moving Average Convergence Divergence (MACD) indicator shows flat lines near the zero mark, suggesting market indecision. The Relative Strength Index (RSI) at 37.98 indicates that Theta is nearing oversold territory, potentially signaling a weakening of bearish momentum.

Should Theta maintain support above $0.48, a short-term retest of $0.51 to $0.54 is possible. However, a daily close below $0.47 could lead to further declines, possibly targeting $0.45 or $0.43.

THETA/USD 4-Hour Chart Analysis

On the 4-hour timeframe, Theta is exhibiting minor consolidation after several attempts to break above $0.49. The Alligator indicator’s downward-spread lines suggest a continued bearish trend in the short term. Resistance levels are observed between $0.492 and $0.499, with the upper boundary at $0.510 serving as a key level for potential upward validation.

The MACD histogram remains slightly negative, and the On-Balance Volume (OBV) at 465 million indicates subdued buying interest. A decisive move above $0.50 could catalyze short-term positive momentum, but failure to do so might push the price back towards $0.475.

Theta Technical Indicators: Levels and Actions

Daily Simple Moving Average (SMA)

| Period | Value | Action |

|---|---|---|

| SMA 3 | $0.6099 | SELL |

| SMA 5 | $0.5884 | SELL |

| SMA 10 | $0.5770 | SELL |

| SMA 21 | $0.5679 | SELL |

| SMA 50 | $0.6769 | SELL |

| SMA 100 | $0.7472 | SELL |

| SMA 200 | $0.8201 | SELL |

Daily Exponential Moving Average (EMA)

| Period | Value | Action |

|---|---|---|

| EMA 3 | $0.5987 | SELL |

| EMA 5 | $0.6429 | SELL |

| EMA 10 | $0.7014 | SELL |

| EMA 21 | $0.7508 | SELL |

| EMA 50 | $0.7833 | SELL |

| EMA 100 | $0.8112 | SELL |

| EMA 200 | $0.9366 | SELL |

What to Expect Next from Theta Price Analysis

Theta is currently attempting to stabilize amidst significant selling pressure, but market momentum remains subdued. A confirmed rebound above the $0.50 level would indicate short-term strength. Otherwise, the token may continue to trade sideways within the $0.47–$0.50 range, awaiting clearer directional signals.

Is Theta a Good Investment?

Theta exhibits considerable long-term potential, driven by its expanding presence in streaming, media, and edge computing. Strong fundamentals and an increasing number of partnerships bolster its growth prospects. However, the persistent challenges of moderate adoption rates and intense competition position Theta as a promising yet speculative investment.

Will Theta Reach $5?

Theta’s ongoing expansion within the media, entertainment, and edge computing sectors provides a solid foundation for long-term growth. Should this development continue, coupled with a favorable overall market, reaching $5 is a plausible long-term objective, dependent on sustained user adoption and tangible utility demand.

Will Theta Reach $10?

Considering Theta’s historical all-time high of approximately $15.72 in 2021, a return to $10 is conceivable if market conditions become strongly bullish and adoption rates accelerate. However, given its current trading levels and the pace of ecosystem growth, achieving such a price point would likely require substantial time and renewed investor interest.

Will Theta Reach $50?

Based on current market estimates and Theta price predictions, reaching $50 in the near future appears unlikely.

Does Theta Have a Good Long-Term Future?

Theta’s focus on decentralized streaming and edge computing, supported by strategic partnerships and robust tokenomics, suggests strong long-term potential. Nevertheless, the company faces hurdles related to adoption and competition, classifying it as a high-risk, high-reward venture.

Recent News and Opinions on Theta

- Deutsche Telekom Joins the Theta Network as an Enterprise Validator Node Operator.

Theta Price Prediction: November 2025

For November 2025, the anticipated minimum value for the THETA token is projected at $0.30. The price could ascend to $0.67, with an expected average trading price of $0.48.

| Month | Potential Low ($) | Potential Average ($) | Potential High ($) |

| November 2025 | 0.30 | 0.48 | 0.67 |

Theta Price Prediction: 2025

The Theta price forecast for 2025 anticipates a high of $0.87. The lowest price predicted for the year is $0.26, with an average trading price of $0.43.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2025 | 0.26 | 0.43 | 0.87 |

Theta Price Predictions: 2026-2031

| Year | Minimum Price | Average Price | Maximum Price |

| 2026 | $0.87 | $1.21 | $1.36 |

| 2027 | $1.55 | $1.69 | $1.84 |

| 2028 | $2.03 | $2.18 | $2.32 |

| 2029 | $2.52 | $2.66 | $2.81 |

| 2030 | $3.00 | $3.15 | $3.29 |

| 2031 | $3.49 | $3.63 | $3.78 |

Theta Price Prediction 2026

Projections suggest THETA will trade between $0.87 and $1.36 in 2026, with an average price of $1.21.

Theta Price Prediction 2027

The Theta forecast for 2027 indicates a price range between $1.55 and $1.84, averaging $1.69.

Theta Price Prediction 2028

Further growth is anticipated by 2028, with Theta’s price predicted to range from a minimum of $2.03 to a maximum of $2.32, averaging $2.18 for the year.

Theta Price Prediction 2029

For 2029, Theta’s price is expected to reach a high of $2.81 and a low of $2.52, with an average price of $2.66.

Theta Crypto Price Prediction 2030

The Theta price prediction for 2030 suggests a trading range between $3.00 and $3.29, with an average price of $3.15.

Theta Price Prediction 2031

Long-term forecasts estimate Theta’s price in 2031 to be between $3.49 and $3.78, averaging $3.63.

Theta Market Price Prediction: Analysts’ Theta Price Forecast

| Platform | 2025 | 2026 |

| Digitalcoinprice | $1.06 | $1.24 |

| CoinCodex | $0.5023 | $0.5365 |

Cryptopolitan’s Theta Price Prediction

Cryptopolitan’s Theta price prediction for 2026 suggests a trading range of $1.50 to $2.20, averaging around $1.78. Please note that these predictions are for informational purposes only and do not constitute investment advice. Always conduct your own research or consult with a professional financial advisor.

Theta Historic Price Sentiment

THETA, initially launched as an ERC-20 token in 2018 before migrating to its own blockchain, experienced an initial price drop from $0.183 to around $0.066 and traded within the $0.051 to $0.107 range throughout 2019.

The year 2020 saw significant momentum, with the price reaching $0.428 mid-year, $0.749 by September, and $1.5 by December. Early 2021 marked a substantial bull run, propelling THETA from $1.9 to an all-time high of $15.72. Following a correction to approximately $4 by July, a second rally uplifted the price to around $8 by November.

Throughout 2022, THETA fluctuated between $1.2 and $4 before declining to about $0.7 by year-end. In early 2023, it briefly surpassed $1 but fell to $0.619 by October, recovering to approximately $1.4 by December.

Opening 2024 near $1, THETA climbed to about $3.4 in March before experiencing a downtrend, closing the year around $1.02.

In 2025, the token has struggled to regain upward momentum, trading primarily between $0.50 and $1.00. As of October 2025, it is currently observing prices between $0.4728 and $0.4961.