- Tariffs are contributing to increased inflation in the US.

- Businesses are grappling with higher input costs, leading to varied pricing strategies.

- Overall economic growth and the labor market remain stable, despite trade policy challenges.

- A government shutdown has impacted the availability of crucial economic data.

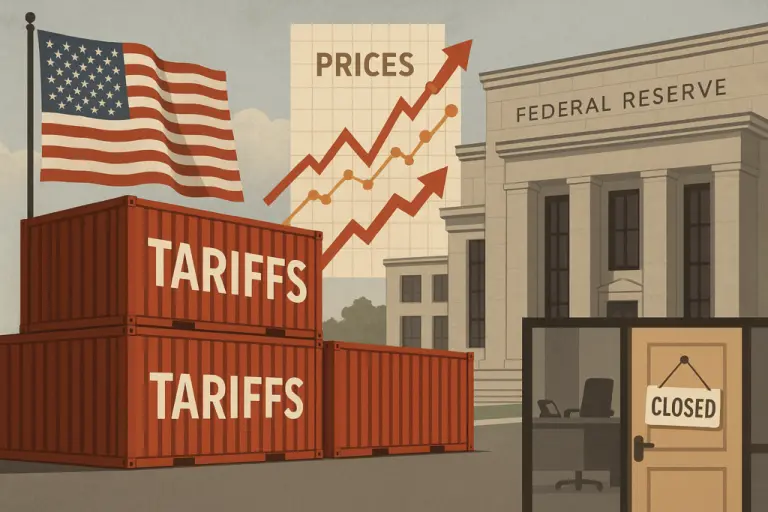

Economic Landscape: Inflationary Pressures and Trade Impact

Our analysis of recent economic indicators reveals that inflation is on the rise, largely influenced by trade policies that have increased costs for businesses. These higher expenses are being absorbed by companies or passed on to consumers, impacting pricing across various sectors.

💡 Consider sourcing alternative domestic raw materials to mitigate effects of external trade disputes.

This situation is further complicated by an ongoing trade dispute, creating uncertainty in the economic environment. The latest reports offer a detailed look at the nation’s economy, highlighting the growing challenges presented by these trade tensions.

📌 Regularly review your supply chain for vulnerabilities to geopolitical events.

Tariffs Fueling Price Increases

Prices have continued to increase during the recent reporting period, with many regions experiencing higher costs directly linked to tariffs. This is a notable shift in pricing dynamics, even as the overall pace of economic growth has remained largely unchanged.

📊 Analyze your own cost structures to identify areas where tariff impacts are most significant.

Businesses are facing a dilemma: absorb these increased input costs or implement higher prices. Some companies are opting to maintain current pricing to remain competitive and retain price-sensitive customers, while others are directly passing the additional expenses onto shoppers.

💬 Evaluate the price elasticity of your products to understand how much you can increase prices without losing significant demand.

The impact of tariffs on input costs is widespread, though the extent to which these costs are passed on varies by region and market conditions. In some areas experiencing slower demand, material prices have actually decreased, indicating a complex inflation scenario influenced by both trade policies and varying consumer activity.

🟥 Stay informed about regional economic variations that might affect your pricing strategy.

This situation unfolds as trade tensions escalate. International trade restrictions on critical materials, essential for advanced manufacturing, have led to retaliatory measures and threats of further tariffs, creating significant uncertainty for global trade.

⚡ Monitor international trade developments closely, as they can rapidly affect commodity prices and supply chains.

Economic Growth and Employment Show Resilience

Despite concerns about inflation, the broader economic picture shows steady growth, and labor market conditions remain stable. Demand in most areas has been moderate, and employment figures have shown little change, suggesting the economy is maintaining a consistent, albeit slow, trajectory despite policy-related challenges.

✅ Assess the stability of your local labor market when planning for expansion or hiring.

Consumer activity has been modest, with spending showing a slight decrease in recent weeks. However, a clear distinction exists between consumer segments. Higher-income households continue to spend readily on luxury goods and travel, while middle and lower-income consumers are increasingly focused on promotions and discounts.

💡 Look for opportunities to target different consumer segments with tailored product offerings or marketing strategies.

Future economic outlooks are cautiously optimistic in several regions. However, concerns have been raised that prolonged government disruptions could negatively impact business sentiment further.

📍 Diversify your customer base to reduce reliance on economically sensitive demographics.

Government Shutdown Hinders Data Collection

The current period of government operations disruption has significantly limited the release of key economic data from vital agencies. This scarcity of up-to-date information complicates efforts to accurately assess inflation, employment trends, and overall economic momentum, especially in the lead-up to important policy meetings.

📊 Develop internal forecasting models to bridge data gaps during periods of reduced official reporting.

Fortunately, some essential statistical work is resuming. Key personnel have been recalled to prepare critical reports, such as the consumer price index, which is a vital measure of inflation and influences cost-of-living adjustments. The delayed release of this data provides the latest inflation reading shortly before the central bank’s policy deliberation.

❗ Stay vigilant on the release schedules of key economic indicators that can influence market sentiment.

While economic activity appears steady and employment robust, the impact of trade policies on inflation is a significant factor. This could present a complex balancing act for policymakers as they aim to support growth while managing rising prices.

💥 Evaluate how potential policy shifts, influenced by inflation data, might affect your business operations and investment strategies.

Fundfa Insight

Our review of the latest economic data highlights how trade policies are directly contributing to inflationary pressures across the US. While overall growth remains stable, businesses are navigating increased costs, and the consistent flow of economic data is being impacted by external factors, requiring careful strategic planning.