At a Glance

- WazirX has reactivated INR and cryptocurrency deposits.

- The exchange is actively working to restore trading and withdrawal services.

- A strategic partnership with BitGo aims to enhance user fund security.

- WazirX’s parent company’s restructuring plan has received approval from the Singapore High Court.

WazirX Resumes Operations with Deposit Functionality

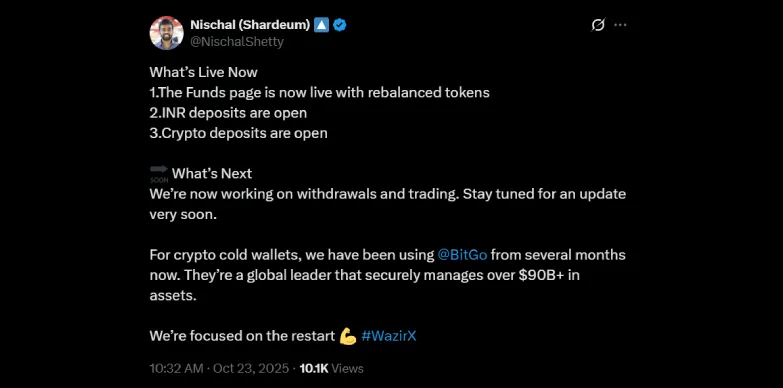

WazirX, a prominent Indian cryptocurrency exchange, has officially entered its relaunch phase, according to recent announcements. CEO Nischal Shetty confirmed via the social media platform X (formerly Twitter) that the Funds page is now live. This reactivation allows users to make both INR and cryptocurrency deposits.

Platform Reactivation and Future Steps

Nischal Shetty’s update on X highlighted the immediate availability of deposit services, catering to both fiat (INR) and crypto assets. Additionally, the platform is implementing updates to the user dashboard. These updates will enable users to view their rebalanced portfolios, providing a clear breakdown of their current holdings in each coin or token post-system integration.

Shetty also outlined the next critical steps the exchange is focusing on: the restoration of trading and withdrawal functionalities. He indicated that further announcements regarding these features are expected very soon. Once the implementation phase is complete, users will gain access to their Recovery Tokens, initiating the process of reclaiming assets under the approved scheme.

If the execution of these plans proceeds as scheduled, WazirX anticipates resuming full trading and withdrawal services by the end of October 2025. This development would offer significant relief to Indian crypto traders who have awaited the platform’s revival for over a year.

Enhanced Security Through BitGo Partnership

In a significant move to bolster user fund protection, WazirX is forging a partnership with BitGo Trust Company, a globally recognized custodian managing over $90 billion in assets. This collaboration, first announced in March 2025, is designed to provide robust security measures, including cold wallet storage, multi-signature security protocols, and insurance coverage of up to $250 million for user assets.

BitGo’s advanced custody system will underpin WazirX’s revamped asset management infrastructure, significantly strengthening fund security in the wake of previous security incidents. According to Shetty, this partnership represents a crucial step in rebuilding user confidence and ensuring transparent handling of client funds.

Restructuring Plan Approval and Distribution

The restructuring plan proposed by WazirX’s parent company, Zettai Pte Ltd, received formal approval from the Singapore High Court on October 13, 2025. This judicial decision marks the conclusion of months of creditor consultations and legal proceedings. The plan garnered substantial support, with over 95% of creditors, both by number and 94.6% by value, endorsing it. The approved plan was subsequently filed with the ARCA on October 15, 2025.

💡 With the approved plan, WazirX is set to begin distributing Recovery Tokens and restoring affected user accounts. Victims can anticipate recovering approximately 75-80% of their total assets, with the recovered value distributed between existing crypto holdings and the newly issued recovery tokens.

Market and User Reactions

The announcement has elicited mixed reactions from the user community. Some users have expressed dissatisfaction with the platform’s rebalancing of assets, noting that the newly distributed amounts appear lower than initial January 2025 estimates. The rebalancing process, completed in February 2025, aimed to cover 85% of the creditor balance from July 2024, but preliminary figures suggest a discrepancy in the actual recovered values.

Conversely, a segment of the user base has welcomed the clarity provided regarding the platform’s situation and the prospect of recovering at least a portion of their invested funds.

Further analysis from some X users points to potential benefits of the new Recovery Tokens, indicating that users could gain more if the exchange achieves greater profitability. The partnership with BitGo is viewed positively for guaranteeing insured and secure funds. Despite the past hack, WazirX retains its position as India’s largest crypto exchange, supported by a loyal user base. The speed of its recovery, marked by the swift move towards payouts, suggests a commitment to rebuilding rapidly, securely, and with user trust as a primary focus.

Expert Summary

WazirX has initiated its relaunch phase by enabling INR and crypto deposits, with trading and withdrawal services expected soon. The exchange is enhancing security through a partnership with BitGo and has secured court approval for its restructuring plan, which aims to return a significant portion of user assets via Recovery Tokens. While some users express concerns about asset rebalancing, the overall move towards recovery and renewed security measures marks a critical step for the platform.