At a Glance

- Wells Fargo initiated coverage of Fox Corporation (NASDAQ: FOX) with an Overweight recommendation on October 31, 2025.

- The average one-year price target for FOX is $56.52, suggesting a potential downside of 3.23% from its recent closing price.

- Projected annual revenue for FOX is $15,434 million, a decrease of 6.31%, with an estimated non-GAAP EPS of $4.15.

- Institutional ownership has seen an increase in the number of funds, though total shares held by institutions decreased.

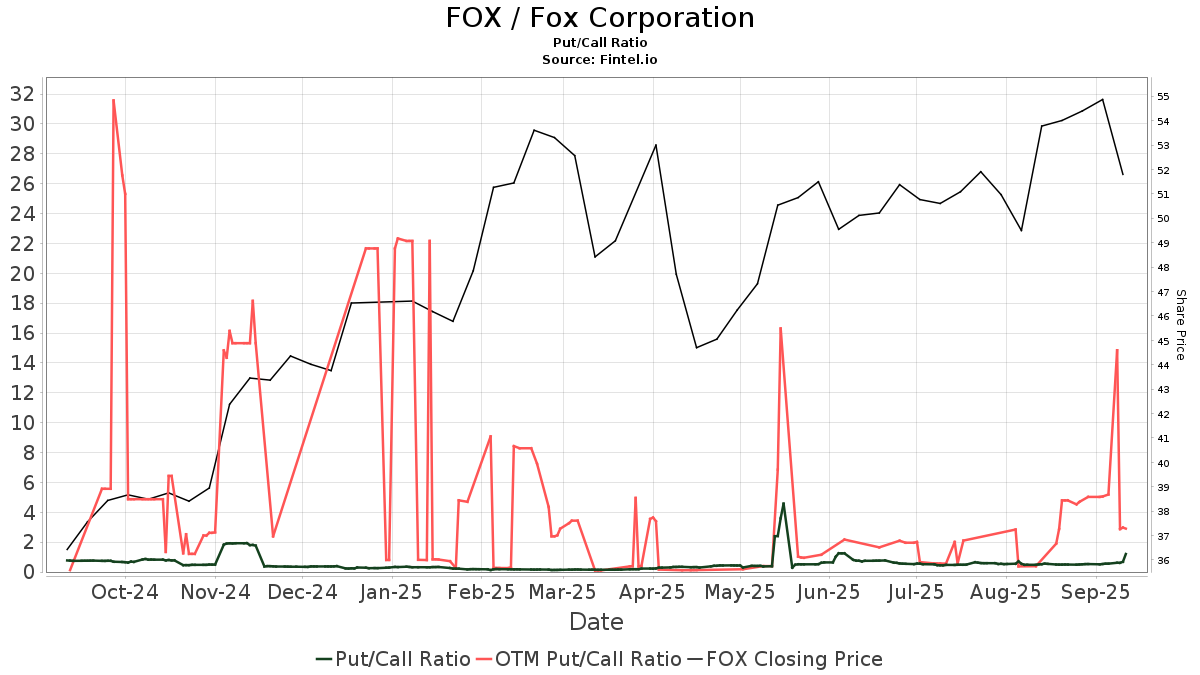

- The put/call ratio for FOX stands at 0.35, indicating a generally bullish sentiment among options traders.

Analyst Rating and Price Target for Fox Corporation

On October 31, 2025, Wells Fargo maintained its coverage of Fox Corporation (NASDAQ: FOX) with an Overweight recommendation, according to Fintel’s report. This analyst action provides insight into the institutional perspective on the media company’s stock.

Price Forecast and Potential Downside

The average one-year price target for Fox Corporation is currently set at $56.52 per share. This forecast, compiled from various analyst projections, ranges from a low of $43.26 to a high of $69.33. The average target suggests a potential downside of approximately 3.23% when compared to the stock’s last reported closing price of $58.41 per share. Investors can explore companies with significant potential price target upside on Fundfa’s leaderboard of companies.

Financial Projections for Fox Corporation

Looking ahead, the projected annual revenue for Fox Corporation is estimated at $15,434 million, which represents a decrease of 6.31%. Furthermore, the projected non-GAAP Earnings Per Share (EPS) is anticipated to be $4.15. These financial outlooks provide a quantitative basis for the analyst’s recommendation.

Institutional Investor Sentiment

📊 The sentiment from institutional investors regarding Fox Corporation appears to be mixed but leans positive in terms of fund participation. Currently, 1,011 funds or institutions report holding positions in FOX. This marks an increase of 19 owners, or 1.92%, over the last quarter. The average portfolio weight dedicated to FOX by all funds stands at 0.13%, showing a notable increase of 13.02%. Despite the increase in fund count and allocation, the total shares owned by institutions saw a decrease of 3.55% in the past three months, settling at 146,021K shares.

⚡ The put/call ratio for FOX is 0.35, which generally indicates a bullish outlook among options traders, as there are more call options being bought than put options.

Analysis of Major Shareholder Activity

📍 A review of major shareholders reveals varying strategies. Dodge & Cox, previously holding 10,099K shares, reduced its stake to 7,309K shares, a decrease of 38.18%. Concurrently, the firm decreased its overall portfolio allocation in FOX by 30.12% over the last quarter.

📍 In contrast, the State Of Wisconsin Investment Board increased its holdings from 5,994K shares to 6,458K shares, representing a 7.19% rise. However, their portfolio allocation in FOX saw a slight decrease of 0.29% in the same period.

📍 Yacktman Asset Management also reduced its position, holding 6,226K shares compared to the prior 6,568K shares, a 5.49% decline. This was accompanied by a 5.12% reduction in their portfolio allocation to FOX.

📍 Dodge & Cox Stock Fund (DODGX) experienced a significant reduction in its holdings, from 7,342K shares to 5,284K shares, a decrease of 38.95%. Their allocation to FOX dropped by 31.60%.

📍 Independent Franchise Partners LLP reported a minor decrease in shares, from 5,261K to 5,208K, a 1.02% reduction. Their portfolio allocation in FOX was reduced by 9.56%.

Expert Summary

Wells Fargo has initiated coverage on Fox Corporation with an Overweight rating, setting a price target that suggests a modest potential downside. While institutional ownership shows an increase in the number of participating funds, overall shareholdings and specific major shareholder activities present a complex picture of investment trends. The options market indicates a bullish sentiment for FOX.