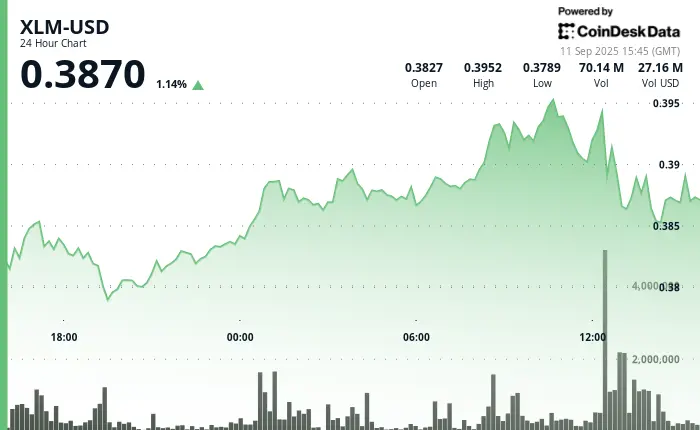

Intraday Price Action

Over the past 24 hours, Stellar’s XLM experienced sharp fluctuations within a $0.017 range, marking a 4.3% swing between $0.379 and $0.396. The rally began shortly after midnight on September 11, with prices climbing from $0.384 to a session high of $0.396 by mid-morning. This move coincided with a surge in market activity, highlighted by an extraordinary 112 million-unit volume spike at noon — far above typical daily averages.

Resistance and Support Levels

Despite the early momentum, XLM retreated to $0.387, confirming strong resistance in the $0.394–$0.396 zone. Buyers were repeatedly absorbed at this level, while accumulation near $0.379–$0.381 signaled the emergence of a solid support base.

Midday Consolidation

Between 1:14 p.m. and 2:13 p.m. on September 11, XLM traded within a narrow $0.003 band, holding support at $0.386 and facing resistance at $0.389. Two brief bullish bursts pushed the price to $0.389 on strong volume, but both attempts were swiftly rejected, reinforcing $0.389 as a key intraday ceiling.

Technical Overview

- Volume Analysis: 112.18 million units traded, significantly above the 24-hour average, indicating institutional activity.

- Support: $0.379–$0.381 range showing consistent accumulation interest.

- Resistance: $0.394–$0.396 zone with multiple rejections on high volume.

- Volatility: 4.30% intraday range offering active trading opportunities.

- Breakout Attempt: Early bullish breakout failed to sustain above critical resistance.

Market Implications

The current pattern reflects a market testing its limits. Sustained upside will depend on XLM’s ability to convert $0.389 into support; failure to do so could trigger another retest of the $0.379–$0.381 base.

Fundfa View

XLM’s high-volume surges suggest strong market interest, but repeated resistance rejections highlight distribution pressure. A confirmed breakout above $0.389 could shift short-term sentiment bullish, while a breakdown below $0.379 may invite further selling pressure.