Quick Summary

- ZCash (ZEC) is experiencing a significant rally, nearing the $400 mark and showing resilience against market corrections.

- The privacy coin has outperformed Bitcoin (BTC) over the past year, gaining over 560% against it.

- ZEC has overtaken Monero (XMR) as the leading privacy coin, with other privacy tokens also seeing price increases.

- While ZEC’s broader DeFi adoption is still developing, it’s being tested as a tool for anonymous transactions on platforms like Near Protocol.

- Derivative markets show a strong preference for short positions, though liquidations remain balanced.

ZEC Surges Towards $400, Resistant to Market Dips

ZCash (ZEC) is making a notable upward move, approaching the $400 price level. This surge appears largely unaffected by broader cryptocurrency market corrections, a notable shift from its performance in previous market cycles.

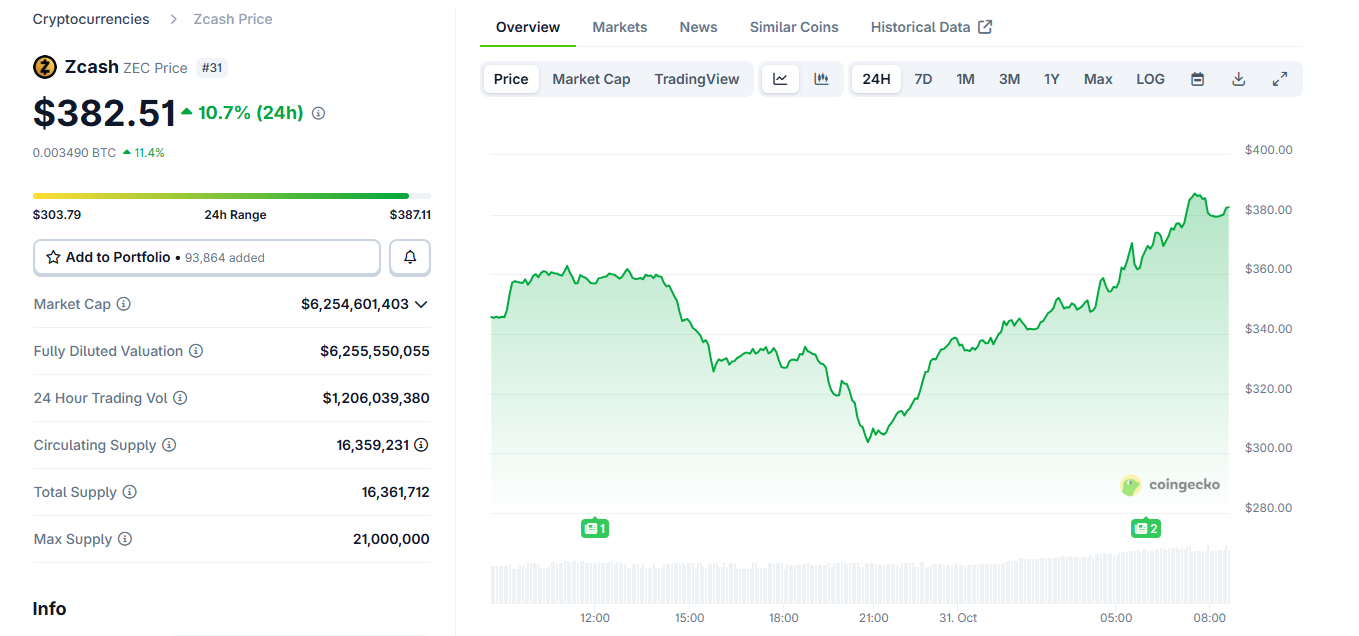

The cryptocurrency is on the cusp of achieving another significant milestone, with predictions suggesting a potential return to four-digit valuations. Currently trading around $382.51, ZEC has seen a 10% increase in its price over the last 24 hours.

This upward momentum occurred even as Bitcoin (BTC) experienced a dip below $107,000. ZEC, in contrast, only saw a minor dip to around $300 before resuming its climb.

💡 Open interest for ZEC has rapidly recovered, exceeding $434 million. However, a significant portion of this open interest, over 62%, is comprised of short positions, suggesting a prevailing sentiment among some traders expecting a downturn.

ZEC has demonstrated a pattern of temporary dips, which have provided opportunities for short-term traders to realize profits. Currently, short and long liquidations for ZEC are relatively balanced, each totaling around $3.2 million in the past 24 hours. Binance stands out as the most active exchange for ZEC derivative trading, with the highest volume of liquidations.

Over the past year, ZEC has shown remarkable performance against Bitcoin, appreciating by more than 560%. A substantial supply of ZEC is still held by early miners and investors. The coin aims to re-establish its reputation and position itself as a privacy-focused alternative to Bitcoin, although it currently lacks Bitcoin’s extensive infrastructure and wider investor base.

ZEC Emerges as Leading Privacy Coin

ZEC has successfully surpassed Monero (XMR) to claim the title of the top privacy coin. Other digital assets in this category are still striving to catch up. Litecoin (LTC) also holds a significant market capitalization, exceeding $7 billion, but ZEC is poised to challenge the current market hierarchy.

Notably, other privacy tokens are also experiencing substantial price pumps, even amidst a generally weaker altcoin market. DASH, a long-standing privacy coin, has managed to retain some of its gains, currently trading at $47.70 after a prolonged period of stagnation in the $20 range.

Railgun (RAIL) has seen a resurgence, trading at $2.71, and other privacy coins are also benefiting from increased demand for anonymous decentralized finance (DeFi) activities.

ZEC’s Appeal in DeFi and Retail Interest

The current ZEC rally appears to be fueled by a combination of influencer endorsements and significant buying activity from whales. Concurrently, there is also evidence of conviction buying from retail investors. ZEC’s positioning as a traditional cryptocurrency with a strong privacy narrative seems to be resonating with a segment of the retail market, driving accumulation.

Data regarding ZEC’s current utilization within the DeFi space remains limited. On Near Protocol, one of the primary decentralized platforms where ZEC is integrated, the token is held by a relatively small number of 6,239 wallets. ZEC’s current liquidity is somewhat low, and it has attracted minimal institutional interest. This environment allows the token to experience rallies within its smaller ecosystem, but questions remain about its long-term sustainability.

📊 Despite its current limitations in widespread DeFi adoption, ZEC is being tested as a tool for private transactions. On Near Protocol, ZEC is showing signs of active trading for smaller token amounts, indicating a nascent use case for anonymity within DeFi.

Final Thoughts

ZCash (ZEC) is demonstrating impressive resilience and growth, nearing a significant price threshold despite broader market volatility. Its recent outperformance against Bitcoin and its ascendant position among privacy coins highlight a renewed interest in its capabilities. While challenges remain regarding widespread DeFi integration and institutional adoption, the current trajectory suggests a growing recognition of ZEC’s privacy-focused utility.